Tremor’s weekly auctions of industry loss warranties (ILW’s) are gaining traction, with around $100 million of capacity available every week and spreads now narrowing fast as the reinsurance and retrocession markets harden.

Tremor Technologies Inc., the technology-based programmatic risk transfer marketplace provider, has made available some unique data insights into its marketplace for industry loss warranty (ILW) products, showing supply of capacity and pricing in a transparent manner, perhaps the first time this kind of information has ever been available in the reinsurance marketplace.

By sharing this transparent, aggregate pricing and volume information from the last eight weeks of ILW auctions, Tremor hopes to demonstrate that the marketplace has real appetite for risk and capacity available, while like any true marketplace spreads that were wide to begin are now narrowing fast.

Already, Tremor had a successful trade on its ILW market in just the second week of its running, since which the availability of capacity has remained stable with around $100 million shown per-week across eight consecutive.

So far, Tremor has seen an average of over US $70 million of capacity offered and US $30 million of protection requested, every week since the ILW auctions launched back in April.

More than 10 markets have participated in the ILW auctions and over 50 bids have been received.

Importantly, Tremor also notes that reinsurance brokers are playing an important role in coordinating supply and demand on the marketplace.

Brokers often forget that tech-based marketplaces like Tremor are to their benefit as well, providing them with a tool to place risk through and bring capacity to, that is often far more advanced than their own.

This can enable reinsurance brokers to secure more efficient placements for their ceding clients, access a wider range of markets, and achieve broader syndication.

While, on the capacity side, brokers can bring markets to the auctions and allow them to express rich preferences around their appetite for risk, participating in any auctions running on the platform that they have access to, which is broader than just these weekly ILW auctions, as Tremor also facilitates efficient placement of traditional reinsurance towers and instruments such as parametric contracts.

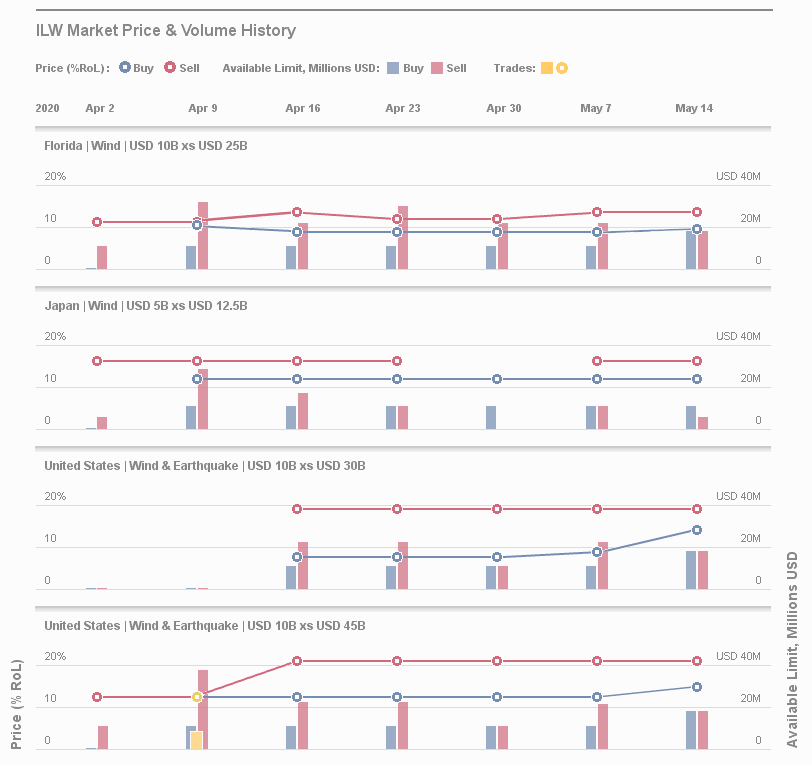

Tremor noted that over the eight weeks that its ILW auctions have been running, spreads have fluctuated each week, with the best buy and sell prices converging to produce the successful US wind and earthquake risk trade.

This is a feature of any marketplace, that bid-ask spreads can be wide and then as traction builds they come closer together. But it also reflects the state of the reinsurance market as well, especially through the uncertainty associated with the pandemic over recent weeks.

But in the last few ILW auctions Tremor notes that spreads are narrowing, in tandem with the traditional reinsurance market hardening that is being seen, and as a result activity is expected to increase going into June and July.

