Catastrophe bond funds have faced pressure on positions in May thanks largely to increasing cat bond spreads, as the secondary market responded to primary issuance premiums, as well as high levels of liquidity that can impact values of positions.

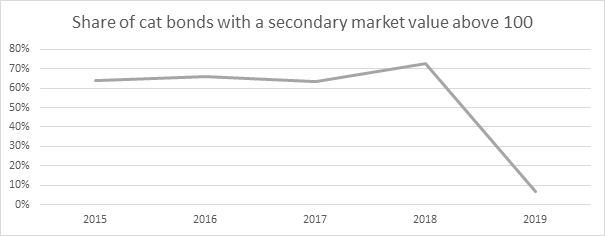

The result is that the share of outstanding catastrophe bonds that were priced at above par, or 100, in the secondary market in May 2019 was just 7%, according to analysis by Swedish ILS fund manager Entropics Asset Management AB.

Entropics CEO Robert Lindblom noted that the continued increase in catastrophe bond premiums has driven a decline in secondary market valuations, which confirms the “increasing demand for return” from investors.

Lindblom believes that the case for investing in cat bonds is currently very good, given the demand for higher returns, ability to buy into the market at lower valuations, and the fact liquidity still remained high providing opportunities for investors.

In addition to the market dynamics that drive secondary market pricing, Lindblom also noted that the month of May saw further loss creep but also greater clarification about the fate of some cat bond positions, which means “the risk of further loss creep has decreased notably.”

This also makes now a good time for entry into the catastrophe bond asset class, he explained.

Explaining the graph above, Lindblom said, “The notable increase of the market’s demand for returns following the historically large catastrophes in 2017/18 is illustrated in the graph below. In 2019, only 7% of the bonds on the market are priced at par 100 or above.”

The graph above only includes natural catastrophe bonds and excludes any cat bonds that are already facing a loss.

The same effect, of higher premiums for cat bonds, is manifested in the higher multiples at market of new catastrophe bond issuances seen so far this year, as we explained recently here.

“The development in 2019 with increasing premiums and a continued large supply of bonds is primarily driven by short term loss events, mostly insurance losses from the two past years,” Lindblom said.

He went on to explain the dynamics that should drive continued catastrophe bond issuance, such as climate change risks, expansion of insurance-linked securities (ILS) into new perils and geographies, as well as continued increases to insured exposures as urbanisation in catastrophe prone areas races ahead.

Lindblom said, “For investors, this development entails, in the longer term, access to new geographies as well as new perils. This should also lead to an increasing interest in ILS and a maintained balance between supply and demand, even if the investor base is expected to grow.”

———–

Get your ticket to attend our next ILS conference in Singapore, ILS Asia 2019.

Get your ticket to attend our next ILS conference in Singapore, ILS Asia 2019.

We’re returning to Singapore for our fourth annual ILS market conference for the Asia region on July 11th 2019.

Please register today to secure your place at the conference. Tickets are now selling fast.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.