Average pricing for Japanese windstorm related reinsurance coverage reached a 25 year high at the recent April 2021 renewal season, while reinsurance buyers also sought out more limit to protect both global and Japanese domestic catastrophe exposures on a combined basis, according to Guy Carpenter.

The global reinsurance broker said that at the April 1st reinsurance renewals property catastrophe pricing rose for a third year in succession.

However, with 2020 the first major loss-free year since 2018, Guy Carpenter explained that, “there was some consolation for buyers in that the average increase was the lowest of the past three years.“

Price discovery was evident in the run up to the April 2021 renewals, as sufficient uncertainty remained over the outcome and quotes had to be actively sought from reinsurance capital providers.

Capacity was slightly increased at the renewal, Guy Carpenter estimates, but the broker noticed no return to the huge oversupply of capacity that buyers enjoyed before the 2018 loss season.

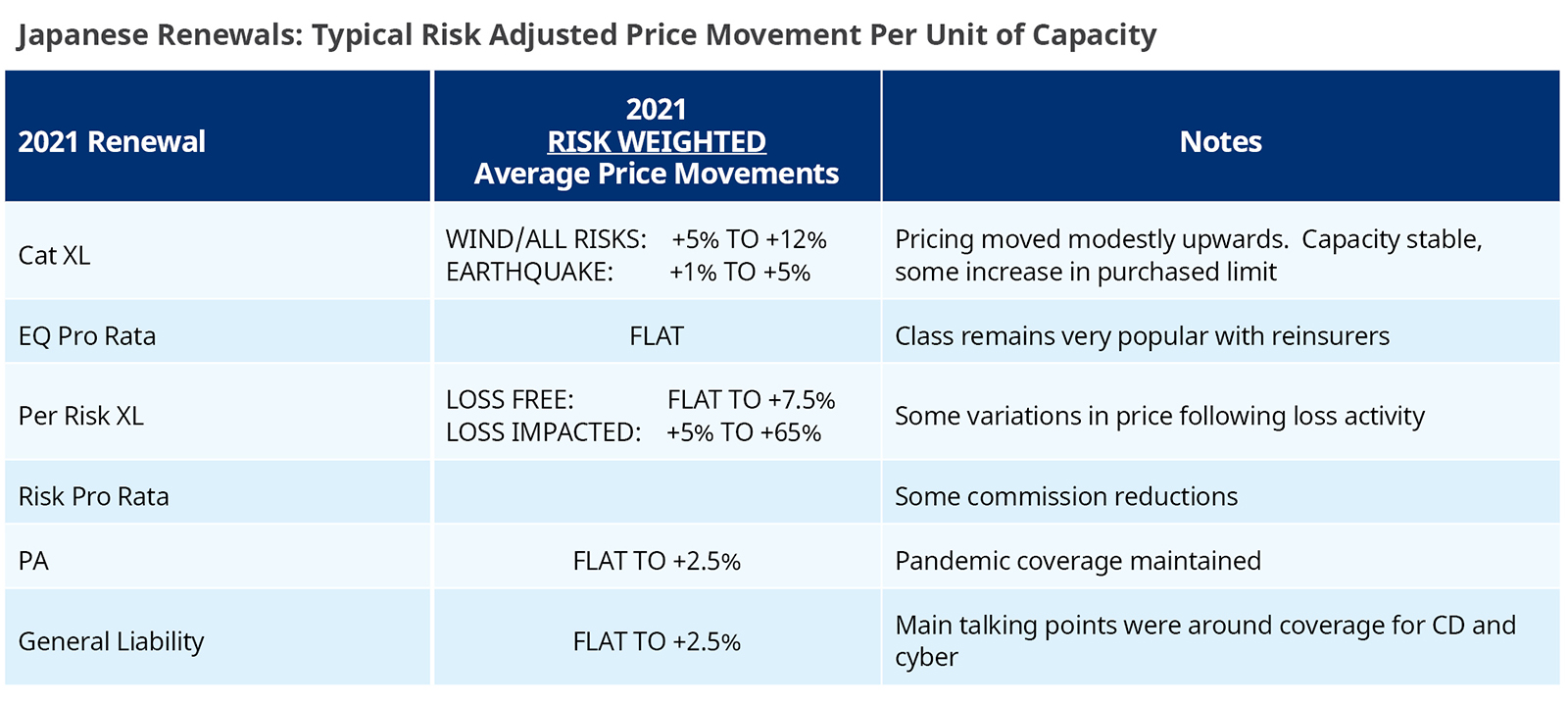

Generally, property catastrophe excess of loss reinsurance prices increased between 5% and 12% for loss-free programs covering windstorm, although Guy Carpenter explained that there were outliers at either end of these ranges.

Interestingly, the broker explained that average pricing for Japanese windstorm covers is now at a 25 year high, as pricing continued to rise in the most loss affected area of the market from recent years.

Reinsurance programs and covers including earthquake risk saw the pricing for that peril only increase by low single digits percentages.

Overall available reinsurance capacity did increase over the prior year, which drove a greater sign down percentage than in recent renewals in Japan.

Another interesting fact on the April 2021 reinsurance renewals is that Guy Carpenter says that the amount of multi-year cover purchased by the Japanese market continued to decline, with no new additional purchases of multi-year capacity in these core areas.

That’s likely an indication of buyers reaction to high pricing, as they may not want to lock-in these rates over multiple seasons at this time.

Guy Carpenter noted that there were two successful catastrophe bond issues around the renewals, but added that total limit supplied by cat bonds remains small in Japan, as a percentage of the total reinsurance program limits purchased.

Also of note is the fact that there was again more limit purchased on a global combined basis in 2021, than in the prior year by Japanese buyers looking to combine reinsurance protection across their domestic market and globally.

Guy Carpenter explained that in April pricing for non-Japanese exposures “generally moved in line with that expected in the local geographies protected.”

But the broker also noted that, “As the market is generally hardening for all international catastrophe excess of loss treaties, this meant the price environment was challenging,” which may suggest further firming at the mid-year renewal season is likely.

Finally, aggregate excess of loss reinsurance pricing also increased at the renewals.

“Buyers were again keen to renew these covers, which have served them so well in recent years. Further losses for some in 2020 made the renewal even more complex. Careful planning and some restructuring was required to secure target placement,” Guy Carpenter said.

Read all of our reinsurance renewal season news coverage here.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.