Insurance-linked securities (ILS), pure catastrophe bond and reinsurance linked investment funds have seen another strong month of performance in September 2016, as seasonal premiums helped to boost the Eurekahedge ILS Advisers Index return to an above average 1.03%.

Similar effects to those seen in August, when ILS funds averaged a 0.86% return, were seen in September 2016, with strong premium allocation to funds, due to being in the peak of the U.S. hurricane season and continued strong demand for catastrophe bonds driving prices higher still.

This seasonal premium allocation has been strong in 2015 and 2016, which is interesting as seasonality does not really change. However the view of science, meteorology and where or when premiums should be largely allocated, based on experience of past seasons, does seem to mean that ILS funds are experiencing stronger uplifts in returns in August and September than they did pre-2010.

Of course there is also the increased impact from expansion into collateralised reinsurance which has driven this change. For any investors reading, it’s worth remembering that many of the ILS funds that experience the highest seasonal uplifts in returns are the ones that require at least a six month commitment of capital, so seasonal speculation, while possible in ILS, is not as simple as some might hope.

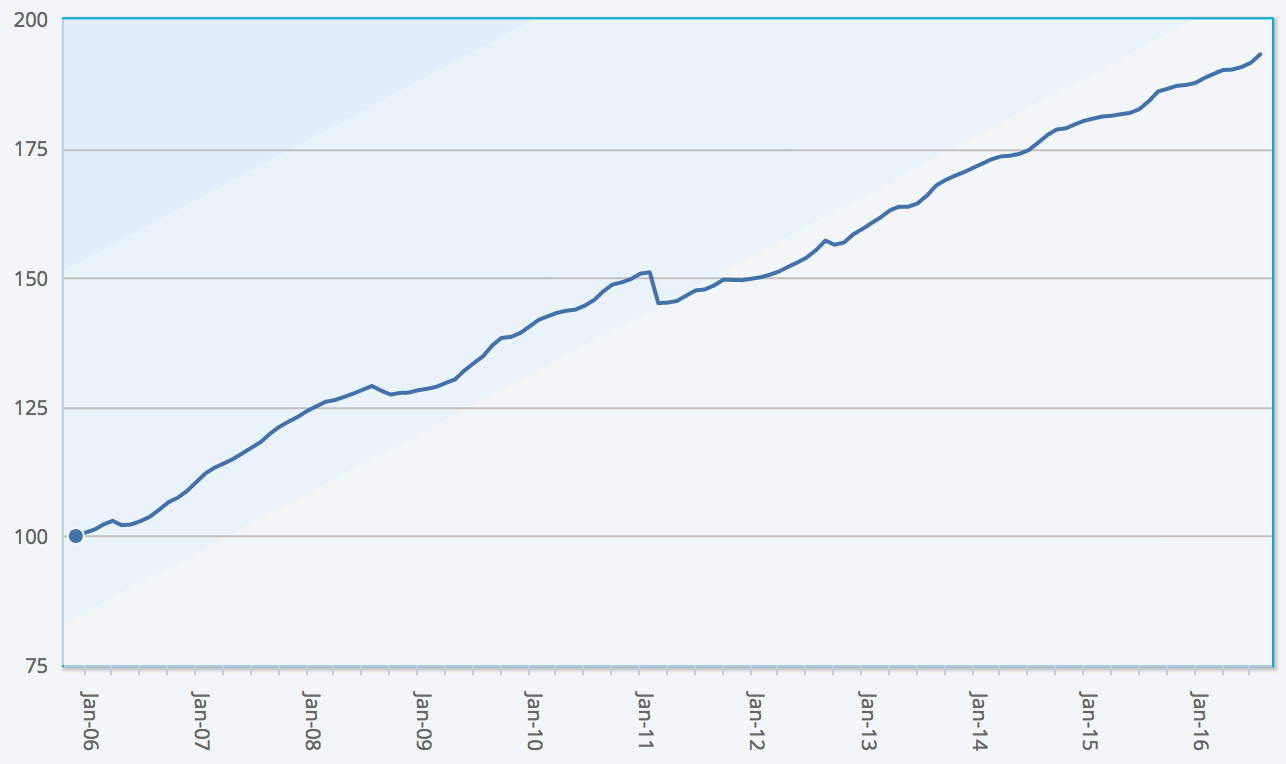

This September the 1.03% performance of the ILS Advisers Index was above the long-term average of 0.96% and was the same as a year earlier. The Index has yielded 4.23% year-to-date, which is the fourth lowest since 2006, but Stefan Kräuchi, founder of ILS Advisers, commented that “We see the returns are coming back to average level.”

Kräuchi explained the ILS fund Index’s September performance; “All funds represented in the Eurekahedge ILS Advisers Index made positive returns. The difference between the best and the worst performing fund was 2.52 percentage point.”

You can imagine that some ILS funds have experienced very strong returns in September, if the difference was as wide as 2.52% but the average return more than one percent.

Once again the catastrophe bond market helped to ensure ILS fund returns were higher, as demand continues to push prices upwards, however private ILS and collateralised reinsurance clearly continues to offer the higher risk/reward seeking investors greater returns.

“Cat bond price return was strong given the seasonal buying although the primary market was almost silent. Pure cat bond funds as a group were up by 0.79% while the subgroup of funds whose strategies include private ILS increased by 1.20%. Private ILS funds outperformed pure cat bond funds by 0.96 percentage points on annualized basis,” Kräuchi highlighted.

Catastrophe bond fund performance was reflected in the strong price return increase of the Swiss Re index, which was up 0.56% in September, while the total return of the outstanding cat bond market was 1.05%.

“The private ILS funds kept its momentum of solid returns into September and made the best monthly return in past 24 months,” he continued, reflecting the greater proportion of premiums allocated to private ILS and collateralised reinsurance in September.

There were few loss impacts to deal with in September and with hurricane Matthew forming during the month but its impacts occurring in October, any decline in performance will be accounted for in the current months returns and beyond.

The 4.23% nine-month performance of the ILS fund index is impressive and close to overtaking 2015’s full-year return of 4.24%. This is especially impressive when you consider that 2016 has seen a greater frequency of loss events that have impacted some of the private ILS focused funds.

It will be interesting to see how ILS fund performance is reported for October, as a number of ILS funds have been reporting loss estimates for the impact of hurricane Matthew during the month ILS Advisers notes in its latest report.

How that affects the performance of the Index will be interesting to see. For catastrophe bond funds the majority of the post-hurricane Matthew price decline has already recovered, so they could see another strong month. It will the private ILS fund losses that could knock the Index in October, but still at this stage based on the anticipated size of the insurance and reinsurance loss from Matthew it looks like the Index could report another positive month overall, albeit at a much lower level.

We’ll update you in a month’s time.

Eurekahedge ILS Advisers Index, showing average return of ILS and cat bond fund market - Click the image for more data on ILS fund performance

You can track the Eurekahedge ILS Advisers Index here on Artemis, including the new USD hedged version of the index. It comprises an equally weighted index of 34 constituent ILS funds which tracks their performance and is the first benchmark that allows a comparison between different insurance-linked securities fund managers in the ILS, reinsurance-linked and catastrophe bond fund investment space.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.