The Lloyd’s of London insurance and reinsurance market suffered a loss of around US $1.1 billion because of winter storm Uri and the Texas freezing weather event in March, but this wasn’t sufficient to dent a set of results that continue to show some improvement in performance.

Lloyd’s CEO John Neal said today that “Performance is the number one priority,” as he continues to focus on improving the quality of business accepted by the market, to drive better underwriting performance.

Lloyd’s CEO John Neal said today that “Performance is the number one priority,” as he continues to focus on improving the quality of business accepted by the market, to drive better underwriting performance.

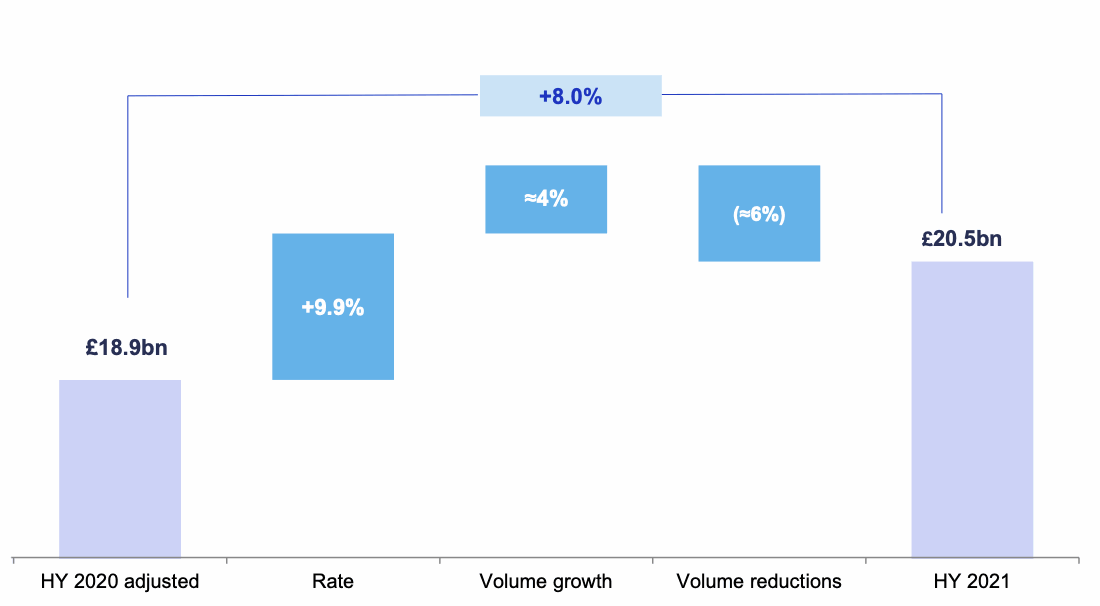

True to this, while Lloyd’s has reported strong gross written premiums of £20.5 billion for the first-half of 2021 (up on the prior year’s £20.0bn), this was largely driven by increases in premium rates, plus high customer retention and some new growth, which is the first time new growth has been seen in four years.

Volume growth accounted for roughly 4% of premiums, but at the same time the focus on performance continued, with around 6% of volume reductions.

Rate has been the main growth driver for Lloyd’s, like so many in the global insurance and reinsurance market, accounting for roughly 9% of premium growth in the first-half.

Positively for the entire global insurance and reinsurance market, Lloyd’s said today it has now experienced some 15 consecutive quarters of positive rate movement.

Rate and growth is not the only story, as on an underwriting basis Lloyd’s results are much improved.

The combined ratio of 92.2% is 4.8 percentage points better than the previous year, if COVID effects are excluded.

That’s even though major claims rose, excluding COVID, although with only a single major catastrophe loss, the Texas winter storm and freeze event.

That catastrophe event alone has driven UK £800m, US $1.1 billion, of losses to Lloyd’s market players, making it one of the most significant catastrophe events of the last few years for the marketplace.

But that hasn’t dented underwriting performance, as Lloyd’s drove home the fact that some 6% of underperforming business was removed from the market, helping to drive forwards this performance push for Neal.

John Neal, Lloyd’s CEO, commented, “In an uncertain world Lloyd’s remains acutely focused on supporting our customers when they need us, and in the first half of 2021 we have paid out nearly £10bn in claims to help the recovery of businesses and economies globally.

“Against this backdrop, Lloyd’s has successfully repositioned the market for sustainable, profitable growth as evidenced in this strong set of financial results. I am encouraged to see that market performance has improved as a result of our ongoing remediation efforts. This, as well as our exceptionally strong balance sheet, brings Lloyd’s performance in line with our global peer group.

“Alongside performance, we are making great strides on all our strategic priorities which focus on improving the culture in the market, the Future at Lloyd’s digital transformation, and sustainability, climate and inclusion which underpin our purpose.”

On performance, Lloyd’s also drove home other data points from the results today, saying that its attritional loss ratio of 50.5% improved by 2.1 percentage points, while the expense ratio of 35.8% was a 1.9 percentage point improvement, and 3.7 percentage points improvement since 2017.

“The reduction in operating expenses remains a focus of Lloyd’s digital transformation programme,” Lloyd’s said today.

On the underwriting front, Casualty was the only line that fell to an underwriting loss in H1 2021, while reinsurance, property and marine, energy and aviation were the best performing market business lines.

On the topic of improving market performance, John Neal explained, “Performance is our number one priority at Lloyd’s, as we position the market for sustainable profitable performance in the long term. Having delivered a strong set of interim results, our continuous performance management approach remains and our objective for 2022 syndicate business planning is centred on delivering logical, realistic and achievable plans. We will heighten our focus on the performance of cyber and financial lines classes in particular and will look to further reduce operating expenses.”

Neal will be pleased with the evident reduction in volatility in the Lloyd’s market’s first-half results. We now have to look forward to consider how Lloyd’s may be hit by recent catastrophe events, such as the European flooding and hurricane Ida, as well as California wildfires.

But one thing is clear from today’s results. Lloyd’s is beginning to look like a more attractive place to deploy capital into for ILS investors and funds, but further work to make it a lower-cost and more efficient place to access risk-linked returns has to continue.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.