September 2020 saw the strongest level of returns from the insurance-linked securities (ILS) market in a year, as the average ILS fund return was reported as 1.08% by ILS Advisers.

Catastrophe bond funds have again led the way, as strong price increases meant that pure cat bond funds outpaced the returns of those ILS funds investing in private transactions and collateralised reinsurance or retrocession.

Catastrophe bond funds have again led the way, as strong price increases meant that pure cat bond funds outpaced the returns of those ILS funds investing in private transactions and collateralised reinsurance or retrocession.

According to the Eurekahedge ILS Advisers Index the average return of catastrophe bond and insurance-linked securities (ILS) funds was 1.08% in September 2020, which is by far the highest returns reported by the ILS fund market since September 2019.

In fact, reflecting the potential of insurance-linked securities (ILS) investments at this time, September 2020 is one of the highest single months for the ILS fund market for a number of years, as you have to go back to September 2013 to find a second month where the figure is higher.

Strong price gains in the catastrophe bond market are again a factor in driving improving returns across the ILS fund market and ILS Advisors explained that “risk spreads tightened further in September as the wind season progressed with no material loss event.”

As a result of this, pure catastrophe bond funds as a group returned an impressive 1.38% on average in September 2020.

While the subgroup of ILS funds that also invest in collateralised reinsurance and private ILS deals were up by a lower 0.82%.

Catastrophe events during the month of September have eroded annual aggregate reinsurance deductibles somewhat, affecting some ILS structures, ILS Advisers explained.

29 out of the ILS funds represented in the ILS Advisers Index reported positive returns in September 2020, while 2 were negative for the month.

The difference between the best and worst performing ILS fund was particularly stark though, at 6.3%, which suggests that some collateralised reinsurance funds saw very positive returns, but some also particularly negative, as it seems likely the private ILS market will sit on both ends of this gap given its size.

October’s returns may not be as impressive, as hurricane activity will likely dent performance for a number of ILS funds.

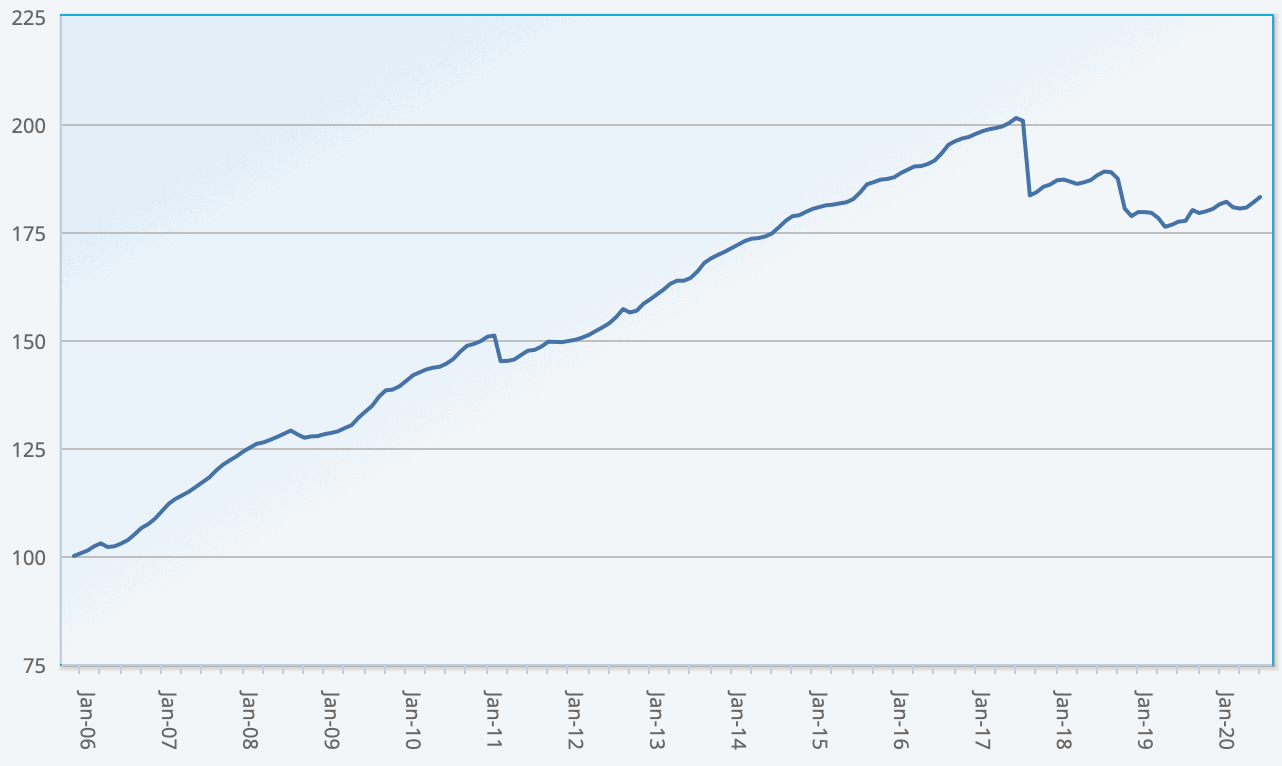

You can track the Eurekahedge ILS Advisers Index here on Artemis, including the USD hedged version of the index. It comprises an equally weighted index of 33 constituent insurance-linked investment funds which tracks their performance and is the first benchmark that allows a comparison between different insurance-linked securities fund managers in the ILS, reinsurance-linked and catastrophe bond investment space.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.