Insurance-linked securities (ILS) funds have just had their best June and July performance since 2011, on average, as the improving returns in catastrophe bonds and other reinsurance linked investments start to become evident in manager’s results.

The average return of catastrophe bond and insurance-linked securities (ILS) funds was 0.67% in July 2020, which followed on from the same amount in June as well, reflecting the attractive ILS market investment opportunity at this time.

The average return of catastrophe bond and insurance-linked securities (ILS) funds was 0.67% in July 2020, which followed on from the same amount in June as well, reflecting the attractive ILS market investment opportunity at this time.

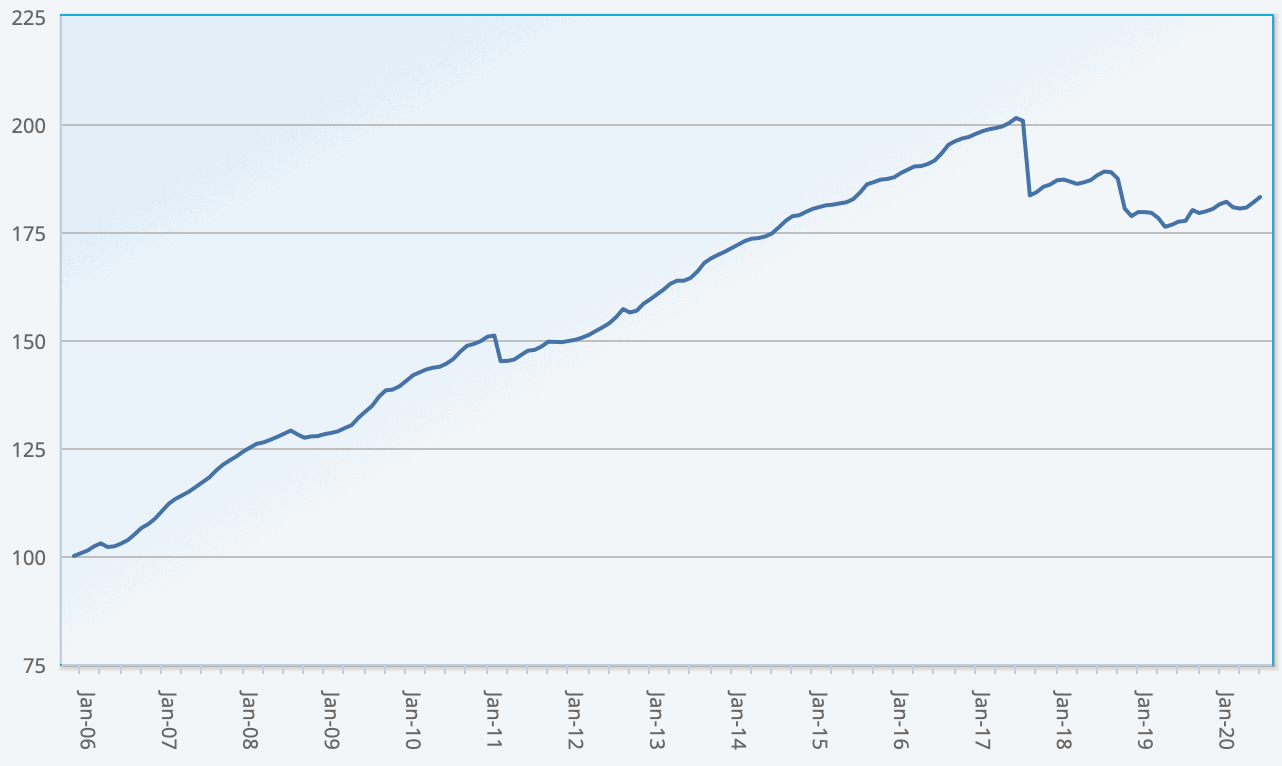

According to the Eurekahedge ILS Advisers Index, the year-to-date return for all ILS and cat bonds funds tracked has now risen to 1.54%, which is the best figure seen since the hurricanes began to impact the sector in 2017.

July 2020 once again saw pure catastrophe bond funds outperforming, as they returned 0.9% for the month, beating the ILS funds that also invest in private ILS and collateralised reinsurance’s 0.5% return.

Catastrophe bond funds continue to be buoyed by the higher returns seen in recent issuances, while private ILS and collateralised reinsurance funds are also seeing the benefits of higher rates, but some remain weighed down by loss creep effects and trapped capital at this time.

Stefan Kräuchi, Founder of ILS Advisers told us, “Overall, it is interesting to note that the Index delivered its best June and July returns since 2011, and this with money market rates close to zero. The improved premium environment this year is starting to show up in manager returns, which is a good sign.”

The range of performance, between best and worst ILS fund returns, was wider than normal.

ILS Advisers said that this could be due to some ILS funds having to make further adjustments to prior year catastrophe loss reserves during the month, as loss creep continues.

There is also a chance some of it could be related to the continued side-pocketing of potentially Covid-19 exposed private ILS positions, as this has become a bit of a trend in recent months.

The highest performing ILS fund for July 2020 returned an impressive 3.9%, while the worst performing ILS fund was down -2.7% for the month.

Seasonality is partially a driver for improving ILS returns in June and July of course, as the hurricane season begins.

But the fact these are the best monthly ILS fund returns since 2011 is perhaps significant, as that was around the time the insurance-linked securities (ILS) sector began its phase of rapid growth over the following years, while reinsurance and cat bond rates declined at the same time.

It clearly demonstrates, especially for the catastrophe bond funds, that forward returns are increasing and as a result the market offers an attractive entry point at this time.

28 of the ILS funds tracked by ILS Advisers for its Index were positive for the month of July 2020, with 4 reporting negative returns for the month.

The range between the best and the worst performing ILS fund was higher than is typical, at 6.65%.

You can track the Eurekahedge ILS Advisers Index here on Artemis, including the USD hedged version of the index. It comprises an equally weighted index of 33 constituent insurance-linked investment funds which tracks their performance and is the first benchmark that allows a comparison between different insurance-linked securities fund managers in the ILS, reinsurance-linked and catastrophe bond investment space.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.