The General Insurance Association of Japan (GIAJ) has reported that already domestic insurers in the country have paid out just under US $2.5 billion for claims from typhoon Faxai, while for more recent typhoon Hagibis the claims are still mounting up.

Image from Kyodo agency (via Japan Today)

Insurance and reinsurance industry loss estimates still suggest a total bill for the market of between US $3 billion and $7 billion for typhoon Faxai.

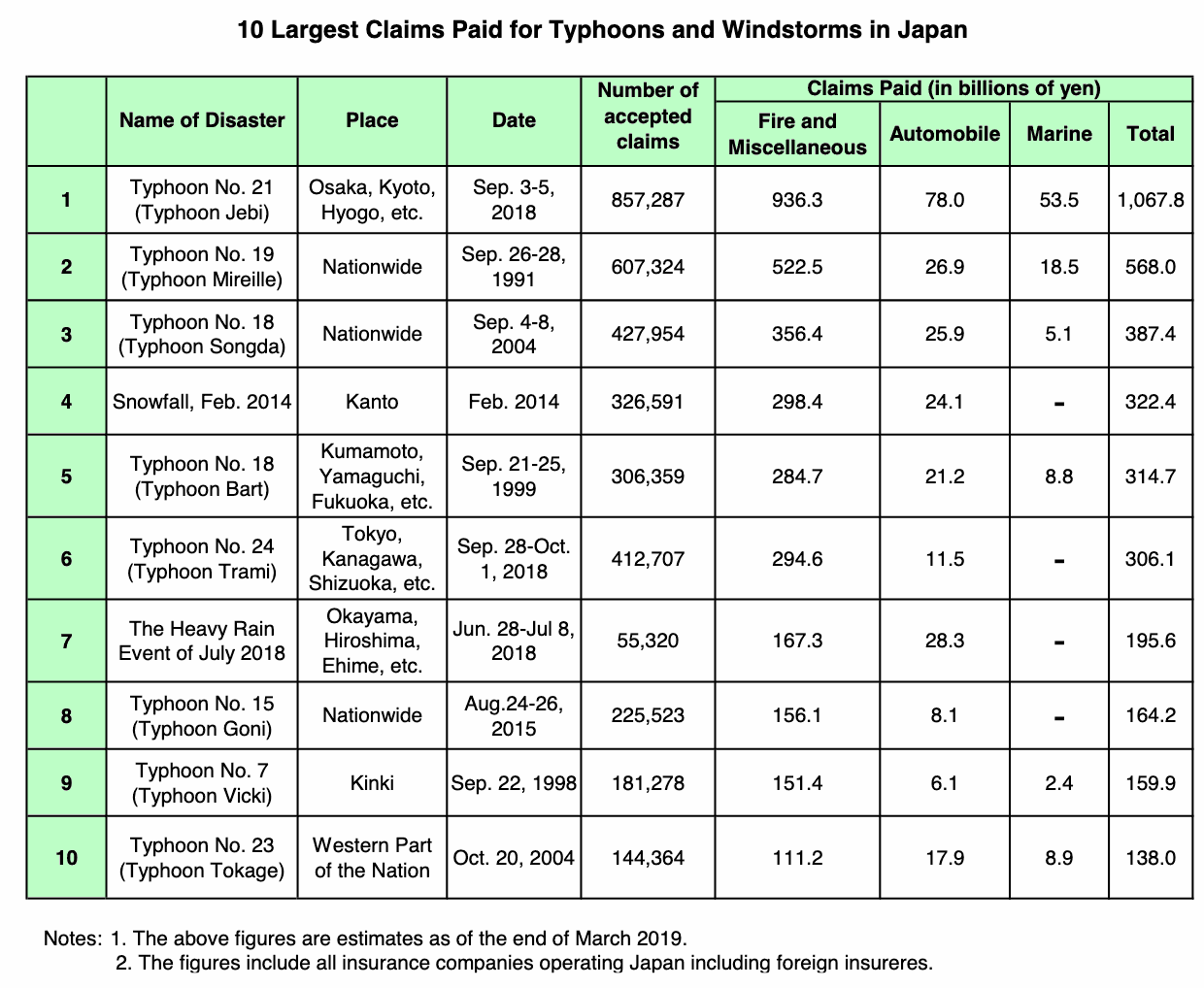

The storm is already approaching the level of claims payments made for 2018’s typhoon Trami, a level that Yasuzo Kanasugi, Chairman of the GIAJ and a senior executive of Aioi Nissay Dowa Insurance Co. had previously said he expects Faxai to surpass.

Trami was the sixth most costly Japanese typhoon event on record, at roughly US $2.8 billion of claims payments based on the GIAJ figures.

Typhoon Faxai is already the seventh most costly typhoon on record and looks set to surpass Trami relatively quickly now.

As of November 5th, Faxai had driven 373,054 of insurance claims, the vast majority of which fall under Japanese fire insurance policies. While 354,320 claims payment have been made, amounting to JPY 265,131,870, so just short of US $2.5 billion.

For the more recent typhoon Hagibis no estimate of claims payments has yet been released, given the recency of this storm.

Typhoon Hagibis continues to be estimated to have caused an insurance and reinsurance market loss of up to US $16 billion, although some in the market expect it will be a little lower than the top-end of estimates ($10bn to $13bn seems a widely discussed range among reinsurance and ILS markets).

Data has now begun to emerge from the Japanese big three primary insurance groups, giving a better view of where the domestic market loss may lie.

Yesterday we reported that MS&AD Holdings said that it expects its ultimate loss from typhoons Hagibis and Faxai will be approximately US $3.36 billion, before reinsurance recoveries, US $2.12 billion of which is from typhoon Hagibis alone.

Combined, the big three Japanese insurers have estimated roughly US $8 billion of ultimate losses across Faxai and Hagibis, which based on the US $2.5 billion of claims already reported for Faxai shows that Hagibis will be the larger loss by a decent margin (as the market expects).

The GIAJ reports that there are already 235,225 accepted claims from typhoon Hagibis, with the majority coming from property covers again.

In addition to the two typhoons, the GIAJ also reports that the heavy rainfall event of late October 2019 drove another 9,858 claims to insurers, with auto policies bearing the brunt of this event that followed Hagibis relatively soon after the storm.

As we reported last week, some catastrophe bonds that are exposed to Japanese typhoon losses had been marked down due to market uncertainty over the eventual industry loss from typhoon Hagibis.

After the initial disclosures from major insurers came out with their results yesterday, it is possible these affected positions will largely recover their value as losses to per-occurrence layers look less likely at this stage.

It’s clear now that once the losses are tallied for 2019’s typhoon Faxai and Hagbis, both of these storms will be at least in the top six typhoon and windstorm loss events to ever hit Japan.

At that stage, five of the top ten windstorm and typhoon insurance market losses in Japan will have occurred in the last two years, as 2018’s Trami, Jebi and July rainfall events are all in this list.

Jebi remains at the top of the list, with domestic insurance claim losses now nearing around US $9.8 billion, from over 857,000 claims.

Whether Hagibis will near that or not remains to be seen. Currently the number of filed and accepted claims, as of November 5th, remains far below that level, but this is certain to rise over the coming weeks and we could see Hagibis vying with Jebi for the top of this list before too much longer.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.