In the main, funds investing in insurance-linked securities (ILS) and collateralised reinsurance are expecting any losses from hurricane Dorian that flow to the sector will be largely attritional in nature.

Speaking with a number of ILS fund managers in Monaco in the last week, as well as communications had more widely with those who don’t attend the Rendezvous, we found the opinion generally aligned on Dorian’s loss to the sector not being meaningful.

Speaking with a number of ILS fund managers in Monaco in the last week, as well as communications had more widely with those who don’t attend the Rendezvous, we found the opinion generally aligned on Dorian’s loss to the sector not being meaningful.

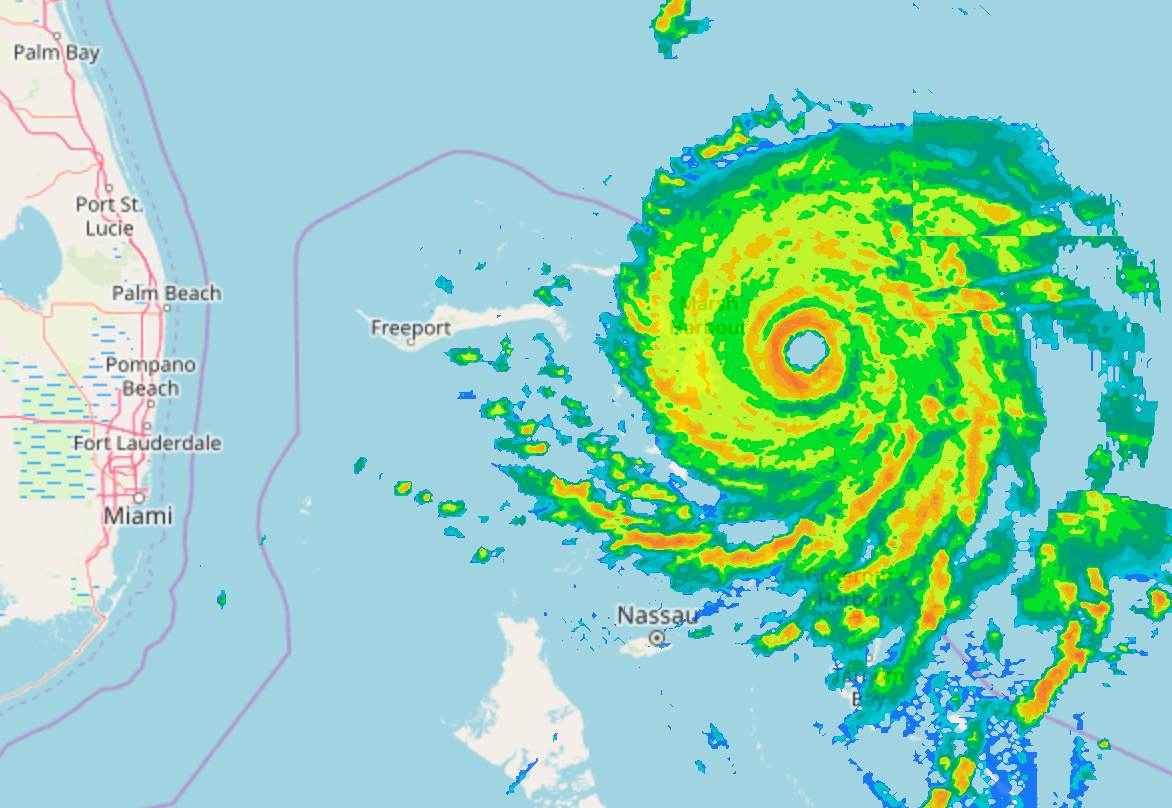

As a reminder, the human impact of hurricane Dorian has been extremely significant, with the Bahamas having faced the heaviest hit in living memory from a storm, with widespread devastation and tragic loss of life.

That will likely result in the largest insurance industry loss in the Bahamas on record, with a share to be dealt with by the global reinsurance market as a result.

But ILS funds in the main only have minimal exposure to reinsurance programs focused on the Bahamas and any other ILS market loss from Dorian’s impacts there is likely to flow through reinsurer sidecars and other joint venture style ILS vehicles.

Dorian’s impacts on the United States southeastern coastal states is currently not anticipated to be too high, in terms of insured losses.

As a result, some ILS managers said there is the potential for some losses to flow to their funds, but across the storm’s impacts still the losses are expected to be attritional in nature and manageable.

Catastrophe bond market impacts are not currently anticipated, although we have yet to see any loss reports coming out of state windpools such as those in North Carolina that have cat bond backed reinsurance. Mark-to-market losses suffered as Dorian approached are all being recovered it seems.

But it seems that the market would expect any losses from Dorian to be caught by the traditional reinsurance layers sitting below those cat bonds.

Collateralised reinsurance transactions, as well as private quota shares, or reinsurer vehicles, are the likely sources of any attritional ILS market losses from hurricane Dorian. There is definitely some transactions that would be considered exposed.

But in general the mood in discussions was that the impact won’t be at all significant to the ILS market, although it should be noted it remains soon after the event to really understand the full extent of any impacts.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.