The share of the insurance-linked securities (ILS) market attributed to direct institutional investors has increased in recent months, with this class of investor gaining ILS market share at the same time as multi-strategy funds have exited the space and reduced theirs, according to Aon.

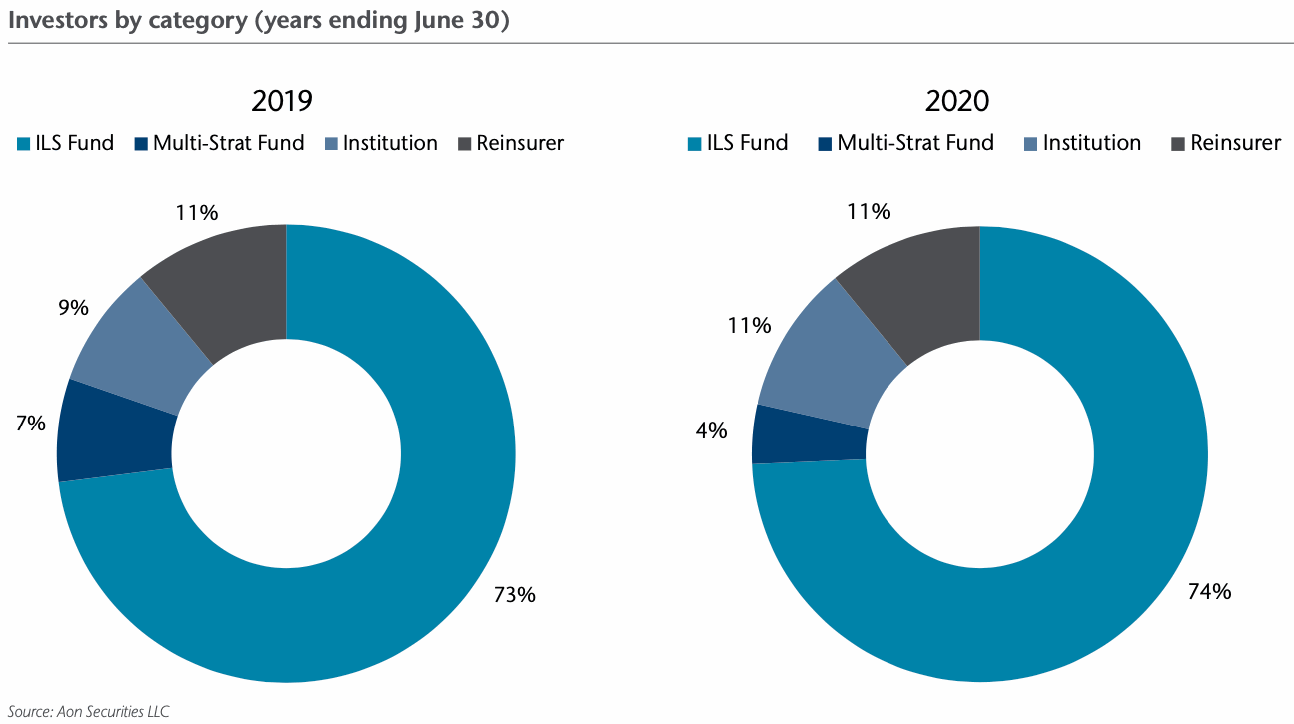

Data from the latest annual insurance-linked securities (ILS) market report from Aon Securities shows that institutional investors grew their share of ILS limit from 9% in 2019 to 11% by mid-2020.

At the same time, multi-strategy investment funds declined, in terms of share of ILS, falling from 7% to just 4% of the market.

Dedicated ILS funds increased their shares slightly on the back of the changing investor base, from 73% of the ILS market in 2019 to 74% by the middle of 2020.

The final segment of investor, reinsurance companies that invest into ILS structures and catastrophe bonds, remained static at 11% of ILS market capacity.

Over the last year to June 30th 2020, “Institutional Investors saw their level of contribution increase back to historical levels following a small decrease in 2019,” Aon Securities explained.

While, “ILS Funds recorded a marginal annual increase from 73 to 74 percent.”

Meaning that, “Together, the two provided 85 percent of total capacity for new issuances brought to market by Aon Securities year-to-date,” but “Multi-Strategy Funds’ participation decreased in 2020.”

Multi-Strategy investment funds were the main class of investor that sold off their catastrophe bond positions in the early days of the COVID-19 pandemic, finding that the ILS market once again offered a rare chance to achieve liquidity at little drop in price, due to the relatively uncorrelated nature of named peril catastrophe risk contracts underpinning cat bonds.

Interestingly, Aon Securities also notes another factor that may have driven some multi-strat investors away.

