Australian headquartered insurance and reinsurance group QBE has issued a warning that it expects elevated attritional losses in U.S. property and North American crop business due to adverse weather conditions and hail.

The re/insurer said that adverse weather conditions, including an unusually cool growing season and increased levels of crop hail have resulted in a spate of prevented planting claims and yield shortfalls.

As a result, QBE’s North American Crop insurance business will report a 2019 current accident year combined operating ratio of around 107% – 109%, the company said, based on net earned premium of almost $1.2 billion.

QBE said that this compares with its first-half 2019 combined operating ratio of 98% for the North American crop business and a 10 year historical average of a combined ratio sitting at about 90%.

That shows the level of impact that QBE’s crop specific business has felt from recent weather trends in the United States, which will read across to other crop insurers and potentially impact some reinsurance capital as well, we’d imagine.

These adverse weather conditions are also expected to drive higher attritional property claims across the United States, QBE continued, saying that some of its North American property classes of business will likely experience elevated levels of attritional loss as a result.

This will likely also read across to other major property insurers across the U.S., as well as to any ILS capital providers allocating to primary pools of property insurance risk.

As a result, despite some improvement in the property attritional claims ratio, QBE says that it could end up finishing 2019 with a Gropup combined operating ratio slightly above the top end of its target range of 94.5% to 96.5%.

QBE Group CEO, Pat Regan, commented, “It’s been an unusually weather-impacted harvest in North America this year. But we’ve got a terrific Crop insurance business that should stand us in good stead looking forward.”

QBE is benefitting from the firming property market though, with pricing momentum accelerating and helping the company achieve an average premiums rate increase in the third-quarter of 7.5%, up from 4.7% in the first-half.

“The rest of the Group continues to perform well and it is pleasing to see pricing momentum accelerate,” CEO Regan explained.

QBE’s experience in crop insurance will likely read across into the reinsurance market to a degree, when aggregated across all providers of private crop coverage.

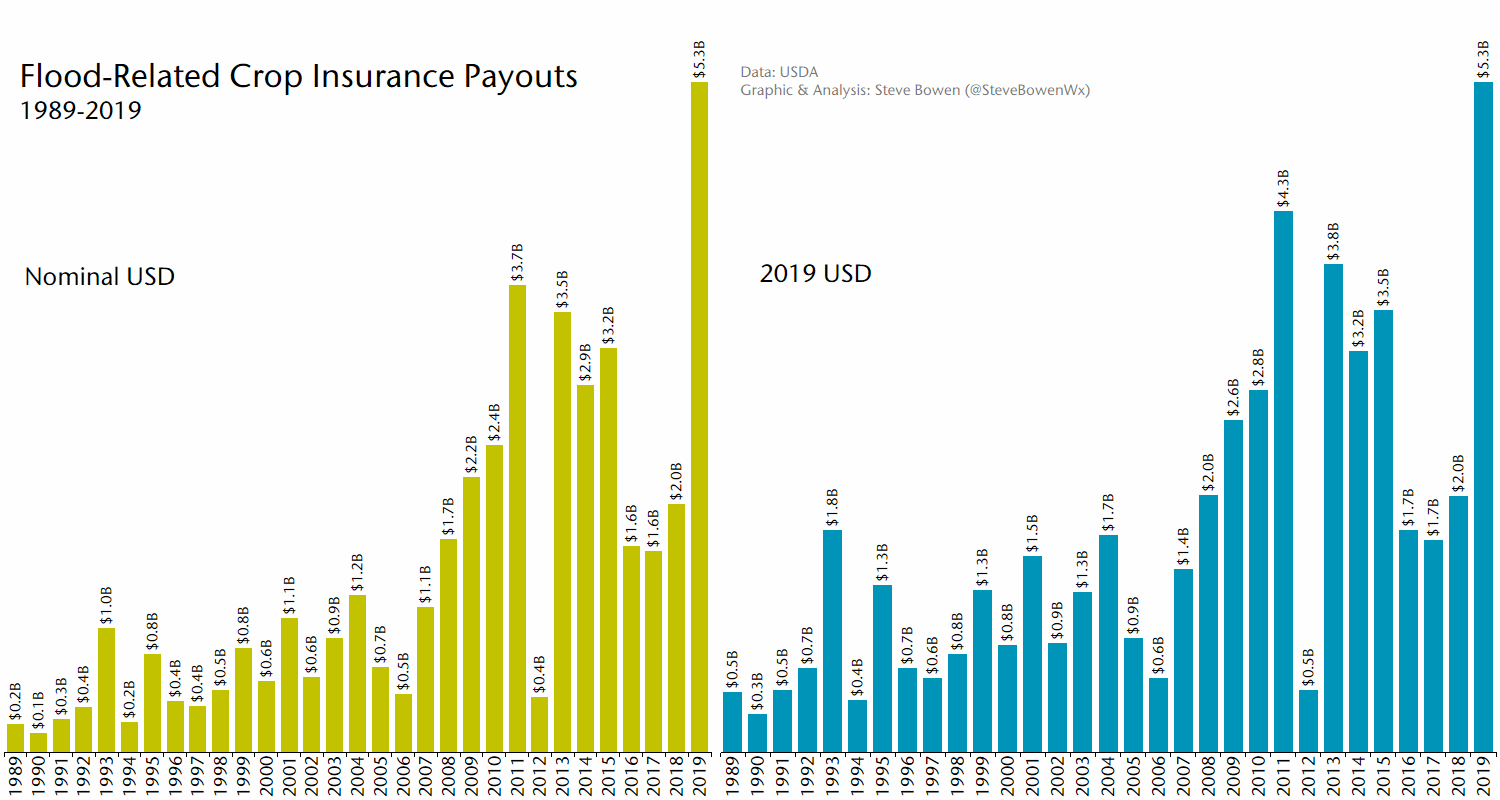

Crop insurance related losses have been trending much higher in 2019, in particular from flood and moisture related claims, which could have driven some of this impact for QBE.

Steve Bowen, Meteorologist & Head of Catastrophe Insight at Aon’s Impact Forecasting, recently shared some data on the high level of crop insurance claims under the USDA’s Risk Management Agency programs, which show 2019 crop claims trending particularly high, as shown below.

The elevated level of attritional property losses in the U.S., which is related to the same adverse weather over recent months, will also read across and perhaps impact some reinsurance providers, as well as leak into quota share covers.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.