The results are now in from our market survey that we launched recently alongside sister publication Reinsurance News asking the insurance, reinsurance and insurance-linked securities (ILS) industry for its opinion on the market implications of the Covid-19 coronavirus pandemic.

We are witnessing history unfolding as a global industry that is profoundly connected and affected – personally and professionally – by the COVID-19 coronavirus pandemic.

But it can be challenging to understand the potential areas of concern, so we launched our short survey to gather quantitative data from senior industry participants to help expose market sentiment and fears.

This outbreak raises many questions and will potentially shape the world’s markets and economy for generations to come and insurance, reinsurance as well as the ILS market is as exposed as any sectors to this potential reshaping.

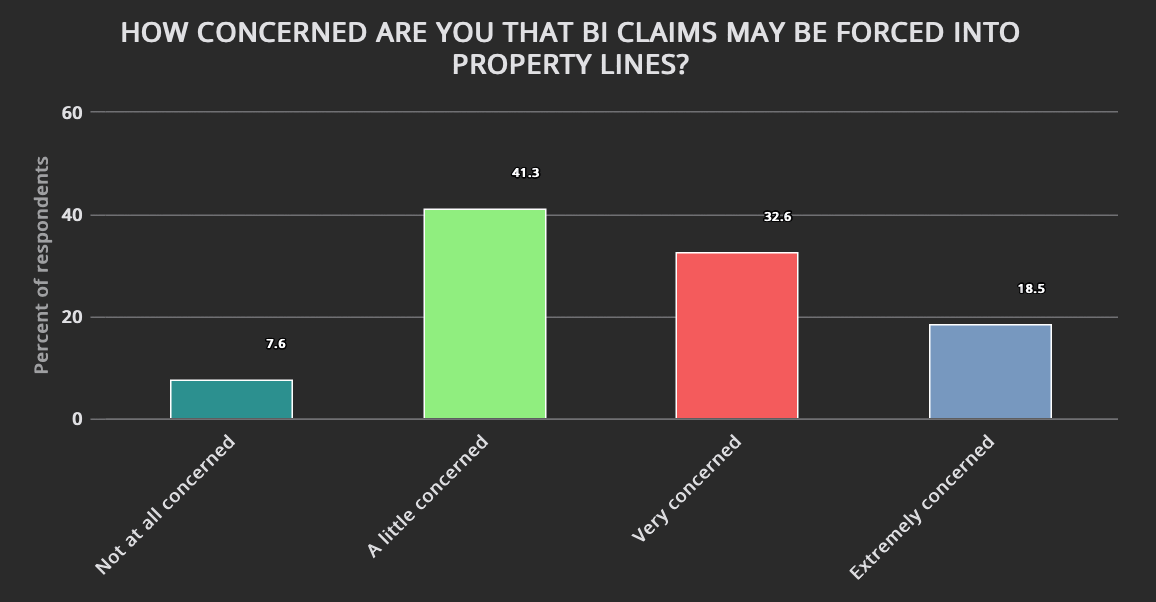

The survey results immediately show us that concerns are particularly high about one of the key issues related to the coronavirus pandemic, the ongoing legal action to force pandemic business interruption and shutdown claims into property programs.

While 41% of respondents said they are a little concerned about the BI issue, almost 33% said they are very concerned by it and another 18.5% said they are extremely concerned.

While many view this issue as one that could result in a small amount of claims leakage, through insurance and reinsurance contracts that were not strongly worded. It seems the sentiment in the market is perhaps less hopeful and more pessimistic on the impact business interruption from the coronavirus pandemic could have.

Clearly this has ramifications for the ILS market, as well as traditional reinsurance and retrocession.

One of the more positive findings of our survey, is that the market expects that the coronavirus pandemic will drive more general reinsurance rate and price firming, with some 85% agreeing this was likely to be the case.

In addition, with over half of our respondents identifying themselves as having input or influence to reinsurance buying decisions, more than 30% of them said that they expect the pandemic will increase their appetite for buying reinsurance and retrocession protection.

Our Covid-19 reinsurance market survey features responses from hundreds of identifiable senior insurance and reinsurance industry executives, including 13 CEO’s, 20 CUO’s, 18 COO’s, 38 senior Board members, reinsurance buyers, senior underwriting executives, ILS managers, brokers and a range of other service providers.

We’ve made the full results of this COVID-19 re/insurance market survey freely available to our readers and we’re happy to discuss the results with industry participants and to discuss sponsorship enquiries from those looking to raise their profile in the reinsurance sector.

Analyse the results of our April 2020 COVID-19 Market Survey here.

Our global readership reached almost 200,000 individuals across Reinsurance News & Artemis in Feb 2020. Please get in touch to work with us on a sponsored survey to gauge the market’s opinion, or to discuss advertising options.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.