Almost a year ago one of our interviewees said the pain was becoming real and at the time it was beginning to be reflected in the results of major reinsurers. In 2017 this soft market pain is becoming increasingly evident, something noted in Swiss Re’s results this morning.

The reinsurance firm has reported a decline in performance, income and returns, as reported this morning over at our other publication, all to a backdrop of a shrinking book of business, as it pulls-back from reinsurance and insurance business that does not meet its requirements anymore.

The reinsurance firm has reported a decline in performance, income and returns, as reported this morning over at our other publication, all to a backdrop of a shrinking book of business, as it pulls-back from reinsurance and insurance business that does not meet its requirements anymore.

Swiss Re’s net income for the first-half of 2017 comes out as $1.2 billion, down 35% year-on-year from $1.86 billion and a 10% miss to analyst consensus, while its return on equity of 7% is down from 10.9% in H1 2016.

It’s a pretty big decline over a single year, particularly while at the same time the company has reduced its gross premiums written by 8.3% to $18.1 billion, which while it puts this pull-back down to “disciplined underwriting and active portfolio management,” does also suggest that the potential for a return to profit levels seen previously is likely seriously diminished by a smaller book.

Consecutive years of pull-back in reinsurance underwriting to protect results is the most sensible response in a softening and challenging market. Underwriting at any cost would very quickly be a problem at a company the size of Swiss Re, so it’s disciplined approach has been welcomed by shareholders.

The problem is that the market is not getting any less competitive and so to return its reinsurance book to anything like the size it was in prior years is likely becoming more difficult with each year of soft market that passes.

Now this may not be a problem for Swiss Re, which has a diversified book across its units and a growing primary insurance focus, but for pure-reinsurers that have been pulling back the chances of recouping business lost, which lets face it a lot has been lost to more efficient ILS fund players, looks pretty unlikely at this stage.

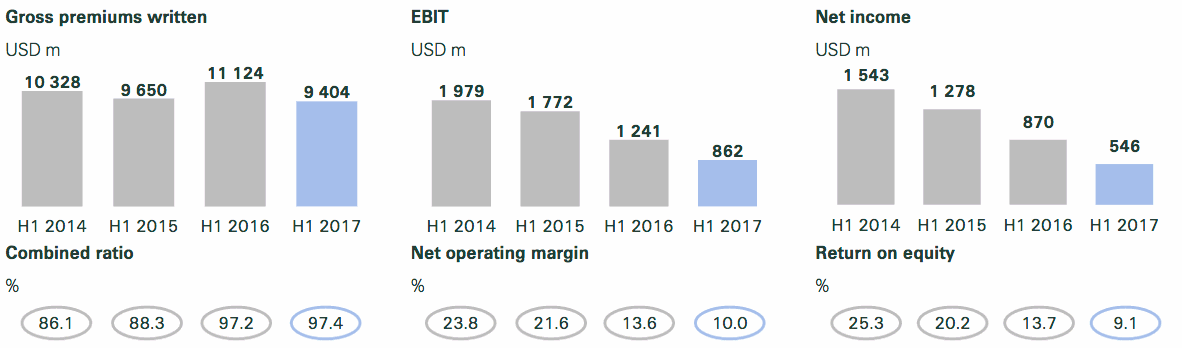

In P&C reinsurance the effects of the soft market are very clear, with these charts from Swiss Re’s financial report, published this morning, making the decline and the pain very clear.

Swiss Re H1 2017 P&C reinsurance results vs prior years

The steady decline in profitability over the last four first-half’s is stark, and it has to be remembered that this is in an environment where major catastrophe losses remain relatively low.

The lower price quality of the overall book will be responsible for much of the decline in earnings and income. It’s quite amazing how much this has declined across just four years.

In a soft market, of course, terms and conditions have generally been expanding over the last four years, which could be reflected in the increasing combined ratio as well, which has the effect of reducing margin.

Alongside the reduction in pure margin of the reinsurance business underwritten, it’s no surprise to see net operating margin and return on equity so much lower, even though we are not seeing any particularly large uptick in losses.

If this much pain is being felt by Swiss Re in its P&C reinsurance business, how much are smaller more catastrophe focused reinsurers feeling?

It’s likely significant and results of some of the Bermudians also show a steady decline in margin and profits over the same period, with an uptick in combined ratio, despite the relatively benign loss environment.

In recent weeks we’ve even had ILS fund managers explaining that the pain they feel in the reinsurance renewal process is greater this year.

It’s often the way, that when people begin to get to grips with operating in a more pressured and challenged environment, the rhetoric quietens down and you can be fooled into thinking it’s all ok. It’s seemed this way in reinsurance, as companies reported more than adequate results repeatedly, but when you look back at just how profitable this business was in prior years the pain becomes increasingly evident.

Swiss Re CEO Christian Mumenthaler, commented on the results, saying; “In the first half of 2017, we reported a solid result – despite the challenging market environment and having paid significant claims in the aftermath of natural catastrophes. While in the short term these drivers, especially the pricing pressures, are concerning and are being addressed, we are steering our company with long-term value creation in mind.”

Major cat losses were felt, with a $360 million hit from Cyclone Debbie in Australia and attrition due to losses across the United States, from severe storms. But these aren’t particularly major, in the scheme of larger loss events seen over the last 10 years.

Perhaps making things even more challenging, the Corporate Solutions build-out is yet to return dividends, as the unit again reported a worsening underwriting loss this half.

In this unit Swiss Re has perhaps begun to come up against even more competition, as more reinsurers looks to commercial insurance lines and even some ILS capacity begins to back commercial property risks in the U.S.

This suggests that the pressure is not going to let up anytime soon, and it may be necessary for companies like Swiss Re to continue to make moves to address ongoing pricing pressure for some time to come.

Looking at the decline in earnings versus the decline in the size of the underwriting book, it is evident that the price per unit of risk underwritten has declined enormously, which also perhaps reflects the amount of risk taken on per dollar of balance-sheet capacity deployed having increased as well, with terms expansion included there.

How sustainable is such a large portfolio generating this level of returns, should pricing not rebound significantly over the next ten years. How much more contraction of the underwriting book will be necessary and where does a major reinsurer like Swiss Re generate its earnings if not from its underwriting?

Once again we have to ask whether reinsurers need to shift their focus to earning fees for their clear risk expertise, rather than being paid for the use of their balance-sheets. If a more efficient underwriting capacity pool can be created (third-party of course), allowing reinsurers to earn fees and profit shares, could that become a viable contributor alongside putting the balance-sheet to work in diversifying areas?

Or can the advent of InsurTech help reinsurers to become so much more efficient they can improve earnings by cutting waste and by making the connections between risk and their capacity so slick that there is little intermediary costs in the way?

Big questions remain for the leadership at a company like Swiss Re. Questions that need answers as, if the rate of decline shown in the charts above continues, what options will be left?

Mumenthaler closed out the results release, saying; “We acknowledge that the market environment remains difficult. At the same time, we take decisive measures addressing the industry challenges head on. We will continue to be selective in choosing the risks we underwrite, aiming to ensure future profitability. We are equally determined to put our knowledge and leadership position to work and collaborate with our clients. I am confident the long-term trends for our industry are positive as risk pools will continue to grow.”

Another question is; who will be originating, analysing, structuring, pricing and underwriting these risk pools, and who will be backing them?

Or perhaps a better question is; what is the most efficient form of capital to back many of the world’s peak risks and emerging risk pools and, if that’s not always a traditional reinsurance balance-sheet anymore, how can a reinsurer like Swiss Re position itself to still earn margin from these opportunities?

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.