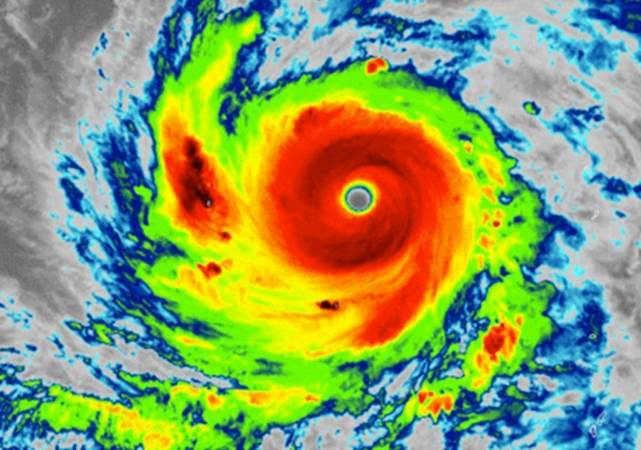

Bermudian insurance and reinsurance group Arch Capital believes the industry loss from typhoon Jebi could now be as high as $13 billion and its CEO Marc Grandisson said that the market missed the business interruption and contingent BI exposures.

Reinsurance market sources had already suggested to us that the industry loss from typhoon Jebi’s impact on Japan would get nearer to $12 billion, as the loss creep continued.

Reinsurance market sources had already suggested to us that the industry loss from typhoon Jebi’s impact on Japan would get nearer to $12 billion, as the loss creep continued.

Jebi is the most costly typhoon event to ever hit Japan, having eclipsed losses from all other typhoon wind and rain catastrophes. But in the case of typhoon Jebi, an unprecedented amount of loss creep has also emerged, which Grandisson puts down to the market completely missing the fact there would be a significant business interruption impact.

Initial loss estimates from risk modelling companies came in as low as $3 billion or so for typhoon Jebi, but quickly the losses escalated and rose towards the $10 billion mark.

It then continued to creep higher in recent weeks, with further impacts seen in reinsurance, in terms of mark to market losses to a catastrophe bond and expected losses to more industry loss warranties (ILW’s) as well.

Arch Capital itself has had to harden its typhoon Jebi loss reserves this quarter, announcing an increase in its reserves for Jebi of $16 million, or 4.6 points on the combined ratio.

The company said this was based on the receipt of updated information from cedents and additional updated industry data.

When asked about Jebi and the loss creep reported during the Arch earnings call, CEO Grandisson explained that while the company had increased its exposure in Japan in recent years, it was not really significant on the wind side.

However, in Japan most insurance and reinsurance firms pick up wind and flood exposure through business contracts and while Arch is not a massive property catastrophe player in the country, it still had significant exposure, especially to business interruption.

Commenting on the loss creep, Grandisson said, “The initial numbers came in at $3 billion, as you know, but developed to about $12.5 billion to $13 billion we believe as we speak.”

That’s the highest estimate we’ve seen to date from a major re/insurer. If Arch has accounted for the Jebi loss at around this level then others will too, and it must be hoped that this is sufficient to cap the claims coming in, so further loss creep surprises don’t occur.

“What was missed by our ceding company, not only by the reinsurance community, was the business interruption and contingent,” Grandisson explained.

He said that exposures that Arch was insuring were exactly in the line of where typhoon Jebi made landfall and tracked across Japan, with impacts seen in the semiconductor industry.

The semiconductor sector carries a lot of business interruption and contingent business interruption risk, he went on to explain, adding that when the initial storm track was modelled against your existing portfolio it did not pick up these potential exposures.

Ceding companies had the same problem, Grandisson said, meaning nobody saw the potential for such significant loss development.

“It was not fully appreciated by most people, by the whole market frankly,” Grandisson said.

As we explained the other day, rising loss estimates for typhoon Jebi from reinsurers Swiss Re and Munich Re have the potential to trigger ILW contracts.

However, the latest estimate from these firms are Swiss Re’s sigma which recently gave an industry loss of $9.77 billion and Munich Re’s NatCat which had stuck at $9 billion for Jebi.

Neither of these are official reporting agencies for trigger purposes, but they have been widely used historically. They also tend not to continue updating losses for long after the events occurred.

But in the case of typhoon Jebi, when the industry is now working off a loss at least 20% higher than these firms have estimated, could we see more updates, perhaps to above $10 billion? And will that trigger more industry loss warranty (ILW) contracts? Something to watch out for in the coming months.

Typhoon Jebi has clearly been a unique loss with a lot for the industry to learn from it. The risk models will need to be updated, or their users taught how to load in the right loss amplification for potential business interruption effects in future.

———–

Register today to attend our next ILS conference in Singapore, ILS Asia 2019.

Register today to attend our next ILS conference in Singapore, ILS Asia 2019.

We’re returning to Singapore for our fourth annual ILS market conference for the Asia region. Please register today to secure the best prices. Early bird tickets are still on sale.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.