The Board of the Texas Windstorm Insurance Association (TWIA) has voted to adopt a multi-model view of risk for 2022, with its newly derived 1-in-100 year probable maximum loss driving a decision to secure a roughly $2.04 billion tower of reinsurance and catastrophe bonds for 2022.

TWIA’s Board met yesterday to discuss the Association’s approach to catastrophe risk modelling, the resultant probable maximum loss, and with these decisions set to inform its reinsurance and catastrophe bond purchases for the coming hurricane season.

TWIA is typically out in the market by April 1st, so at this meeting its Board needed to provide a decision that would support it securing sufficient claims paying capacity for the coming 2022 treaty year.

The risk transfer and reinsurance budget had been set at the same level as 2021, at $102.6 million, but given the way reinsurance rates have moved and the fact TWIA’s exposure has increased in the last year, the Board were realistic in acknowledging that securing their necessary reinsurance and cat bonds within that budget is going to be a particular challenge for its new reinsurance broker Gallagher Re.

TWIA had changed up its service providers for 2022, with insurance and reinsurance broker Aon now delivering catastrophe risk modelling support, while Gallagher Re is broking reinsurance and its capital markets unit Gallagher Securities arm providing cat bond services.

The first decision taken, on the catastrophe modelling approach, resulted in the TWIA Board voting to utilise an equal blend of four models, from RMS, Verisk (AIR), CoreLogic and Aon’s own Impact Forecasting.

Alongside this, the Board adopted a motion to utilise the near term assumption view of risk when deriving a 1-in-100 year probable maximum loss figure to base their risk transfer purchases on.

Importantly, inflationary factors are top of mind for the TWIA Board and also feature in their assumptions on reinsurance buying.

Because of this, the Board also decided to include loss adjustment expenses (LAE) within their PML figure for 2022.

As a result, the 1-in-100 year PML, based on aggregate exceedance probability, includes a 15% weighting for LAE and using the new expanded model blend, comes out at $4.2363 billion for 2022.

The Board then moved on to discuss TWIA’s reinsurance and catastrophe bond needs for 2022.

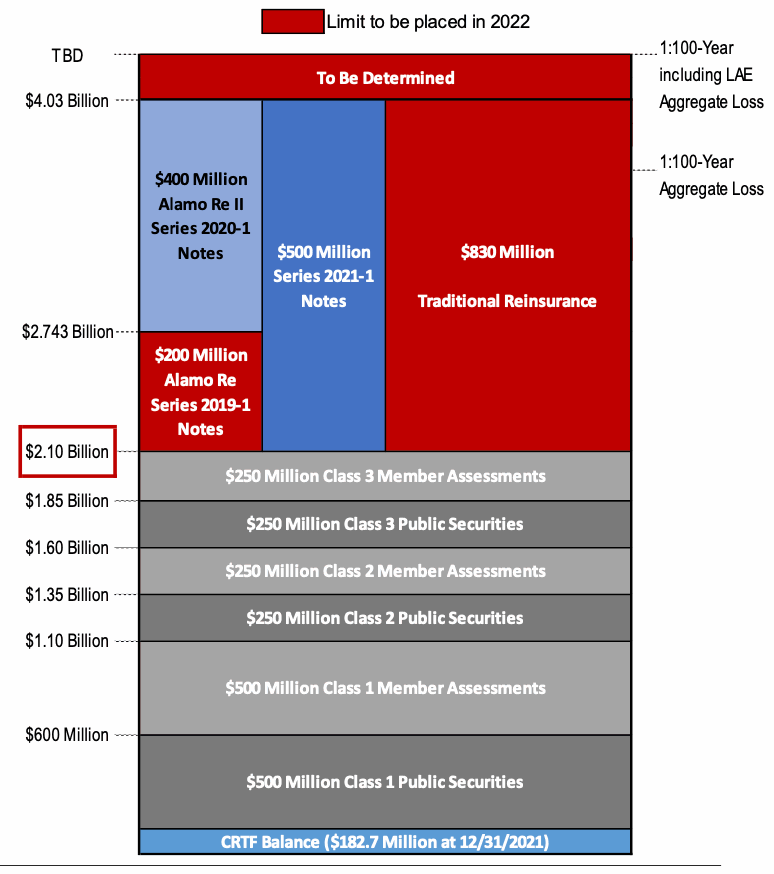

TWIA will have $900 million of multi-year catastrophe bond protection still in-force through this renewal, from its $400 million Alamo Re II Pte. Ltd. (Series 2020-1) catastrophe bond and $500 million Alamo Re Ltd. (Series 2021-1) catastrophe bond.

But the $200 million of Alamo Re Ltd. (Series 2019-1) cat bonds mature this year and so will need replacing in some form, while TWIA’s $830 million of traditional reinsurance will also need renewing, again in whatever form is most cost-effective.

TWIA expects to lift the reinsurance attachment point to $2.2 billion this year, adding $100 million through some new funding for its Catastrophe Reserve Trust Fund (CRTF) that sits at the bottom of the tower.

The image below shows TWIA’s projected reinsurance tower for 2022 before yesterday’s Board meeting, hence the CRTF hasn’t been doubled at the bottom and the attachment is shown lower as a result.

But with TWIA now planning to try and stretch its budget, or increase its budget, to secure coverage up to $4.2363 billion for 2022, the Association needs to have $2.0363 billion of reinsurance and cat bonds, excess the $2.2 billion attachment.

That means, taking off the $900 million of in-force cat bonds, TWIA needs to procure new reinsurance and cat bonds totalling $1.1363 billion, or thereabouts, for 2022.

With the catastrophe bond market competing with traditional reinsurance and providing cost-effective coverage in a hardening market, it would not be surprising to see TWIA more than replacing the maturing $200 million Alamo 2019 and once again making cat bonds a significant component of its reinsurance tower for 2022.

This year there is a real opportunity for the cat bond market to take another dominant share in TWIA’s reinsurance tower.

Last year, cat bonds made up 57% of TWIA’s reinsurance arrangements.

With the benefits of multi-year cover again evident in the $900 million of cat bonds TWIA does not need to renew in this harder market, it would not surprise to see the Association again placing more reliance on the insurance-linked securities (ILS) market in 2022.

During the discussion, TWIA’s Board acknowledged that they may have underestimated where reinsurance costs were heading when setting their 2022 budget, so they are not going to be surprised if more budget is required to secure the targeted reinsurance and cat bonds this year.

While the budget has been set at almost $103 million, the Board discussed the fact that by maturing some traditional bonding they could save money to be put towards reinsurance, with the possibility of the budget being able to stretch to as much as $117 million.

Gallagher Re’s representatives explained that TWIA’s exposure is up 7% year-on-year, suggesting a need to spend more just to secure the same reinsurance tower as a year ago.

With now more protection being sought, an increased budget is almost definitely required, although TWIA will as ever task their reinsurance broker to go to market and secure as much as possible with the budgeted amount, while getting indications on what additional budget may be required to cover the targeted 1-in-100 year PML for 2022.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.