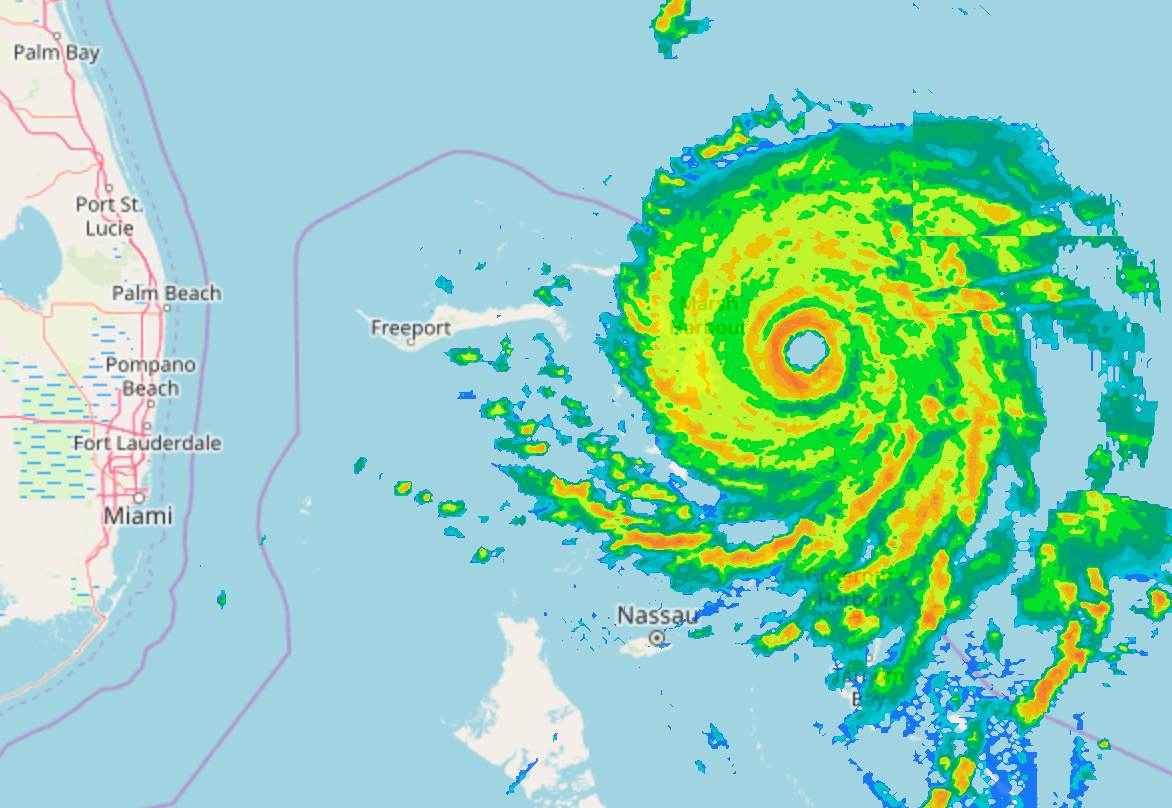

SCOR, the global reinsurance player headquartered in France, has been benefiting from its retrocesssion program for recent catastrophes, making recoveries for both hurricane Dorian and typhoon Faxai, according to the CEO of SCOR Global P&C.

As we explained yesterday, SCOR remains on target for the full-year despite suffering higher than budgeted catastrophe losses during the third-quarter period, which is partly thanks to its retrocessionaires.

As we explained yesterday, SCOR remains on target for the full-year despite suffering higher than budgeted catastrophe losses during the third-quarter period, which is partly thanks to its retrocessionaires.

SCOR’s retro program has been adjusted over recent renewals to provide more responsive protection for the firm and it seems to be responding well to mid-sized loss events, such as those experienced with recent hurricane Dorian and typhoon Faxai.

CEO of SCOR Global P&C, Jean-Paul Conoscente has confirmed that SCOR has made some recoveries under its retrocessional reinsurance program for both of these catastrophe loss events, while also implying that there remains proportional protection in place in Japan that could also help the reinsurer in paying its claims from typhoon Hagibis as well.

Speaking during the reinsurers earnings call yesterday, Conoscente explained that SCOR experienced a, “Heavy cat burden, resulting in a cat ratio of 7.6% for the year-to-date, slightly above our 7% cat budget, driven by net contributions from Typhoon Dorian and Faxai, respectively, EUR 92 million and EUR 89 million.”

Continuing to explain, “We’re the fifth-largest reinsurer in the Caribbean and the fourth-largest reinsurer in Japan, and these impacts are consistent with our market share.”

Asked whether SCOR has been benefiting from any protection of its retro program for these events, Consocente went on to confirm that it has.

“On both, we have some retro that is paying for us,” he explained. “We have some proportional retro in Japan which provides some relief and a limited amount of retro on the Caribbean loss.”

Then asked whether there is retro protection still available to SCOR for future loss events, which would include typhoon Hagibis given it occurred in Q4, Conoscente confirmed that protection still exists.

“Regarding the rest of the year, we haven’t affected our excess of loss retrocession, which remains intact and the proportional retro we have in place remains intact as well,” Conoscente said.

Proportional retro would be expected to respond to typhoon Hagibis as well, given that appears to be set to create an even larger industry loss than Faxai.

The proportional aspects of SCOR’s retro program could include its sidecar and private quota share arrangements, suggesting some capital market investors or ILS funds may assist the company on these losses.

CEO of SCOR Denis Kessler referred to the retro program as part of the reinsurers to absorb shocks through quarters where catastrophe and other major loss activity is higher.

SCOR expects that the Japanese insurer market will pay back its reinsurance providers after recent losses and a second year of significant typhoon impacts.

“Both the Caribbean and the Japanese markets and known for their loyalty and short payback periods. We are therefore confident in our ability to recoup on these events,” Conoscente said.

“In the Japanese market, the mentality of the companies there is to pay back reinsurers over time,” he continued.

He said that it took roughly four years for SCOR to feel it had been paid back for the losses suffered in 2011 in Japan and that after last year SCOR saw 25% rate increases on catastrophe excess-of-loss contracts and expects that price increases will continue in Japan in 2020 as well.

“We expect price increases to continue in 2020,” he said. Adding that, “The mentality of Japanese clients is not just to give payback on the specific programs that were impacted, but across the whole portfolio. This is what was achieved after the 2011 losses and we expect a very similar trend to happen at this renewal.”

As a reminder, SCOR is also into its retrocession for any additional typhoon Jebi loss creep it suffers, further demonstrating that its retrocession program is responsive to recent catastrophe loss years and providing the important capital shield for its quarterly results, both immediately and into the future as well.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.