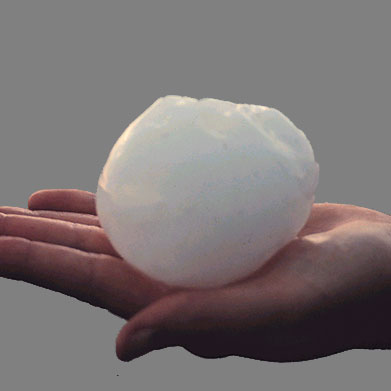

Increasing losses from the December hail storm in Sydney and the surrounding area of Australia has hiked the overall insurance and reinsurance bill for summer catastrophes that have been designated in the country to A$2.2 billion (US $1.57bn).

At the last update back in January, the Insurance Council of Australia (ICA) had estimated insurance market losses from the hail storm at A$871 million based on 99,638 claims reported, with the majority at 71,475 being motor vehicle claims, 22,057 home building and 4563 contents claims.

At the last update back in January, the Insurance Council of Australia (ICA) had estimated insurance market losses from the hail storm at A$871 million based on 99,638 claims reported, with the majority at 71,475 being motor vehicle claims, 22,057 home building and 4563 contents claims.

Now, the ICA has updated that loss estimate, putting the total impact to insurance and reinsurance market interests from the hail storm in Sydney area at A$1.189 billion from 130,000 claims.

So far over 30,000 hail-related insurance claims have been closed, the ICA said, suggesting there is considerable work to do and the potential for the industry loss from this hail event to increase further.

The other catastrophe events designated by the ICA in the summer months include the Townsville, Queensland flooding, which as we explained last week is now estimated to have caused an industry loss of A$1.04 billion.

In addition, the Bunyip bushfires in eastern Victoria that occurred in late February have driven a further $20 million of insurance market losses from 365 claims, the ICA said.

ICA General Manager of Communications and Media Relations Campbell Fuller commented, “Insurers are working around the clock in three states to support customers affected by extreme weather catastrophes.

“They are also standing by to help policyholders in Queensland, the Northern Territory and north-western WA who have suffered losses caused by cyclones Trevor and Veronica.”

It’s no surprise that the Sydney hail storm and severe convective weather event has driven the highest insurance and reinsurance market loss so far, as analysts had previously suggested the impacts could rise to as high as A$2 billion.

It seems unlikely that total will be reached, but the overall impact has been significant enough to erode some Australian insurers reinsurance deductibles and along with the other catastrophe events in recent months a number of reinsurance programs are being triggered.

Cyclone’s Trevor and Veronica are both set to drive some additional insured impacts, but at this time it seems the overall impacts were less than they could have been, thanks to the sparsely populated area that cyclone Trevor came ashore and the fact cyclone Veronica stayed offshore for so long.

——————————-

Register today to attend our next ILS conference in Singapore, ILS Asia 2019.

Register today to attend our next ILS conference in Singapore, ILS Asia 2019.

We’re returning to Singapore for our fourth annual ILS market conference for the Asia region. Please register today to secure the best prices. Super early bird tickets are now almost sold out.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.