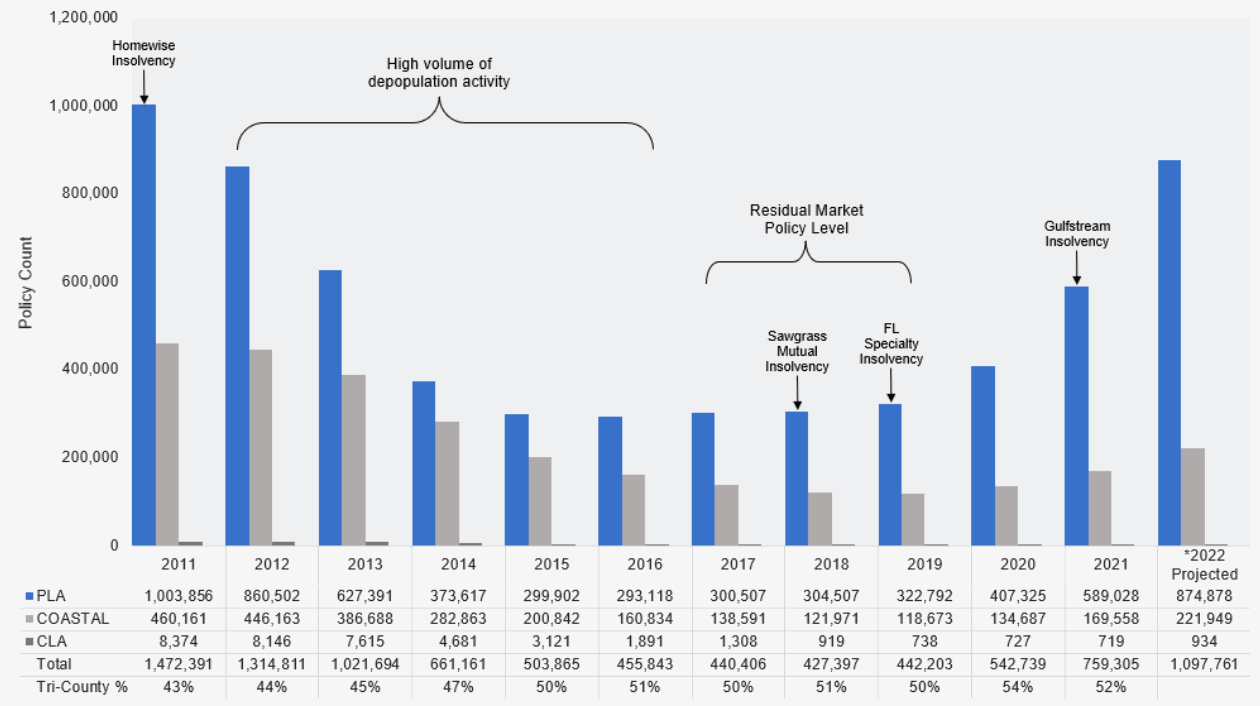

Florida’s Citizens Property Insurance Corporation added on average 32,000 new policies to its portfolios every month through 2021, with projections for the end of 2022 suggesting it may have almost 1.1 million policies in-force, driving the need for more catastrophe bonds and reinsurance risk transfer.

Florida Citizens has been growing, in terms of policy count and so exposure, since 2020 and that growth accelerates when Florida property insurers fail, as has been seen in a few cases over the last year.

With Florida’s property insurance market facing ongoing challenges from losses, loss amplification and inflation, litigation, rising reinsurance costs and the thinly capitalised nature of some of its P&C carriers, Citizens becomes the defacto home for many of the policyholders that have been dropped or abandoned.

The chart below shows Citizens policy count over just more than a decade.

At a rate hearing yesterday, Citizens staff laid the case for some of the most significant rate increases it has implemented in years, with increases of as high as 11% being sought, as we explained in this article.

As of mid-March 2022, Florida Citizens policy count had reached almost 810,000 and at the average rate of growth of growth, at roughly 32,000 policies per-month, it suggests Citizens could add as many as 288,000 more this year, if that run-rate were to continue.

Of course, with Floridian P&C insurers facing significant challenges and rating agency Demotech warning more may get downgraded, the run-rate could actually increase if there were any more failures over the coming months.

The chart below shows Citizens policy count growth run-rate over the last year:

Florida Citizens staff said that its rates are below private market competitors, while the rate increases achieved by private Florida market P&C insurers have tended to be higher, than the increases Citizens has imposed.

While Citizens is designed to be a residual market type of insurer, the insurer of last resort, it still has to make economic sense, or risk putting additional financial risk on Florida taxpayers and residents.

