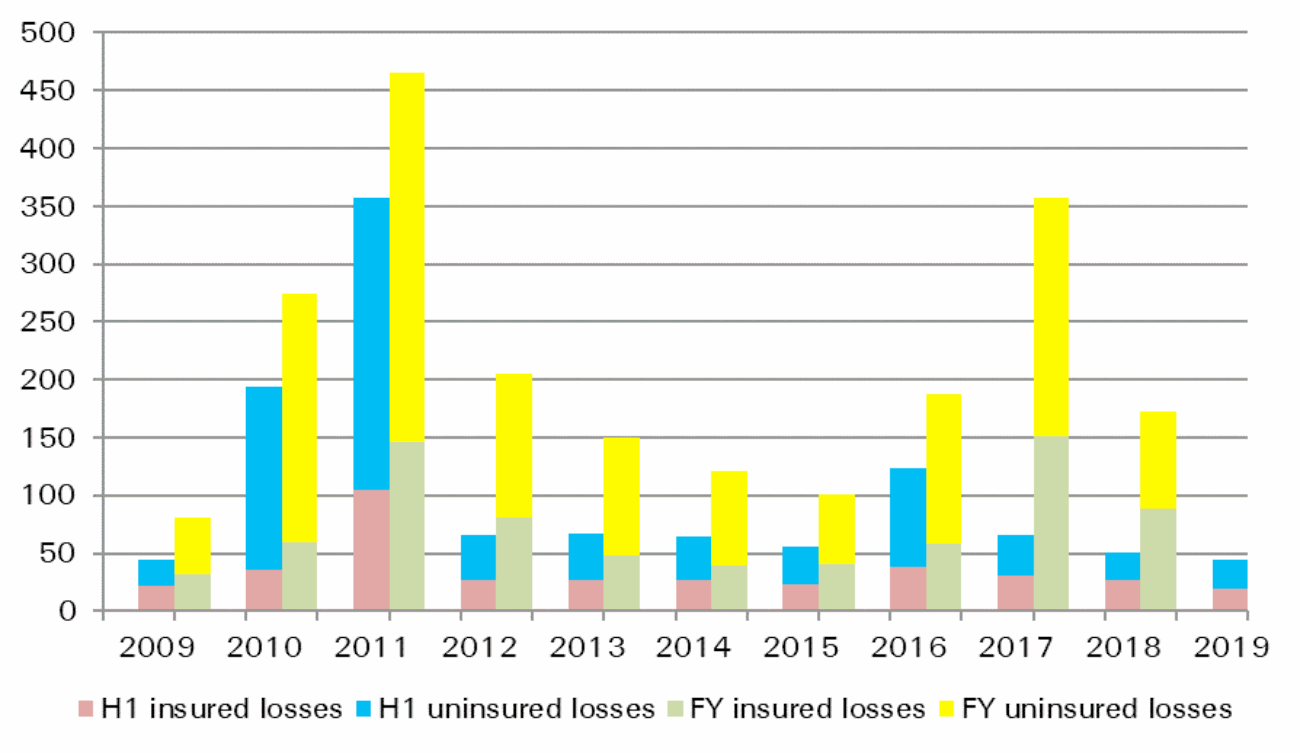

Global reinsurance firm Swiss Re has estimated that first-half 2019 natural catastrophes and severe weather events around the globe cost the insurance industry $19 billion, covering just 42% of the $40 billion economic impact.

The percentage of economic losses insured is lower than a year ago, on Swiss Re’s data, when $45 billion of catastrophe economic impacts drove $26 billion of insured losses in H1 of 2018.

The figures are well below the long-term averages, with $109 billion being the average for first-half economic losses of the previous ten years and $36 billion the average insurance industry loss.

Insurance and reinsurance covered $15 billion of losses from natural catastrophes in H1 2019, down from $21 billion in the prior year.

The other $4 billion of insured losses were from man-made disasters that occurred over the first six months of this year, down from $5 billion in H1 2018.

Martin Bertogg, Head of Catastrophe Perils at Swiss Re, commented, “The experience of the first half of this year has once again exposed the existing protection gap issues in emerging countries. For example, cyclone Idai showed just how fragile African coastal communities are. And in India, cyclone Fani inflicted widespread damage and large uninsured losses.”

In the case of cyclone Idai, for which economic losses are estimated to be more than $2 billion, only about 7% were insured.

The reinsurance firm notes the influence of so-called secondary perils in the H1 2019 disaster losses to the industry.

“The nature and location of the events underline the theme of secondary perils taking a larger share of the overall loss burden,” Bertogg explained.

Thunderstorms, torrential rainfall and snowmelt (all considered secondary perils) caused the highest losses through wind and water damage in the first half of 2019 for regions of the world, such as the U.S., Canada, Europe, Australia, China and Iran.

Swiss Re estimates that total economic losses from secondary peril events came to $32 billion, roughly $13 billion of which were covered by insurance and reinsurance markets during the period.

Heat waves and dry weather, particularly in Europe, are likely to add to the tally for the first-half in time, but the costs of these remains largely undetermined at this stage.

Bertogg said, “Intense heatwaves and dry spells of the like we’ve seen over the last few years are expected to become more frequent, exacerbating the conditions conducive to wildfires and agriculture losses. We also expect more variable rain patterns, as rising temperatures load the atmosphere with more vapour. Society will need to adapt and prepare for these increasing occurrences.”

Swiss Re’s estimate for $19 billion of insured catastrophe losses in the first-half is higher than Munich Re’s figure of $15 billion, but slightly below the $20 billion estimate from insurance and reinsurance broker Aon.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.