The return of catastrophe bond and insurance-linked securities (ILS) funds as a group was above average in May 2021, at 0.58%, and even if you subtract the extraordinary boost one fund got due to what is expected to have been wildfire subrogation recoveries, the average ILS fund return was still better than the long-term mean.

This is according to the Eurekahedge ILS Advisers Index, which was up by 0.58% for May 2021 and if the one outlier ILS fund is subtracted was still up by 0.32%, which was also above the average seen.

This is according to the Eurekahedge ILS Advisers Index, which was up by 0.58% for May 2021 and if the one outlier ILS fund is subtracted was still up by 0.32%, which was also above the average seen.

In fact, May 2021’s ILS fund returns were particularly good for the month, as if you look back at the returns of previous May’s through until 2006, then take off the two negative years, the 0.32% is still better than the average for the month.

A sign of better reinsurance returns, off the back of higher pricing, flowing through to the ILS fund market? Perhaps to a degree.

Maybe more of a factor was the relatively benign catastrophe loss environment for the period though.

There weren’t any significant catastrophe events that affected the global reinsurance market in May, although there was a continuation of severe and convective weather in the United States.

However, this was not considered significant enough to cause a negative impact to insurance-linked securities (ILS) strategies, in the main.

Meanwhile, the issuance market for catastrophe bonds remained very robust in May, as detailed in our latest cat bond market report here, while collateralized reinsurance contracts came up for renewal in time for June 1st.

Cat bond prices rose by 0.18% in May, ILS Advisers explained, driving the total return of the Swiss Re cat bond index to 0.68% for the month.

However, pure catastrophe bond funds as a group only gained 0.28% in May, according to ILS Adviser’s Index.

Meanwhile, the group of ILS funds that include private ILS, or collateralized reinsurance and retrocession investments, rose strongly by 0.77% as a group.

Returns, as ever, were not equal though and one ILS fund fell to a -0.52% loss for the month of May, while another, the outlier we mentioned, rose by 7.62%.

Now, we suspect the outlier here is the Markel CATCo managed retrocession fund, which gained close to 8% for May thanks to reduced wildfire ultimates, which we suspect is a result of subrogation recoveries flowing back to the fund.

But, even if you exclude this fund, which ILS Advisers notes was an “extraordinary gain”, the ILS Advisers Index would still have risen by 0.32% in May 2021, and the group of private ILS funds would have gained 0.34%.

Making this May just gone a strong one for the ILS fund market, thanks to limited catastrophe impacts, with higher returns coming from well-priced transactions and cat bonds.

Overall, 24 ILS funds were positive for the month of May, but 4 in total were negative, showing that some ILS funds continue to deal with issues related to prior period loss activity and possibly loss creep.

Excluding previously negative May months, the long-term average for the period is still only 0.30%, showing that ILS fund returns have been particularly robust.

How that will continue for June is going to be interesting, as more wind season premium may flow for the private ILS funds, boosting returns slightly and having been another relatively benign period for catastrophe events, we could see another strong month of ILS investment performance.

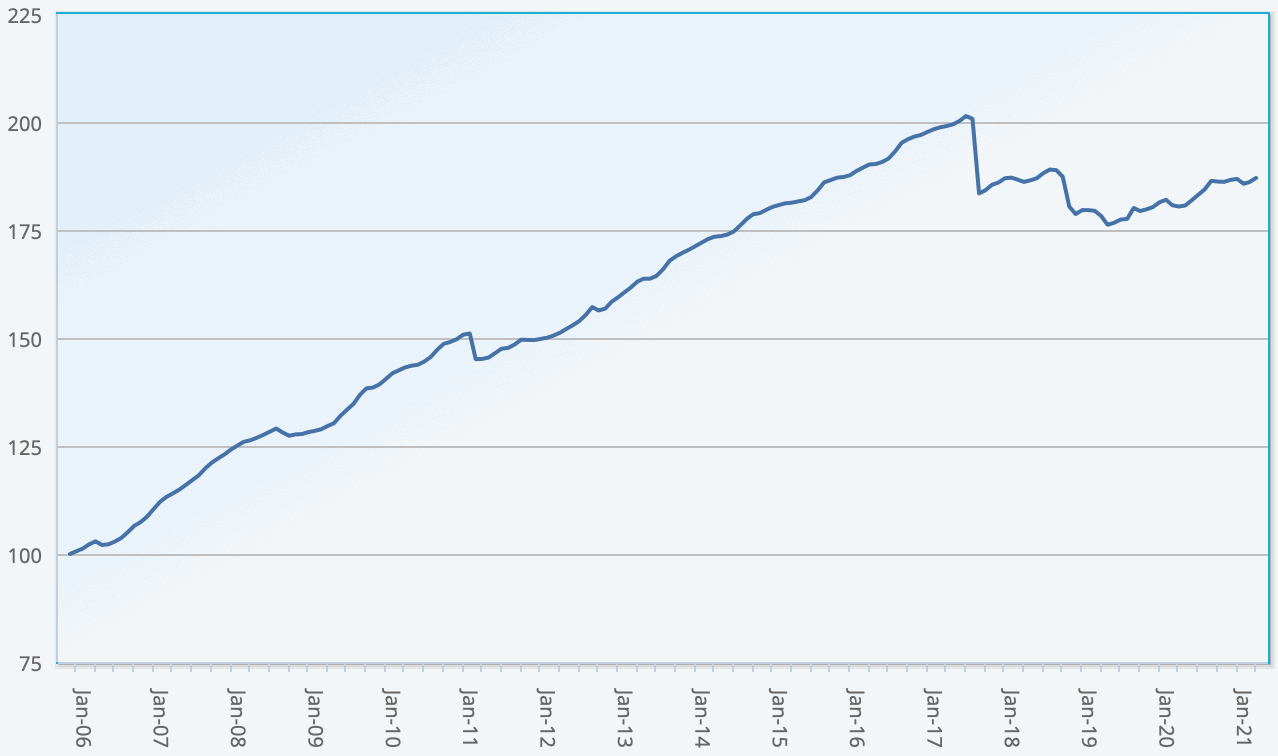

You can track the Eurekahedge ILS Advisers Index here on Artemis, including the USD hedged version of the index. It comprises an equally weighted index of 32 constituent insurance-linked investment funds which tracks their performance and is the first benchmark that allows a comparison between different insurance-linked securities fund managers in the ILS, reinsurance-linked and catastrophe bond investment space.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.