Swiss Re Corporate Solutions’ Innovative Risk Solutions team, a division of reinsurance giant Swiss Re, has launched a digital parametric natural catastrophe platform in the U.S. for the small and medium-sized enterprise (SME) market, called Parametric Online Platform (“POP”) STORM.

Parametric risk transfer mechanisms are a common feature of insurance and reinsurance, as well as a trigger applied in the insurance-linked securities (ILS) sector.

Parametric risk transfer mechanisms are a common feature of insurance and reinsurance, as well as a trigger applied in the insurance-linked securities (ILS) sector.

They have been most often used by large corporations, sovereign risk transfer sponsors and risk pools around the world, as well as in micro-insurance and reinsurance for micro programs, as an alternative and often more responsive form of risk transfer to traditional, indemnity-based solutions.

Benefiting from fast and efficient proof of loss which requires no input from loss-adjusters, with payout being tied to predetermined parameters such as volume of rainfall or wind speed, parametric insurance offers rapid payout post-event and after the occurrence of natural catastrophes, such as hurricanes, can be extremely valuable and effective.

In an effort to expand the utilisation of parametric risk transfer to a wider range of SMEs in the U.S., Swiss Re Corporate Solutions has developed POP STORM – a digital parametric natural catastrophe risk transfer platform focused on U.S. coastal areas that continue to suffer impacts from large hurricane events.

The platform is already live and in light of its launch, Artemis spoke with Martin Hotz, Head Parametric Nat Cat and Vice President Products & Global Markets, Swiss Re Corporate Solutions.

To begin, Hotz explained that the firm knew that the challenge of being un-or underinsured goes far beyond the large corporate sector.

“Whilst we have been successfully structuring parametric solutions for corporate clients, we knew that offering the same product to the small and medium-sized enterprise (SME) market required a more automated underwriting approach.

“The POP STORM platform offers exactly that – an efficient, reliable and user-friendly way to access the coverage within minutes.”

He continued to explain that with POP STORM, the trigger is the reported wind speed at a point within less than a kilometre of the insured’s location.

“By using the wind speed as a parameter, the basis risk is lower than with a Cat-in-the-circle cover. For instance, a Category 3 storm right over an insured’s location can be more impactful than a compact Category 5 20 miles (32 km) away. The wind speed data is obtained from an independent 3rd party data provider,” said Hotz.

After an event occurs, continued Hotz, the policyholder must submit a notification and proof of loss, with the policy then making payments within 30 days of the event.

The digital platform was recently rolled out in the U.S., and Hotz underlined that it enables a broker to be autonomous in providing indications to SME clients for Swiss Re Corporate Solutions’ proprietary parametric US Hurricane wind product, while at the same time bind the policies via the platform, absent the need for referral.

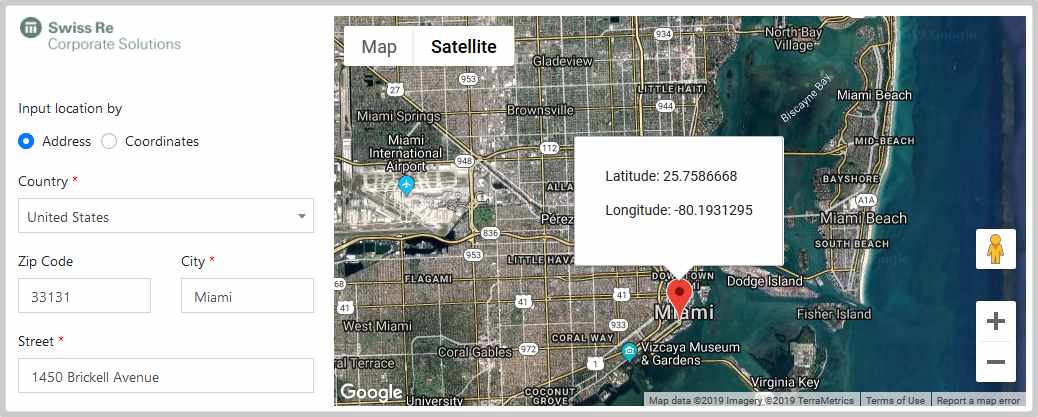

Commenting more broadly on how the platform works for brokers, Hotz said, “The platform is user-intuitive and requires very little information. The price of a parametric cover depends solely on the risk location. A broker can log into the POP STORM website, enter the address (or just set the risk location pin on the map) and get an indication within seconds.

“The indication can be shared with the client, along with the product information that explains how the cover works and provides examples. When the client decides to buy the coverage, the broker can convert the indication to a bound policy within seconds using the platform, without any referral to Swiss Re Corporate Solutions.”

Hotz told Artemis that Swiss Re Corporate Solutions has already sold some policies and that for the 2019 Atlantic hurricane season it is partnering with AmWins Group Inc., the global distributor of specialty insurance products and solutions, with plans to expand the distribution going forward.

Harry Tucker, Executive Vice President (EVP) of Property at AmWINS, commented on the partnership with Swiss Re Corporate Solutions, “We are very happy to be Swiss Re Corporate Solutions’ exclusive distributor for such an innovative property product.

“They have built a platform that combines speed, ease of use, and creativity to deliver a parametric product competitive for middle market accounts. We view this as a powerful tool and differentiator in a changing market.”

Historically, parametric solutions have been made available primarily to large corporate clients, but Hotz explained that this could change as automation makes this type of product more widely available across the insurance and reinsurance industry.

“With a digital solution that automates the process, such products become accessible to smaller businesses that tend to be more vulnerable to nat cat losses and frequently have protection gaps that can be filled with parametric products,” said Hotz.

The Corporate Solutions unit of reinsurance giant Swiss Re offers a wide range of parametric solutions, and with this in mind, Hotz said that expansion into other perils is a possibility. For now, however, U.S. coastal areas exposed to hurricanes and tropical storms clearly remains the focus.

“We have been focused on the U.S. coastal areas that continue to suffer through large hurricane events – most recently Hurricanes Florence and Michael. Florida alone has 1.5 million SMEs that stand to benefit from the STORM solution given their location and the seasonality of the hurricane events,” said Hotz.

Encouragingly, Swiss Re Corporate Solutions is also seeing increasing demand for parametric insurance products from smaller protection buyers, a trend that suggests broadening knowledge of the product and its benefits.

“As the concept of parametric insurance takes a firmer hold in the market, we have seen a considerable uptick in the number of smaller clients who want to utilize parametric covers to help them better manage their Nat Cat risk,” said Cole Mayer, Vice President Innovative Risk Solutions at Swiss Re Corporate Solutions. “These tend to be smaller limit and smaller premium deals, so we had to find an efficient way to deliver them to the market. We have found exactly that with the POP STORM platform.”

“The combination of transparent claims process, speed of payout and flexibility in the use of the funds make parametric covers a very powerful tool in the risk management toolbox.”

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.