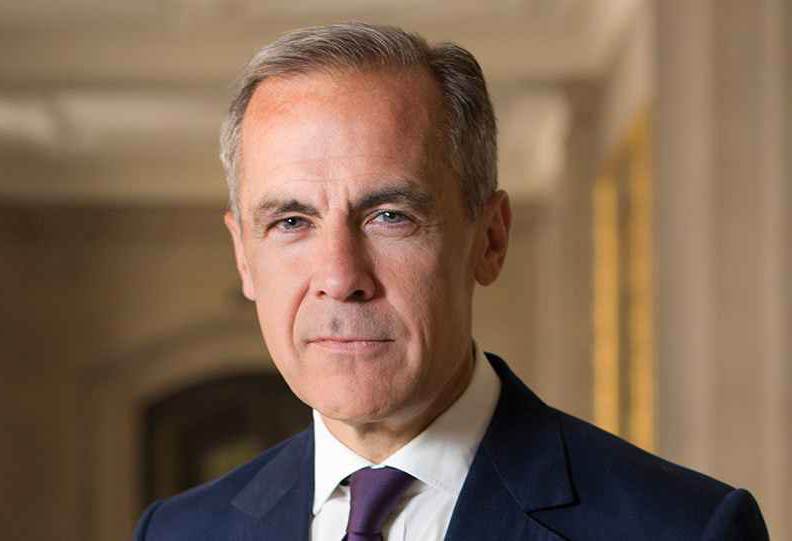

Mark Carney, the Governor of the Bank of England, discussed the role of insurance and reinsurance technology as an essential financial took to smooth the world’s transition to a 1.5 degree world and highlighted the role of insurance-linked securities (ILS) within that.

Speaking on Sunday in New York, on the sidelines of the Climate Action Summit held at the United Nations, Carney said that the insurance and reinsurance sectors role in responding to climate change is “crucial” and can be “decisive.”

Speaking on Sunday in New York, on the sidelines of the Climate Action Summit held at the United Nations, Carney said that the insurance and reinsurance sectors role in responding to climate change is “crucial” and can be “decisive.”

The Governor of the Bank of England explained that the re/insurance market brings three valuable traits with it, expertise, money and a perspective on climate related risks, which are all “crucial in helping society adjust to the reality of that transition.”

Decisive contributions to the ongoing transition through climate change to a 1.5 degree world can be made by re/insurers, Carney said, “Whether it’s reducing the protection gap, financing resilient infrastructure or improving reporting, risk management and return optimisation across the financial sector.”

“The insurance industry has a unique contribution of large capital (over $30 trillion), deep risk management expertise and long-term perspective.”

The insurance and reinsurance industry is already “well aware that the physical risks of climate change are being felt across the globe with a plague of extreme weather events,” Carney continued.

Climate related perils cause “immeasurable” human costs, but in finance and insurance the costs can be measured, although they are significant, Carney said.

However, protection gaps remain an issue as greater costs are borne by the uninsured.

But closing these gaps presents a huge societal opportunity to improve well-being and livelihoods, and Carney stressed this saying “The potential economic benefits of closing the insurance gap are striking.”

But the gap is narrowing very slowly, Carney explained, although some recent data shows that certain insurance protection gaps are actually widening, highlighting the still increasing need for more coverage.

Carney said that to respond to the challenge of the world’s climate transition and to narrow these protection gaps both sides of the insurance and reinsurance market balance-sheet are required.

“On the liability side, the focus must be reducing the protection gap and supporting the resilience of households and companies to growing climate risks,” Carney told the audience in New York.

Going on to explain the importance of risk models in developing a better understanding of past losses and improving the data for risk analysis.

But in addition to this, Carney also sees the need for innovative risk transfer structures and those backed by the capital markets are included in this.

“New products, such as insurance-linked securities based on parametric triggers, are vital to help reduce macro protection gaps and increase resilience,” Carney explained.

Going on to say, “These are generally cheaper to structure and administer and more efficient to blend with commercial finance if required.”

In addition, Carney highlighted the role of multilateral banks and development agencies in providing assistance where the traditional insurance and risk markets find climate-related tail risks uneconomic to cover.

“Disaster reinsurance could be one of the most effective uses of development financing,” he explained.

Carney also highlighted the investment side of the re/insurance industries balance-sheet, urging investment in climate-resilient infrastructure and sustainable energy.

In addition he highlighted the potential for a broadening of the remit of the catastrophe bond to support climate-resilient infrastructure development efforts as well, the much-discussed resilience bond.

“It’s imperative to act now to create practical tools and frameworks to support climate-resilient infrastructure investments – ranging from broader use of catastrophe bonds to greater risk pooling for the most vulnerable countries,” Carney stressed.

“The world needs much more investment in infrastructure, and greater risk sharing of climate risks,” he said.

Then explained that the re/insurance market has “a unique ability to meet both needs,” while we would add (of course) that the capital markets and insurance-linked securities (ILS) funds have a unique ability to innovate structurally and mobilise significant capacity to support these goals.

To see the Governor of the Bank of England highlight parametric ILS and catastrophe bonds as key financial market tools for climate resilience, capacity building and in smoothing the world’s transition is encouraging.

ILS, or the use of capital markets technology and financing to support risk transfer, can be integrated much more broadly into the world’s financial systems and resilience efforts.

While parametric triggers can provide precisely the kind of responsive protection that can be closely aligned to climate-related perils and exposures, as well as with resilience goals.

Integrating ILS risk transfer and parametric risk transfer more closely into the financial economies of particularly at-risk nations can only benefit society as a whole.

Although, as we’ve said before, there remains work to do on increasing the efficiency of risk transfer, lowering its cost, and that may require an unbundling of certain parts of the risk transfer market chain for the effectiveness of efforts to narrow the protection gap to be fully-realised (efficient capital or otherwise).

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.