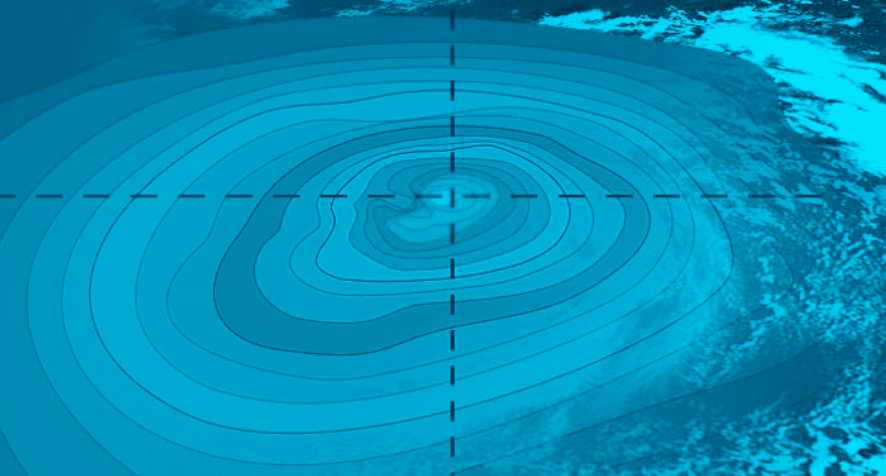

Catastrophe risk modelling specialist RMS has updated its suite of HWind hurricane forecasting products, which are part of the RMS HWind Real-Time Analysis solution.

Coming as the 2020 hurricane season moves towards the peak of what is forecast to be an incredibly active year, RMS’ tools that help insurance, reinsurance and insurance-linked securities (ILS) players better understand the potential impacts of hurricanes as they approach landfall can be critical inputs to decision-making when storms are in the water.

Coming as the 2020 hurricane season moves towards the peak of what is forecast to be an incredibly active year, RMS’ tools that help insurance, reinsurance and insurance-linked securities (ILS) players better understand the potential impacts of hurricanes as they approach landfall can be critical inputs to decision-making when storms are in the water.

RMS launched a suite of hurricane forecasting products for the North Atlantic powered by RMS HWind back in 2019 and the tool has become widely used in the insurance, reinsurance and ILS sectors.

At that time, HWind offered its users an ensemble of forecast tracks, track and gust probability metrics, as well as individual wind hazard and corresponding loss scenario footprints covering the following five days.

Now, the product has been developed to help provide insurance, reinsurance and ILS markets’ with detailed insights throughout a hurricane’s life cycle.

HWind now features: coastal storm surge data and forecasts; track intensity forecast maps; industry loss insights; and an increased frequency and variety of deliverables.

Real-time information is key, as when a hurricane approaches a slight wobble in track, or wind speed intensity, can make all the difference when it comes to understanding the potential insurance, reinsurance and ILS market loss.

The goal is to help markets make informed decisions, understanding both the wind and now storm surge impact of a pre-landfall hurricane event.

The tool provides the ability for those with capital at risk to understand the potential industry impacts, portfolio losses and also other asset impacts, using the same hazard, vulnerability, and financial estimation framework implemented in the RMS North Atlantic Hurricane Models.

This can also inform the need for hedging as hurricanes approach, with HWind a tool that can be used to understand the potential portfolio losses a hurricane could bring, and so inform choices on trading of positions, such as catastrophe bonds, or purchase of last-minute hedging capacity, such as industry loss warranties (ILW’s).

As data and analytics on hurricanes and their potential impacts continue to improve, the ability to make informed live cat hedging decisions does too, with HWind a tool that may help to arm re/insurance and ILS markets with the kind of information that actually stimulates the ability to trade and hedge more effectively and with greater knowledge of the potential impacts.

Pete Dailey, vice president, model development at RMS commented, “If and when tropical cyclone activity escalates and storms threaten exposures at risk, it will become a hectic and fraught time for the market. Now is the time for companies to ready themselves and their hurricane event response processes as the climatological peak of the hurricane season approaches.”

Also, as a reminder, back in 2015 we explained that the HWind product had been used for the development of triggers for parametric insurance and reinsurance products leveraging its real-time hurricane exposure capabilities.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.