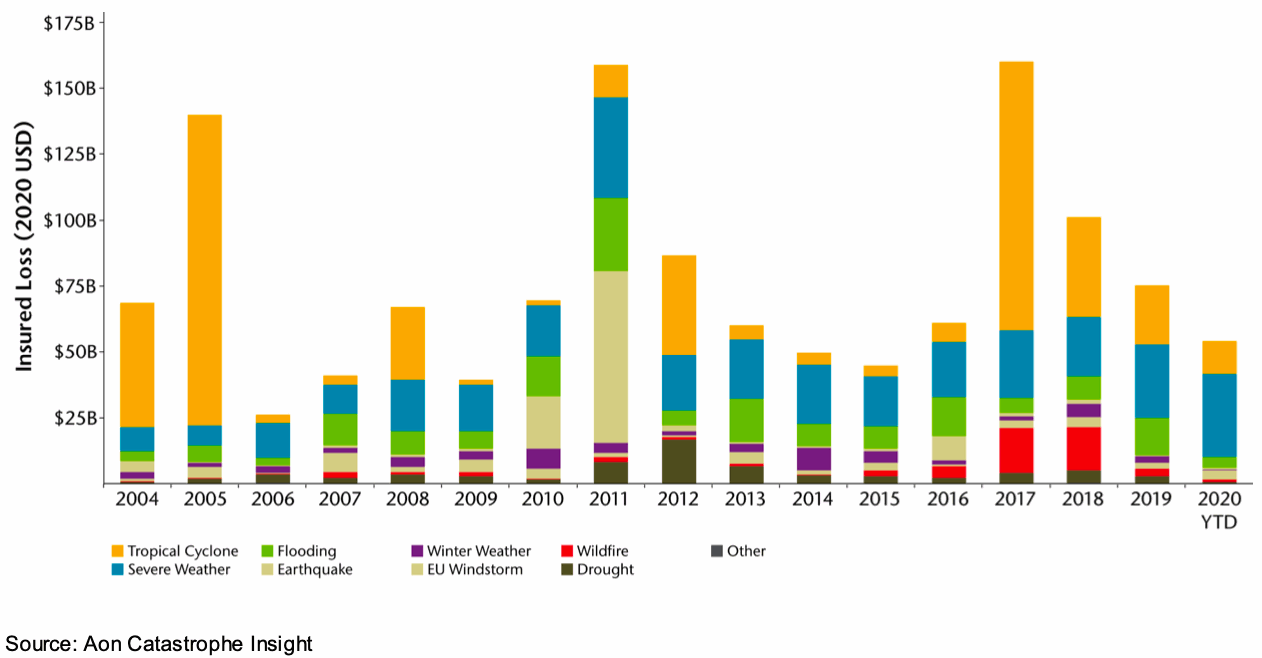

Global insured losses from catastrophe events and severe weather have already reached $54 billion in 2020 and the effects of the COVID-19 pandemic are evident in prolonged loss development, according to insurance and reinsurance broker Aon.

Insured catastrophe losses are still behind the $75 billion Aon counted for 2019, but with over three months left to run, the rate of losses flowing to insurance and reinsurance market interests looks like the total for this year could surpass that.

Secondary perils are a clear driver of insured losses from severe weather events in 2020, with Aon explaining that, “More than 60 percent of 2020 insured losses have been caused by secondary perils and eight of the last ten years have seen higher economic losses from secondary perils than primary perils.”

This is a particularly important trend, alongside loss development and how that is affected by social factors.

Leading Aon to say, “These industry trends coupled with higher quality claims information demonstrate the need to better harness data and analytics, and develop custom views of insurer risk that can further improve the ability to trade catastrophe risk.”

There have already been some notable catastrophe loss events in the third-quarter of 2020, but in addition Aon notes that Q1 and Q2 loss events continue to develop.

Leading the broker to say, “Large events thus far in 2020 have also shown prolonged loss development as the COVID-19 environment has forced a change in how damage assessments are conducted and the speed by which claims are approved / paid.”

Aon highlights that the severe convective storm, of thunderstorm, peril in the United States has again been a significant driver of insurance and reinsurance losses this year.

“Through the first eight months of 2020, the severe convective storm (SCS) peril – USD32 billion – remains the costliest globally and accounts for nearly 60 percent of insured losses. Most of those losses occurred in the United States following what has been a very active spring and summer for tornadoes, large hail, and damaging straight-line winds. SCS losses for U.S. insurers have topped USD10 billion in insured losses every year since 2008, with 2020 marking the 13th consecutive year,” the broker said.

In fact, through the middle of Q3, there have already been 14 individual billion-dollar insured loss events around the globe and 12 of these were in the United States.

We can maybe add another to that list with hurricane Sally as well.

More telling perhaps is that 11 of the 14 were from severe convective storms, the other three being hurricanes and a European windstorm.

All of this is helping to drive demand for catastrophe reinsurance and Aon explains that this is a trend we are likely to see more of.

“We have seen increased demand to mitigate tail risk from catastrophe events. At the same time, a growing number of “mini-cats” from secondary perils have eroded underwriting results and we have seen insurers shift toward earnings protections,” the broker said.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.