One of the most telling and timely findings of our latest global reinsurance market survey is related to a topic we’ve been covering regularly of late, the special session of the Florida legislature and its proposed property insurance market reforms.

Timeliness is everything and just yesterday the package of reforms cleared the House floor, moving on to be signed by the Governor of Florida.

We’ve been writing about the potential for the reforms to make a difference to Florida’s dysfunctional property insurance marketplace and the plague of litigation and fraud that has affected it.

One of the key issues, from our readerships point of view, is whether the reforms will result in a reduction in the risk or severity of loss amplification and social inflation in the state?

So, in our recent global reinsurance market survey, we asked respondents: How quickly they felt any legislation changes enacted in the special session could have a positive impact on reinsurance conditions in the state?

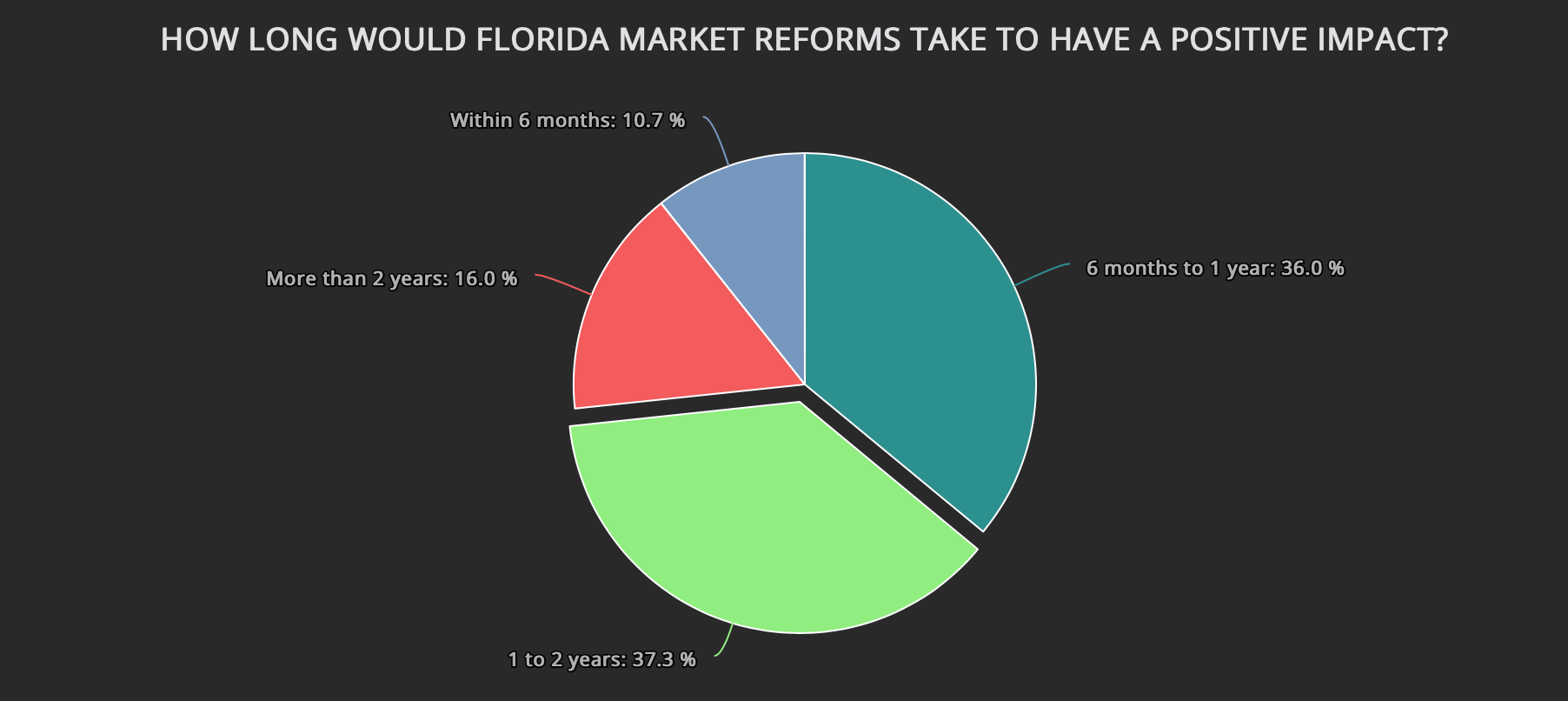

Perhaps unsurprisingly, the results from our hundreds of survey respondents suggest positive reinsurance market effects won’t be felt for some time, with 53% saying it will likely take more than one-year for any benefits to flow through.

The bill and measures that are set to be implemented in Florida promise to reduce litigation; provide a taxpayer-backed $2 billion reinsurance layer that will sit below the FHCF and can be used to help insurers reduce rates; home retrofitting support; roof replacement rule changes; and some insurer oversight additions.

Litigation is the main cause of Florida’s property insurance crisis, that has become abundantly clear in recent months and has been quite a focus for lawmakers.

But, for measures designed to counter litigation to take effect, they have to filter through into the market and in this case many have said they don’t go far enough.

The reinsurance fund addition takes risk away from the open-market, effectively subsidising some lower layers in return for rate reductions. As such, it really makes no difference to your average reinsurance or ILS fund view of risk in the state of Florida.

So, the results of this question from our recent survey are not surprising.

Just 10.7% of respondents felt that the reforms on the table for the special session could have a positive effect on reinsurance market conditions in Florida within a six month time frame.

36% said positive effects on reinsurance market conditions could be felt in between six months and one year, while the largest proportion, at 37%, said it will take between one and two years for Florida’s reinsurance market to improve.

More pessimistic though were the last 16%, who believe it will take more than two years for Florida’s reinsurance market to experience any positive effects from the property insurance reforms.

With reinsurance such a critical capital source for Florida’s insurance carriers, encouraging risk capital back to the state and reducing the perception of risk that reinsurers and capital market investors have of deploying capital in the state is vital to the property insurance market’s long-term health.

At this stage, it appears the market does not have much confidence in the reforms tabled, feeling this is not going to move the dial on reinsurance costs and availability for Florida very quickly.

We’ll report on more interesting findings from the survey over the coming days and you can access the full results here.

Read all our coverage of Florida’s property insurance crisis here.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.