The longevity swap market is forecast to experience record levels of activity in 2020, with availability of reinsurance capacity likely to be a key consideration for pensions looking to offload the risk of their members living longer.

Willis Towers Watson (WTW), the insurance or reinsurance brokerage and consultancy, says that it expects to see longevity swap volumes surpassing UK £25 billion, which would be more than double the market activity seen in 2019.

2019 saw £12 billion of longevity swaps completed, as well as £41 billion of bulk annuities.

The availability of reinsurance capacity wasn’t a defining issue in 2019, as the market appetite from reinsurers remained significant. Rather it appears some level of confusion over mortality measurements may have driven the year to a slower start.

Looking ahead to 2020, WTW says to expect more deals getting done, with less of a focus on the very large arrangements.

The company says that, “A new regulatory regime, changing mortality, and shifting scheme and insurer demands are set to define another bumper year for longevity hedging and bulk annuities.”

Bulk annuity volumes are expected to dip in 2020, to around £30 billion.

But longevity swap and risk transfer deals are forecast to make up the difference, rising to £25 billion this year, WTW expects.

“The first half of the year will be particularly active, reflecting pent up market demand from schemes unable to transact by the end of 2019. Scheme funding levels have trended upwards due to positive asset returns alongside longevity gains, enabling schemes to de-risk earlier than expected,” the company explains.

Longevity swap activity is forecast to reach a “record high” with more than £25 billion expected to be transacted, although with deals “heavily weighted towards white collar schemes.”

“Opportunities for blue collar schemes will arise throughout the year as the reinsurers who have already won business seek to diversify and the others will target schemes that better suit their preferred member demographics,” WTW says.

The UK’s incoming Pension Schemes Bill mandates pension fund trustee boards to establish a long-term funding objective, WTW says, which will drive an increased focus on longevity risk management, including through longevity swaps.

In particular, small and medium size schemes are expected to increasingly look to longevity risk transfer, as targets are set, which may please insurance and reinsurance capital providers looking for more diversity away from very large pools of longevity risk.

Pensions are expected to transfer their exposure to insurers, to help in risk reduction or to settle liabilities. Here defining the right longevity hedging solution will be critical and availability of reinsurance capital for longevity risks will be a factor in this decision-making.

Commenting on the longevity market trends for 2020, Shelly Beard, Senior Director at WTW, said, “The number of mega deals completed through 2019 shouldn’t be repeated in 2020, but there is certainly a lot of demand for deals across the market.

“The changes in pricing over the past few years do show that the importance of choosing the right time to complete a transaction rather than simply leaving it to chance. Knowing your target price, retaining price discipline and flexibility are all key to achieving the best deal possible in this new market environment.”

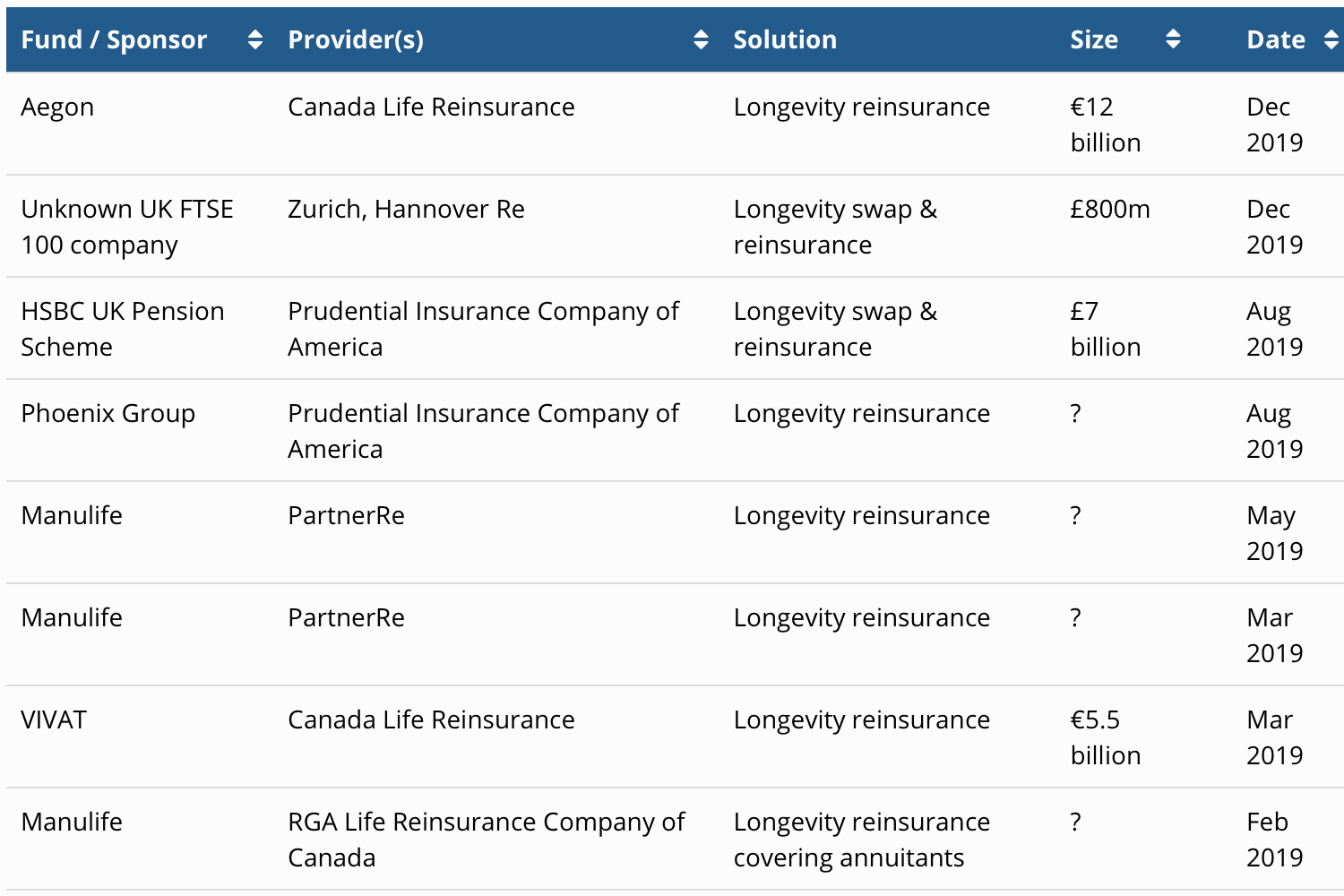

Read details of many longevity hedging transactions in our longevity swap, reinsurance and risk transfer deal directory.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.