Loss creep primarily from typhoon Jebi has dragged the average performance of catastrophe bond, insurance-linked securities (ILS) and reinsurance linked investment funds down to a disappointing -0.70% for the month of April 2019.

Once again, performance was disparate across the group of ILS funds tracked by the ILS Advisors Index, with a wide range between best and worst performing ILS fund of 10.85% for the month.

Once again, performance was disparate across the group of ILS funds tracked by the ILS Advisors Index, with a wide range between best and worst performing ILS fund of 10.85% for the month.

Typhoon Jebi’s rising industry loss has severely impacted some private ILS and collateralised reinsurance positions during the month of April, as well as driving down a few catastrophe bond prices, one of which (Akibare Re 2016) is now set to become a total loss.

With typhoon Jebi, virtually no one across reinsurance and ILS markets has been completely immune to the loss creep, as the industry loss has risen steadily from initial modelled estimates of around $3 billion to $5 billion, to now become a $15 billion plus market wide loss event.

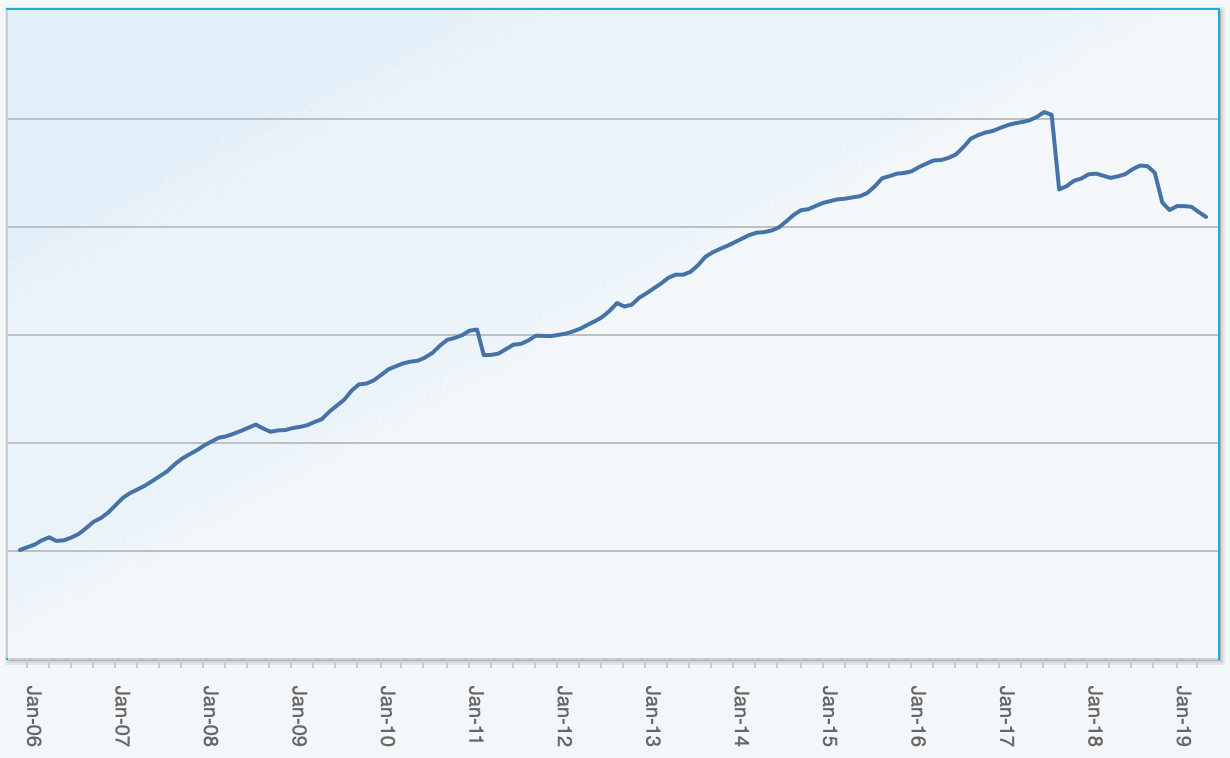

The impacts are clear in the performance of the Eurekahedge ILS Advisers Index for April 2019, with the average return for the month -0.7%, which is the lowest April on record and compares particularly badly to the 14 year average return for the month of 0.29%.

