Private insurance-linked securities (ILS) fund strategies outperformed in January 2022, as pure catastrophe bond funds absorbed the impact of a loss after the triggering of the Philippines World Bank issued catastrophe bond.

On average, insurance-linked securities (ILS) funds returned 0.26% to begin the year in January 2022, according to the Eurekahedge ILS Advisers Index.

On average, insurance-linked securities (ILS) funds returned 0.26% to begin the year in January 2022, according to the Eurekahedge ILS Advisers Index.

January was generally a quieter month for catastrophe events around the globe, meaning the only significant impact event for the ILS fund market was typhoon Rai (known in the Philippines as Odette) which struck the Philippines and triggered the World Bank issued catastrophe bond.

That resulted in a $52.5 million payout for cat bond holders and with many of the cat bond funds holding a slice of the World Bank issued IBRD CAR 123-124 catastrophe bond, this dented returns for some of them.

According to ILS Advisers, “This payout demonstrates the positive social impact that ILS capital can have on dis- advantaged populations.”

For January 2022, pure catastrophe bond funds only delivered a 0.13% return as a group, while the subset of ILS funds that invest in private deals and collateralised reinsurance contracts outperformed, gaining 0.35% for the month.

Across the ILS funds tracked by ILS Advisers and Eurekahedge for the Index, 6 reported negative returns for January 2022.

The other 17 ILS funds were in positive territory for January 2022, with a spread of performance from -0.4% to +1.6% reported, once again demonstrating the range of risk and return strategies in the ILS investment fund marketplace.

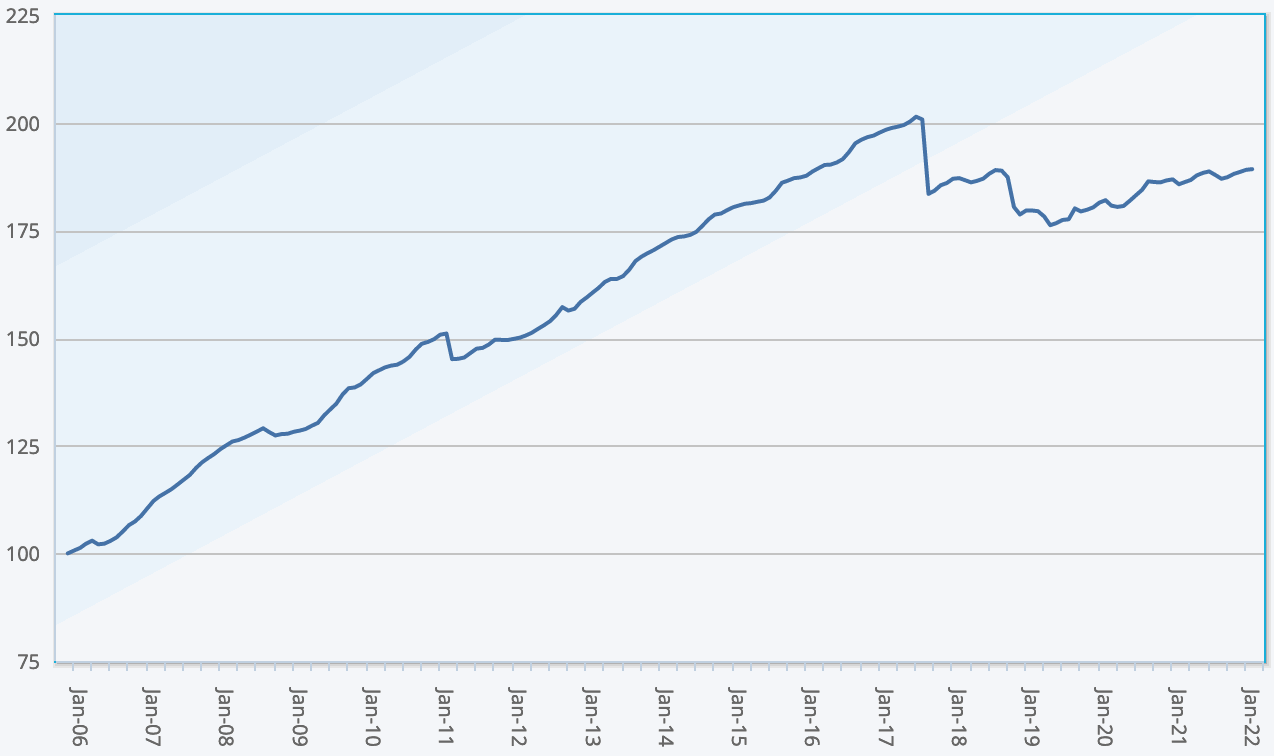

You can track the Eurekahedge ILS Advisers Index here on Artemis, including the USD hedged version of the index. It comprises an equally weighted index of 28 constituent insurance-linked investment funds which tracks their performance and is the first benchmark that allows a comparison between different insurance-linked securities fund managers in the ILS, reinsurance-linked and catastrophe bond investment space.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.