Insurance-linked securities (ILS) fund strategies delivered muted performance in February 2022, with catastrophe bond funds affected by market dynamic related pricing pressure, while some private ILS fund strategies experienced impacts to aggregate positions.

On average, insurance-linked securities (ILS) funds delivered a 0.09% return for February 2022, according to the Eurekahedge ILS Advisers Index.

On average, insurance-linked securities (ILS) funds delivered a 0.09% return for February 2022, according to the Eurekahedge ILS Advisers Index.

With nothing particularly significant in the way of major catastrophe loss activity, February did see some smaller to mid-sized impacts though, in particular from European windstorms and flooding in Australia.

These events, while relatively minor in isolation for the ILS fund market, with only minimal impacts, have been counted towards annual aggregates for some contracts, ILS Advisers explained.

The storms and floods are enough to dent some ILS funds returns in that case, which alongside catastrophe bond market dynamics resulted in the muted average ILS fund return.

Private ILS funds, so those investing in collateralised reinsurance and related opportunities, outperformed again in February, delivering an average return of 0.15%.

Meanwhile, catastrophe bond funds as a group were flat, as pricing pressure dented overall returns for that segment.

However, catastrophe bonds and private ILS delivered on one of their core promises again in February 2022.

ILS Advisers explained, “In the context of a global sell-off across equity and credit markets due to the war in Ukraine, combined to losses in bond markets from rising infla- tion and interest rate, ILS investments held up to their promise to deliver uncorrelated returns.”

Out of the ILS funds tracked by the Index, 19 delivered positive performance in February 2022, while 6 were negative.

The gap between best and worst performing ILS fund was relatively narrow for the month, at -0.5% to +1%, reflecting the muted effects of the catastrophes that did occur and the fact cat bond funds were in a relatively tight range.

Year-to-date, the average ILS fund return is +0.34% after the first two months of the year, which is an improvement on 2021 and further underscores the general lack of correlation the ILS sector exhbits to global macro and economic events.

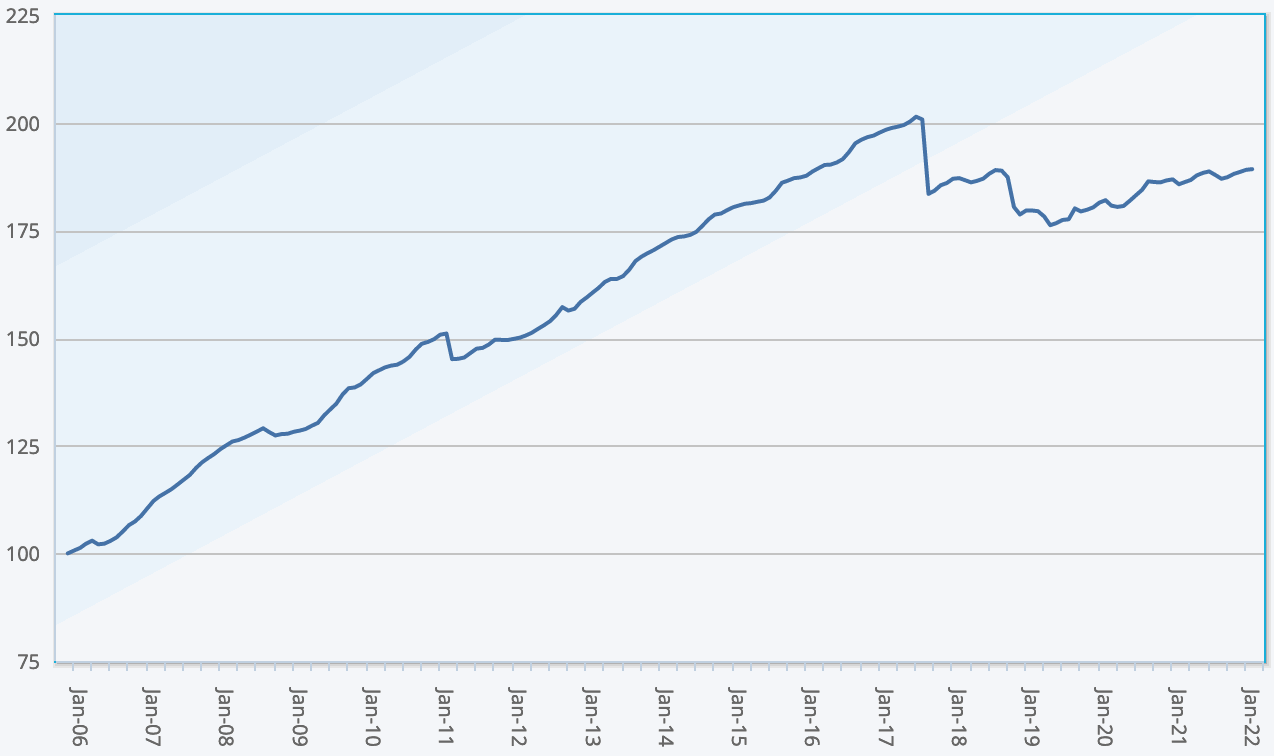

You can track the Eurekahedge ILS Advisers Index here on Artemis, including the USD hedged version of the index. It comprises an equally weighted index of 28 constituent insurance-linked investment funds which tracks their performance and is the first benchmark that allows a comparison between different insurance-linked securities fund managers in the ILS, reinsurance-linked and catastrophe bond investment space.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.