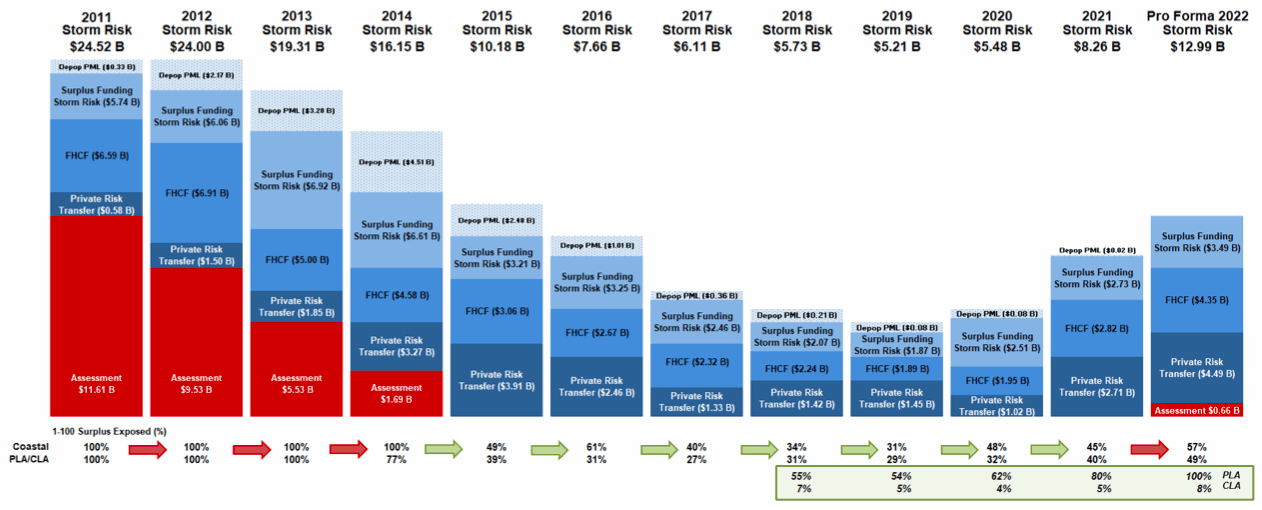

Because of the growth in policy counts, exposure and total insured values (TIV) at Citizens, the insurer now faces the 2022 hurricane season with the potential to have to level assessments after a 1-in-100 year storm hit the state of Florida.

At this 1-in-100 year level, Florida Citizens hasn’t modelled any assessment risk since 2015, as its depopulation and the use of risk transfer removed that threat from taxpayers.

Back in 2011, a 1-in-100 year hurricane event threatened a massive $11.6 billion assessment on Floridians, something which Citizens is determined to avoid becoming a threat again.

As a result, the continued use of risk transfer, through catastrophe bonds and reinsurance is assured, with the only question being just how much cover Citizens staff can buy in 2022 for its budgeted $400 million spend.

At 1 million policies, two Category 4 hurricanes hitting Florida in one season could drive a $14.5 billion potential assessment, Citizens said, so that threat will not disappear.

But the use of cat bonds and reinsurance can lower the assessment risk significantly for Citizens, helping to make the Florida insurance market a little more stable at a challenging time.

The image below shows Florida Citizens funding and assessment risk over the years (click for a larger version):

The chart above was shared during yesterday’s rate hearing and shows Florida Citizens hoping to secure a risk transfer program of almost $4.5 billion in 2022, significantly larger than the program of $2.7 billion secured a year ago.

As we explained before, that could result in $3.4 billion of new traditional reinsurance and catastrophe bonds being procured before the 2022 hurricane season begins, which may result in a large cat bond from Citizens, given attractive market conditions in the cat bond space right now.

Whatever the eventual mix of risk transfer is, it is clear from the data that buying more reinsurance and risk transfer will be in Citizens future, until the policy count can be brought down, perhaps through a renewed focus on depopulation.

But, in order to depopulate, there needs to be an appetite to take on Florida property insurance risk, which right now, given the challenges that market faces, is far from guaranteed to be abundantly available.

Also read:

Florida Citizens seeks higher rate increases at upcoming hearing.

Lighthouse the first to lose Demotech rating, as Ida losses weigh.

AIG’s Lexington pulls-back in Florida, raising questions on E&S market.

AM Best cites Florida market challenges as it downgrades Florida Farm Bureau.

Demotech calls for Florida market reform with rating downgrades likely.

Florida Citizens targets “the best deal we can get” on risk transfer: Montero.

No quick fix as Florida property insurance reforms fail to pass.

Another one bites the dust – Florida’s insurance failures continue.

Florida P&C claims litigation concerning, as cases soar: CaseGlide CEO Todd.

Florida P&C rate filings show reinsurance firming needs to continue.

Assignment of benefit (AOB) claims rising for Florida P&C insurers.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.