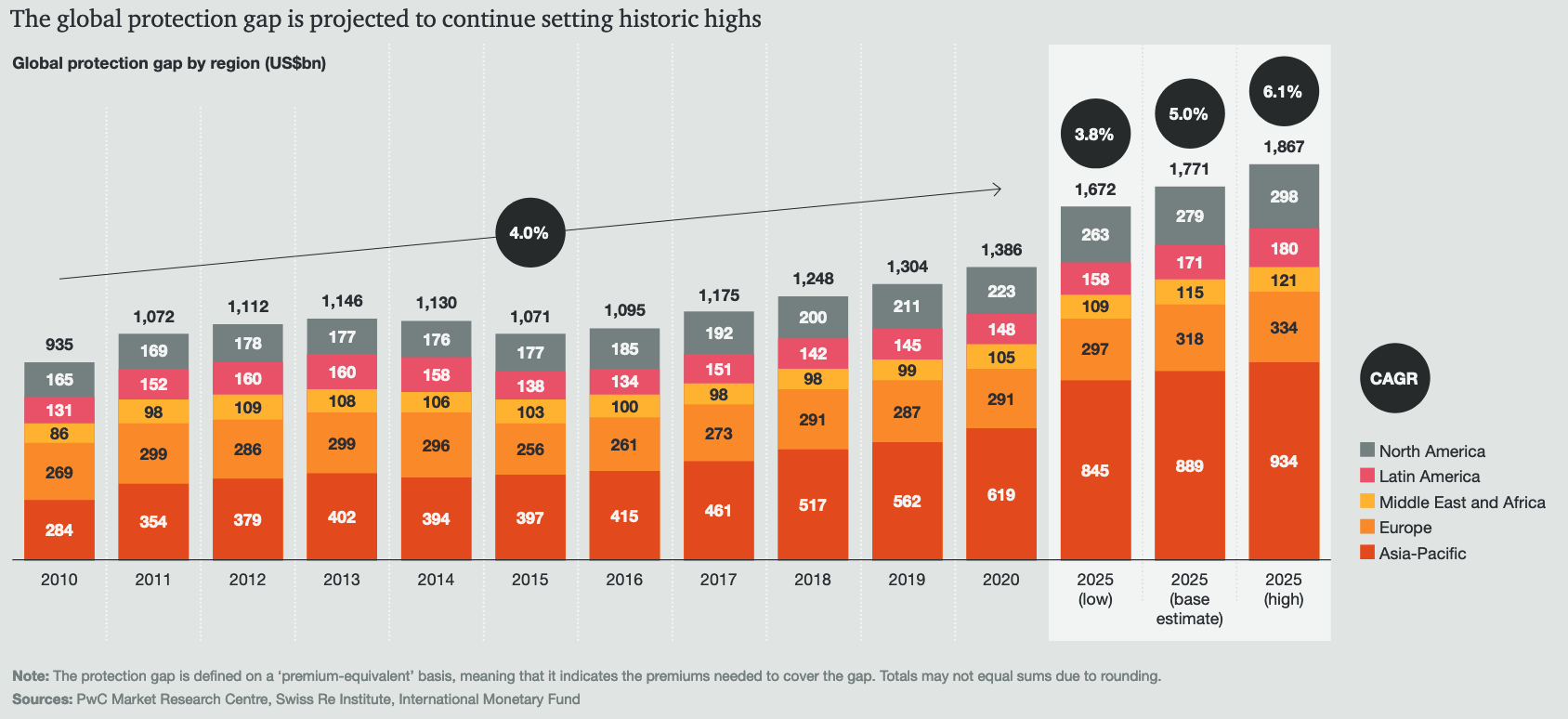

The global insurance and reinsurance market faces a range of challenges, but at the same time the opportunities for the sector and for the provision of efficient capital to absorb societal risks, is also expanding, with PwC estimating that the global protection gap may expand to US $1.86 trillion by 2025.

That’s significant growth of around 33% in just a few years, as the protection gap, so the gap between economic and insured losses, was estimated to have reached US $1.4 trillion in 2020.

PwC believes the size of the protection gap is actually accelerating now, as insurance coverage is not keeping up with economic growth and increasing values-at-risk in terms of urbanisation.

Matthew Britten, Partner, Insurance at PwC Bermuda commented, “Insurers and reinsurers must harness the momentum they’ve gained to reassess the future and determine what long-term changes are needed for their industry to serve a higher purpose in an uncertain world.

“One of the main economic lessons from the pandemic has been the importance of innovation, diversification and strategic agility in sustaining business resilience. And this has been heightened by a perfect storm of geopolitical instability, pressure on costs, competition for talent and changes in approaches to taxation globally.”

The response to a widening protection gap needs to be innovation-led and efficient risk capital needs to be at its heart, meaning the opportunities to provide insurance and reinsurance capital in capital market forms will almost certainly be at the center of efforts to narrow the gap, or at least slow the widening.

PwC explained in a new report, “With a growing need to find long-term solutions to address social and economic disparities and business resilience, insurers must go beyond their traditional mandate.”

Going beyond the traditional is a god mantra, as in order to remain relevant and meet customer needs through the coming decades, insurance and reinsurance markets are going to have to focus on service provision, while embracing the most efficient sources of and ways to match capital to the risks they underwrite, we believe.

Unfortunately, PwC believes that trust is also an issue for the re/insurance market, and driving the protection gap wider as well, as “This erosion of trust, combined with lack of access and poor financial education, has made customers less likely to buy insurance and has led to wider protection gaps and higher economic losses.”

If people trust insurance less and less, it means the industry will increasingly struggle to maintain its relevance, and so the gap will widen as more of society foregoes coverage in certain areas of their lives.

But, with insurable values rising exponentially higher, the need for risk capital is only going to grow.

To bridge the trust gap and narrow the protection gap, it’s going to take a customer-first, product design-led approach to insurance protection, backed by the most efficient access to reinsurance capital there can be.

Capacity and risk capital will be needed in significant amounts, as the industry adjusts to respond to the accelerated widening of protection gaps.

A clear opportunity for insurance-linked securities (ILS) specialists and capital market investors, who’s capital can be integrated into newly designed protection models that are fit for the future and respond to evolving customer needs.

PwC’s new report can be accessed here.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.