Global reinsurance company Swiss Re has estimated that 2022 saw $125 billion of insured natural catastrophe losses, which the company explains was a story of rising property exposure, rather than extreme events.

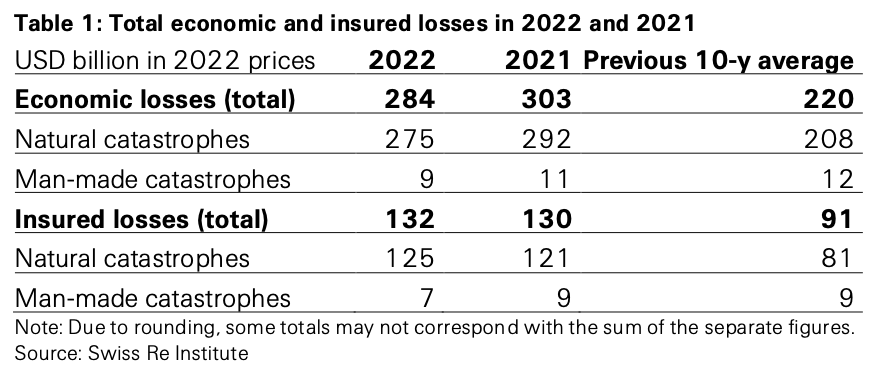

The $125 billion of insured catastrophe losses covered a portion of the $275 billion of economic losses these natural disaster and severe weather events caused, the reinsurer explained this morning.

But it was economic growth and the accumulation of property assets in exposed areas, that were the main drivers of loss in 2022, aggravated by exceptional inflation pressure, Swiss Re said.

2022 was the second consecutive year in which insured losses from natural catastrophes exceeded the US $100 billion mark, which Swiss Re says “affirms the trend of a 5 – 7% average annual increase in insured losses over the past three decades.”

Martin Bertogg, Head of Catastrophe Perils at Swiss Re commented, “The magnitude of losses in 2022 is not a story of exceptional natural hazards, but rather a picture of growing property exposure, accentuated by exceptional inflation.

“While inflation may subside, increasing value concentration in areas vulnerable to natural catastrophes remains a key driver for increasing losses. For our industry this is a call both to reflect the latest exposure even more carefully in risk assessments while continuing to support society in being better prepared.”

Inflation has surged in the last two years, averaging 7% in advanced economies and 9% in emerging economies in 2022, Swiss Re said.

The nominal value of buildings, vehicles and other insurable assets have been inflated as a result, pushing up insurance claims for damage caused by natural catastrophes.

“The economic storm is not over, and interest rates will likely have to increase further given existing inflation pressure. This means higher financing costs and, as a result, capacity providers are likely to remain more cautious in deploying capital for a number of reasons, including risk assessment and loss experience. In our view, as higher exposures encounter shrinking risk appetite, momentum for rising prices, higher retentions and tighter terms and conditions will likely continue,” Jérôme Jean Haegeli, Swiss Re’s Group Chief Economist said.

Hurricane Ian was the largest loss, at an estimated US $50 billion to US $65 billion. That’s quite a wide range for Swiss Re to estimate an event at, as typically reinsurers estimate cat losses much narrower than that, this far after the event.

Which reflects the fact there is still uncertainty in precisely where the industry loss from hurricane Ian settles, and there could be room for loss creep as a result.

As you can see in the table above, there were US $9 billion of man-made insured losses in 2022 as well, taking the disaster loss total to $130 billion for the global re/insurance industry.

At $125 billion, 2022’s natural catastrophe insured losses were higher than 2021 $121 billion, and far higher than the 10-year average of $81 billion.

Just earlier this week we reported that Swiss Re has said property insurance claims costs are rising faster than rates, with inflation the key driver.

Along with the fact inflation is driving natural catastrophe claims higher, these factors will help to sustain the impetus for higher reinsurance pricing as well.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.