Sean Bourgeois, Tremor’s Founder & CEO explained, “The Tremor team is thrilled with the early and consistent engagement of the industry with our new marketplace dedicated to ILW trading. We have had more buyers and sellers than expected and much more volume than expected with new participants offering quotes every week – and we are still a few weeks out from midyear renewals. Reinsurance brokers are playing an important role as well, advising their clients how to bid programmatically on Tremor. We believe that activity will increase even further after midyear renewals complete when the dust begins to settle on traditional placements.

“Spreads have started to narrow quickly which is a great sign, signaling that the market is getting more and more serious about trading ILWs more frequently while the UNL market continues to harden. To promote further transparency, Tremor is pleased to release all of its aggregate market data, which is available to members of the Tremor marketplace.”

“We offer a unique, discreet and transparent way to buy or sell common ILW structures which we believe will be highly attractive to reinsurers, Lloyd’s syndicates, ILS funds and for certain insurance companies. We hope that our market will continue to grow to become a permanent feature of the retro market to enable dynamic ILW trading throughout the year,” Bourgeois continued.

At the moment Tremor is offering four standard ILW structures in its auctions, although any contract could be syndicated and placed using its technology.

The four included in the weekly auctions are:

Tremor

currently offers the following basket of ILWs each week:

- Florida Wind: USD 10B xs. USD 25B (PCS)

- Japan Wind: USD 5Bxs. USD 12.5B (PCS)

- US Wind and Earthquake (excluding PR and T):

Two triggers, USD 10B xs. USD30B and USD 10B xs. USD 45B (PCS)

These are structures many will understand in the market and looking at the data Tremor has provided, it seems pricing is actually very keen and could be attractive to protection buyers at this time.

ILW protection is in demand right now, as reinsurers are facing capital hits from all-sides, underwriting and investment, while also trying to capitalise on hardening reinsurance rates. All of which is adding up to a situation where reinsurers may need to hedge their portfolios around and after the mid-year renewals, especially with so much uncertainty still hanging over the sector due to the pandemic.

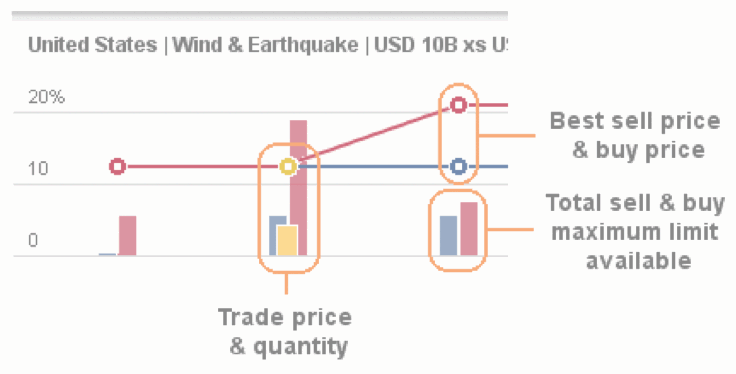

Tremor reports the following data for each product.

Tremor reports the following data for each product.

- Buy and sell limit available – The total limit priced by buyers (respectively sellers) irrespective of price.

- Best buy and best sell prices (the price spread) – When buy bids (respectively sell bids) are present, the price (% rate on line) at which the first dollar of coverage would be bought (respectively sold).

- Trade volume – The total volume (dollars of limit) transacted.

- Clearing price – When coverage is transacted on an ILW, the price (% rate on line) of the transaction.

All prices are reported net of brokerage and fees.

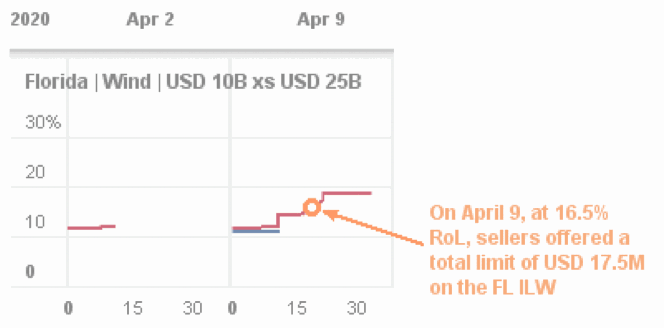

The graphic below shows the data from seven of Tremor’s ILW auctions, with the narrowing of spreads clearly visible.

