Only 5 of the 33 insurance-linked securities (ILS) funds tracked by ILS Advisers reported positive returns in May 2019, as catastrophe loss creep and cat bond price pressure dented sector returns, resulting in the Index falling to a negative -1.13% for the month.

That’s the lowest monthly return for the Eurekahedge ILS Advisers Index since last November, when the wildfires hit the ILS and collateralized reinsurance market, and reflects just how difficult ongoing loss creep has made life for some ILS funds.

That’s the lowest monthly return for the Eurekahedge ILS Advisers Index since last November, when the wildfires hit the ILS and collateralized reinsurance market, and reflects just how difficult ongoing loss creep has made life for some ILS funds.

Typhoon Jebi was the major source of catastrophe loss creep in May 2019, with the hardening of reserves and changes in side pocket valuations seemingly widespread across the ILS market during the month.

The catastrophe bond market suffered in May from both loss creep associated with Japanese typhoon Jebi as well as mark-to-market pressure on positions heightened by selling pressure in the secondary market.

In addition, the Peruvian governments World Bank sponsored catastrophe bond was impacted by an earthquake in May, which has now resulted in a 30% or $60 million payout of principal for that bond.

On the Swiss Re catastrophe bond indices the poor performance of the cat bond market in May was stark, as the price return fell by -1.47% while the total return fell -1.18%. That takes the year-to-date performance of the Swiss Re cat bond index to -0.41%.

The ILS Advisers Index was also hit by the performance on the private ILS and collateralised reinsurance side of the market as well, of course, as it tracks a wide-range of ILS fund strategies.

Private ILS funds and collateralised reinsurance funds suffered from typhoon Jebi loss creep during the period, as some of their side pockets decreased further in value in May.

Despite this, the main shares of many ILS funds remained buoyant, recording positive premium payment during the month, ILS Advisers explained.

With just 5 of the ILS funds tracked by ILS Advisers being positive, the month of May 2019 has become the worst since November 2018 and before that September 2017.

The difference between best and worst performing ILS fund in May was a huge 19.74 percentage points, ILS Advisers said.

Pure catastrophe bond funds actually fared slightly better as a group, being down -0.86% for the month of May. The group of funds that invest in private ILS and collateralised reinsurance were worse off at -1.33%.

On an annualised year-to-date basis, the funds that invest in private ILS and collateralised reinsurance trail pure cat bond funds by -2.81%.

June looks set to be a much better month so far and it is to be hoped that this might be most of the remaining typhoon Jebi loss creep now accounted for.

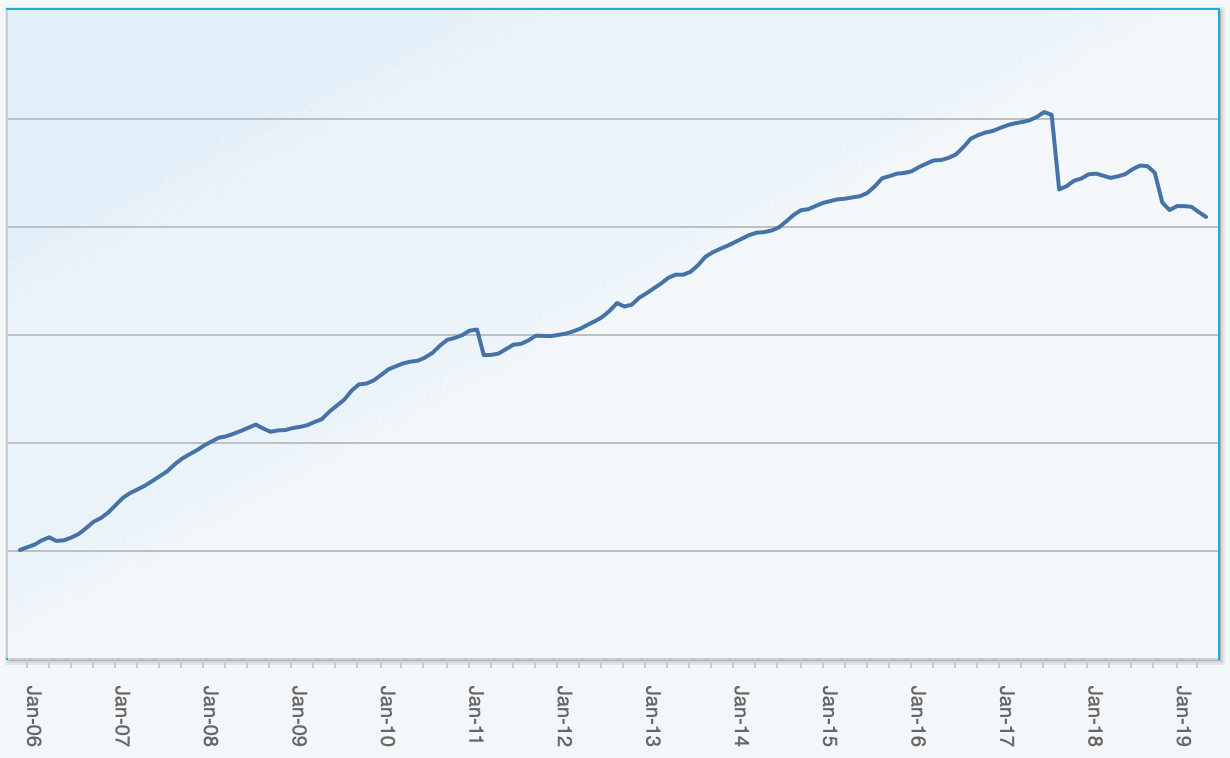

You can track the Eurekahedge ILS Advisers Index on Artemis here, including the new USD hedged version of the index. It comprises an equally weighted index of 32 constituent insurance-linked investment funds which tracks their performance and is the first benchmark that allows a comparison between different insurance-linked securities fund managers in the ILS, reinsurance-linked and catastrophe bond investment space.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.