That dragged the year to date performance into negative territory for the ILS Advisers Index, -0.26% to end of April, and it’s clear that the loss creep reporting has not ended, as the Index is already reporting negative results for May 2019 from ILS funds that have submitted their performance so far. Of course there is a further cat bond mark down to come in May as well, from the Peru earthquake deal.

Both the catastrophe bond market and the broader private ILS and collateralised reinsurance market were hit by loss creep in April, with the cat bond market faring slightly better due to its generally higher-up exposure to Japan typhoon risks.

The cat bond funds tracked by the ILS Advisers Index reported an average performance of -0.4% for April, while those ILS funds also investing in collateralised reinsurance and private deals reported an average performance of -0.9%.

It’s important to note thought that not every ILS fund was down and some strategies actually did relatively well in April.

This is because some ILS funds had already reserved sufficiently for Jebi, while some others actually had reserve releases to apply in April, we understand from our sources, resulting in a boost to performance as these funds had reserved prudently for events from the last two years.

As a result, the difference between best and worst performing ILS fund in April 2019 was significant, at 10.85% points. With the biggest gainer a private ILS fund that reported positive performance of 0.87%, while the biggest loser was also a private ILS fund that lost 9.98% for the month.

ILS Advisors Founder Stefan Kräuchi commented on the ILS fund performance seen in April 2019, saying, “Loss creep of Jebi has been increasingly impacting ILS. Some cat bond prices dropped over 25% in a single month.

“The private ILS was impacted as well due to the loss reserves increase and the side pockets of some funds are believed to suffer quite badly.

“Regarding the worst performing fund, the main shares were up more than 1% but when combining the sidepockets, the performance dropped significantly to almost minus 10%.”

Of course all of this provides further evidence to investors on how ILS fund managers have been managing their reserving and exposures.

But it is important to keep in mind that the loss creep associated with typhoon Jebi has caused many traditional reinsurers to double or more their loss reserves for the event, so the loss creep is a market-wide phenomenon.

“The result is related to the diverse reserving policies among private ILS funds, which creates different level of volatility in performance. Investors should take these differences into account when comparing different funds,” Kräuchi said.

One interesting point that the ILS Advisers Index tracking of ILS funds helps to make clearer, is that the loss creep seen tends to impact private ILS and collateralised reinsurance assets more than cat bonds.

As a result, on an annualised year-to-date basis pure catastrophe bond funds are now outperforming the group of fund also investing in private ILS by a significant 2.18%.

Of course that doesn’t mean all cat bond funds are ahead of collateralised reinsurance strategies, far from it. It just means that the performance range is far wider in the private ILS fund space, leading to the average outperformance.

But still the highest performing ILS funds over the last year are those investing in collateralised reinsurance as well, given the returns can be so much higher than cat bonds.

May 2019 looks set to deliver further negativity for some ILS funds and it will be interesting to see whether the Index average ILS fund return is positive or negative for the month. We’ll report on this in a months time when all the results are in.

You can track the Eurekahedge ILS Advisers Index on Artemis here, including the new USD hedged version of the index. It comprises an equally weighted index of 32 constituent insurance-linked investment funds which tracks their performance and is the first benchmark that allows a comparison between different insurance-linked securities fund managers in the ILS, reinsurance-linked and catastrophe bond investment space.

———–

Register today to attend our next ILS conference in Singapore, ILS Asia 2019.

Register today to attend our next ILS conference in Singapore, ILS Asia 2019.

We’re returning to Singapore for our fourth annual ILS market conference for the Asia region. Please register today to secure your place at the conference. Tickets are now selling fast.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.