“This decrease may be attributed to the decrease in average Expected Loss and average spread on the transactions issued in 2020 as some Multi-Strat investors prefer riskier, higher-yielding classes of notes. Overall, the ILS market keeps attracting a wide range of investor profiles,” the brokers capital market unit explained.

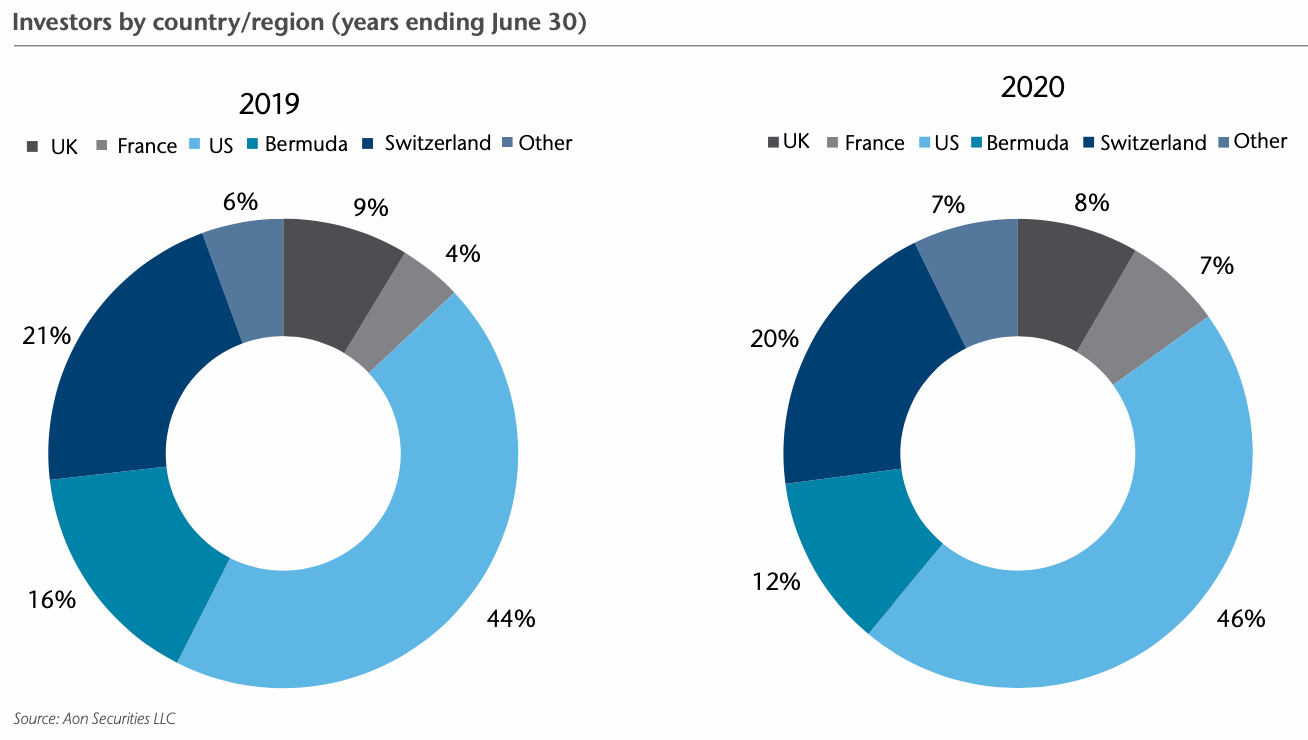

More interesting dynamics in the ILS investor base over the last year are noted in the report in terms of the original location of assets deployed into the asset class.

Most notable is the fact that Bermuda, as a base or source for ILS assets, has actually seen its market share shrink, dropping from 16% to 12% of the market.

The United States remains the largest source, at 46%, slightly up on the 44% it contributed a year earlier.

Of course, Bermuda has not really been the home of end-investors in ILS, rather the experts that manage and deploy the capital. So with the ILS market expanding, alongside some erosion of certain loss-hit ILS funds, it’s no real surprise Bermuda’s share shrank a little in the last year.

One notable other change though is that France saw its ILS investor participation nearly double, rising almost back to its 2018 level.

Other sources of investor capital increased marginally, signalling some increasing interest from investors in countries such as Sweden, Canada, Germany and Japan.

Increasing interest from investors in deploying more capital into ILS is also a theme that Aon Securities highlights, saying that, “The rate environment post COVID-19 outbreak has led to some investors to return to the ILS market as spreads on new issuances have widened and become more attractive.”

That trend is likely to continue through year-end and could drive further changes to these charts in a years time.

Also read: Cat bond market in a strong position with busy pipeline: Schultz, Aon.

Analyse catastrophe bond issuance and data using our Deal Directory, Dashboard and Charts.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.