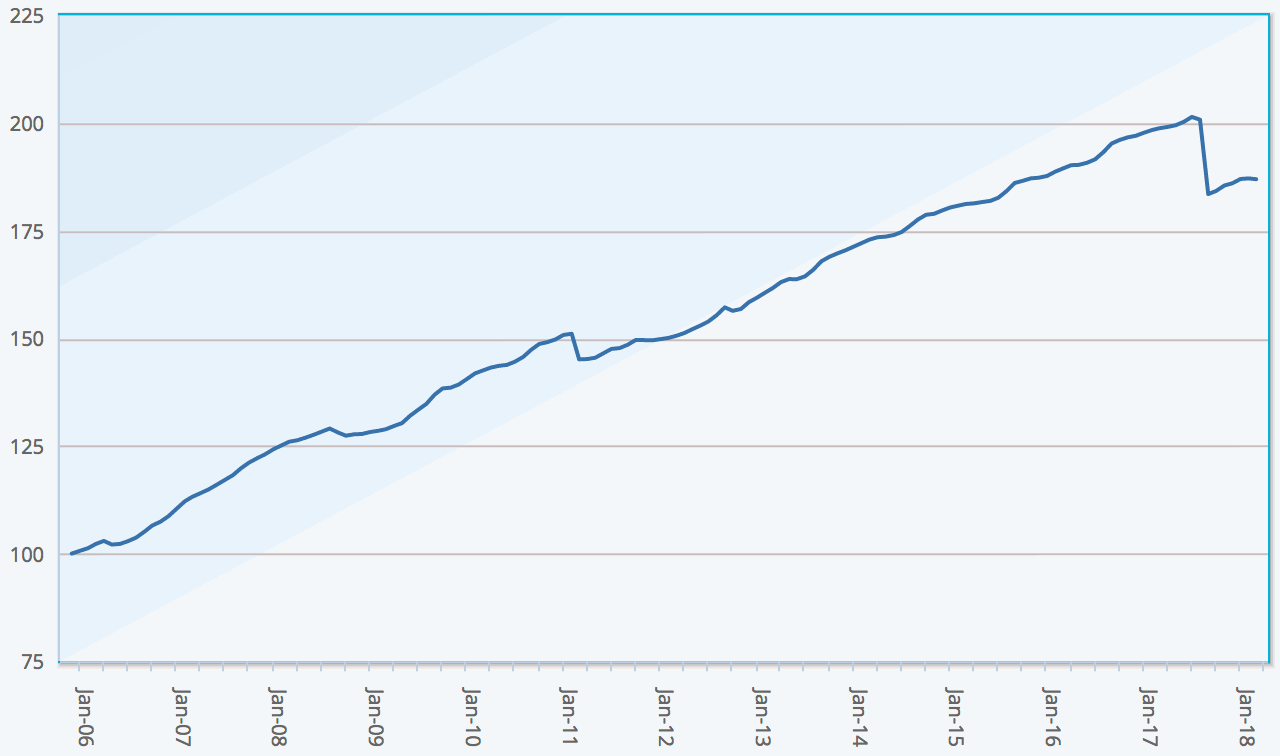

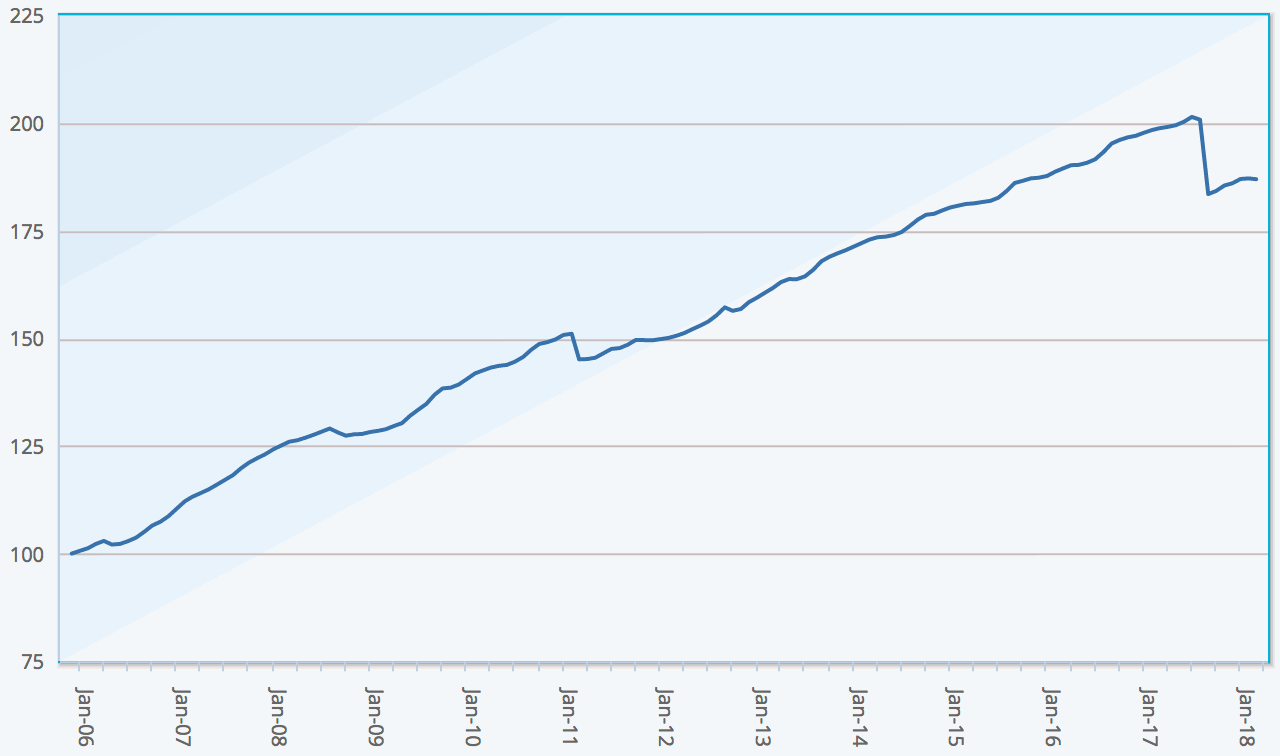

Insurance-linked securities (ILS) and collateralized reinsurance funds managed a positive average return of 0.19% for the month of May 2018, but the impacts of last year’s hurricanes and other catastrophe losses continued to hurt some fund strategies with a number falling negative for the month.

May 2018 saw five ILS funds that invest in private contracts and collateralized reinsurance falling to negative returns, as loss adjustments and estimate increases continue to factor into some funds performance almost half-way through the year.

May 2018 saw five ILS funds that invest in private contracts and collateralized reinsurance falling to negative returns, as loss adjustments and estimate increases continue to factor into some funds performance almost half-way through the year.

This is largely the ongoing loss creep from the 2017 catastrophe losses, particularly hurricane Irma which has driven most of the negativity for ILS funds through 2018 so far.

But there has also been an element of losses from May severe storms in the United States driving some of the negativity, although it is the added losses to side-pockets from 2017 that has driven most of the impacts for the month, we understand.

The 0.19% average return of the Eurekahedge ILS Advisers Index for May 2018 has taken the year-to-date average ILS fund return to just 0.27% after five months, but some ILS funds will be negative after a number of months of increasing losses as the divergence between the returns of different strategies continues.

The return for May is only slightly below the historical average of 0.21% though, but the year-to-date figure is now the second worst average return for the first five months of any year since the Index began recording ILS fund performance.

Stefan Kräuchi, Founder of ILS Advisers, commented on May’s ILS fund performance gap, “29 funds represented in the Eurekahedge ILS Advisers Index made positive returns. The difference between the best and the worst performing fund was 1.81 percentage points.”