Tremor explains:

As can be seen above, spreads are beginning to narrow on the majority of ILW products over the last two weeks. As the market moves towards June 1 renewals, we expect spreads to continue to narrow and for more trade to clear. As more and more firms participate, more value is created for them as spreads will naturally narrow and trade will accelerate, so it’s a virtuous cycle for every participant. The marketplace gets more valuable to everyone the more everyone uses it.

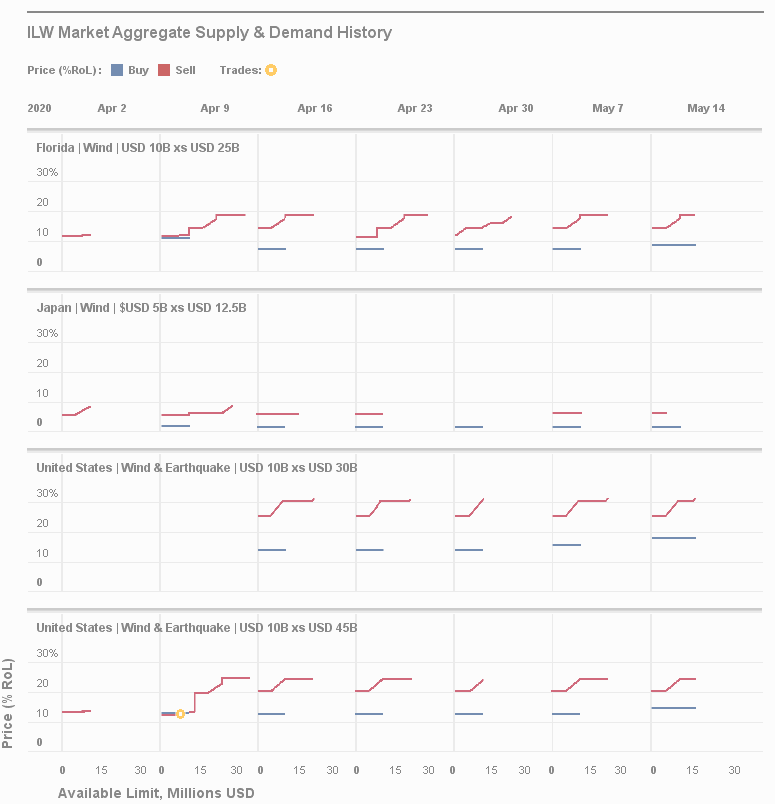

Tremor also captures and is making available important data on supply and demand, essentially the order book for each weeks ILW auction.

Tremor said:

The order book on Tremor is captured by aggregate supply and demand curves. This data is unique to Tremor, since Tremor collects thousands of price and quantity indications from each participant. In de-identified aggregate form, it is highly valuable and useful to every market participant. An aggregate supply curve represents the total amount of capacity sellers authorize to provide at each price point. Likewise, aggregate demand captures the total amount of coverage buyers offer to purchase.

The image to the right (above) shows an example of how this can be displayed.

The graphic below shows data from Tremor’s ILW auctions displaying the aggregate supply and demand curves.

Tremor said:

Aggregate supply and demand for the last seven weeks are shown in the figure above. This is unique data, real aggregate pricing rather than simple indications from both sides of the market – completely unique in the industry. No other marketplace captures this level of rich data and offers it to participants to enhance trade in the industry today. It’s Tremor’s view that a transparent marketplace with posted prices will further induce trade, resulting in the most liquid, competitive marketplace for ILWs in the industry.

This information on true ILW market supply and demand, pricing and spreads, is absolutely unique.

Right now, the most transparent pricing indications get in reinsurance, retrocession and in particular ILW’s is broker pricing sheets. But as we’ve explained before, these are often far from the true prices a trade could clear at.

Tremor’s data is powerful as it shows the building appetite for risk on its marketplace, how much capacity is currently available through its market, giving some transparency into where the buyers and sellers may meet and trades could be completed in future as spread narrowing continues.

As with any marketplace it takes time for bids and offers to meet and spreads can seem overly wide for a time. Tremor sees this data as a starting point and expects the narrowing to continue, but urges those involved in the market to get involved as the more bids/offers the better quality and more realistic this data will become.

The ILW auctions are set to continue on a weekly basis and it will be interesting to see whether activity levels rise, as demand for ILW capacity certainly has in the last fortnight and this is likely to continue.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.