Natural catastrophe events cost the global economy an estimated $232 billion in 2019, while the insurance and reinsurance industry is estimated to have paid for roughly 31% of this at $72 billion, according to broker Aon.

The insurance and reinsurance broking professional services firm has estimated 2019’s insurance industry loss from natural catastrophes at a significantly higher level than the major reinsurance firms.

Aon’s figure of a $72 billion insurance market loss in 2019 comes from some 409 natural catastrophe events, the broker said.

But Munich Re, one of the largest reinsurance firms, estimated the same at just $52 billion, coming from a huge 820 catastrophe events.

The reinsurers figures are just preliminary, but were delivered only a month or so ago.

Differences aside, what Aon’s figures tell us is that estimates of insurance market losses can differ dramatically and that it is the brokers that tend to have the highest (for 2018 Aon said $90bn, Munich Re $80bn and Swiss Re $79bn).

Aon’s estimate of $232 billion of economic losses from natural catastrophes in 2019 is some 3% below the average annual loss for this century and 20% lower than the previous decade.

The estimate for private sector and government-sponsored insurance losses of $71 billion is a full 6% higher than the century average, Aon said.

It puts the protection gap, between economic and insured losses, at 69% in 2019, which Aon says is the fifth-lowest since 2000.

There were 41 billion-dollar economic loss events, and 12 billion-dollar insured loss events during the year.

The two most expensive catastrophe events were the Japanese typhoons, typhoon Hagibis and typhoon Faxai, which Aon estimates as having caused $9 billion and $6 billion of insured losses respectively.

That compares to Munich Re’s estimates of $10 billion for Hagibis and $7 billion for Faxai, and Swiss Re’s $8 billion for Hagibis and $7 billion for Faxai.

Aon says that inland flooding was the costliest individual peril, cauising some $82 billion of economic losses globally, followed closely by tropical cyclones which caused $68 billion of economic losses.

Andy Marcell, CEO of Aon’s Reinsurance Solutions business, commented on the data, “Following two costly back-to-back years for natural disasters in 2017 and 2018, there were several moderately large catastrophes but strong capitalization has allowed the re/insurance industry to comfortably manage recent losses. However, as socioeconomic patterns further combine with scientific factors such as climate change or extreme weather variability, the potential financial costs at play are only going to increase so building resilience is key.”

Aon also noted that the years 2010-2019 marked the costliest decade on record, as economic damage from natural catastrophes and severe weather events reached a huge $2.98 trillion globally, with Asia-Pacific accounting for 44%. That’s a massive $1.19 trillion higher than 2000-2009.

During the last decade private and public insurance markets paid out $845 billion of losses for these events, with the U.S. accounting for 55% alone.

That suggests that only 28% of economic losses from natural catastrophes around the globe were covered by insurance over the last decade, driving home that there is much more for the insurance, reinsurance and insurance-linked securities (ILS) market to do on penetration rates and closing this protection gap.

Steve Bowen, Director and Meteorologist at Aon’s Impact Forecasting team, stated, “Perhaps the biggest takeaway from the last decade of natural disasters was the emergence of previously considered ‘secondary’ perils – such as wildfire, flood, and drought – becoming much more costly and impactful. Scientific research indicates that climate change will continue to affect all types of weather phenomena and subsequently impact increasingly urbanized areas. As the public and private sectors balance an understanding of the science with smart business solutions, this will lead to new advances that lower the physical risk and improve overall awareness.”

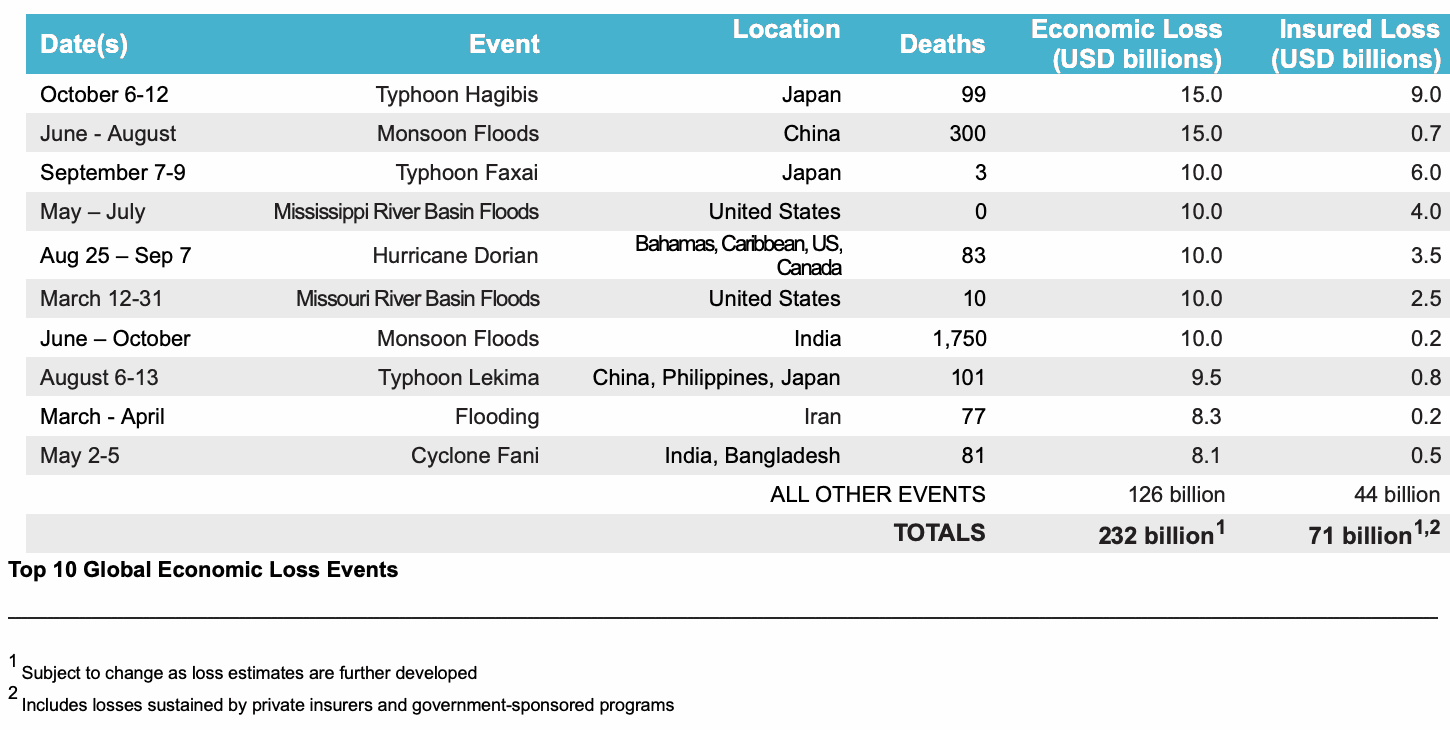

Then table below shows the top-10 economic catastrophe loss events of 2019.

–

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.