“Among the 5 negative funds, 3 are private ILS funds. Private ILS funds on average continued to underperform pure cat bond funds YTD. The biggest gainer is a private ILS fund that increased by 0.65%. The biggest loser in the Index is also a private ILS fund that lost 1.16% for the month. Again this shows the divergence among private ILS funds.”

ILS Advisers also noted that capital continued to be plentiful into the recent renewals, with the catastrophe bond market experiencing bumper issuance and collateralized or ILS fund markets making further progress into traditional reinsurance.

The pure catastrophe bond investment funds were up by 0.27% as a group, while the subgroup of funds whose strategies include private ILS and collateralized reinsurance were only up by 0.13%, according to the Index.

Given the ongoing impacts of the 2017 catastrophe losses, the Index now reports that private ILS funds have underperformed pure cat bond funds by 4.75% on an annualised basis so far in 2018.

This underperformance may continue for some more months to come, especially as loss estimates for some events have been increased further in the last fortnight, we understand.

Not long until our Singapore conference, July 12th. Final tickets on sale here.

Eurekahedge ILS Advisers Index, showing average return of ILS and cat bond fund market - Click the image for more data on ILS fund performance

You can track the Eurekahedge ILS Advisers Index on Artemis here, including the new USD hedged version of the index. It comprises an equally weighted index of 34 constituent insurance-linked investment funds which tracks their performance and is the first benchmark that allows a comparison between different insurance-linked securities fund managers in the ILS, reinsurance-linked and catastrophe bond investment space.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.