Insurance-linked securities (ILS) related fee income and profit shares can become a “significant contributor” to the earnings of insurance and reinsurance firms that manage third-party capital, according to rating agency Moody’s.

While the vast majority of reinsurers already leverage alternative capital and insurance-linked securities (ILS) within their retrocession arrangements, some have gone further to integrate third-party investors into their businesses.

Moody’s explained, “A number of reinsurers have also built sizable third-party capital platforms to manage alternative reinsurance capital investments for institutional investors through sidecar joint ventures and insurance-linked securities (ILS) funds management, creating a stream of relatively stable management fee income and profit-sharing arrangements.”

Approximately 45% of total alternative capacity may be under the management of a reinsurance company, Moody’s estimates, with the majority in reinsurance sidecars, other collateralized vehicles and insurance-linked securities (ILS) funds.

This strong engagement, between traditional re/insurers and third-party investors demonstrates “the extent of convergence that has occurred over the years between alternative reinsurance capital and traditional reinsurance,” the rating agency explained.

But just a handful of reinsurers that manage alternative capital are disclosing the fee income they earn from these activities.

Typically, there is a management fee and also profit commissions to be earned, similarly to a hedge fund model.

In addition, sidecars and quota shares may have performance overrides, boosting the potential earnings for a reinsurer.

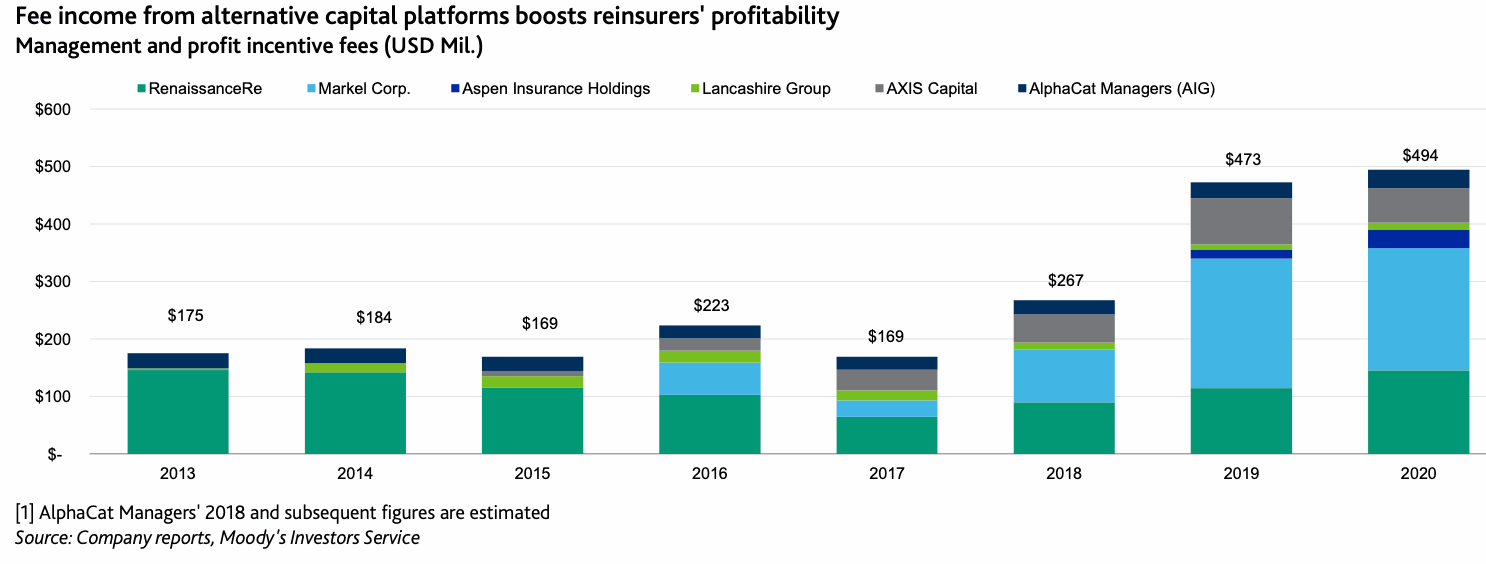

Moody’s has tracked re/insurer earnings from ILS activities through 2020, where possible, finding that some $494 million in aggregate fee income was earned by the group, a not insignificant figure.

The chart above shows how reinsurer fee and management earnings from ILS ventures has grown. With so many reinsurers not disclosing this at all, it is easy to imagine the total earnings of the industry from these third-party reinsurance capital activities will be well into the billions at this stage.

The $494 million of fee income tracked by Moody’s was across just six firms, led by Markel’s Nephila Capital ILS management business and RenaissanceRe’s affiliated sidecar, collateralized reinsurance and ILS fund vehicles.

Of course, fee income is just one of the benefits to managing third-party capital, as the capacity it provides can enable reinsurers to more carefully navigate the global property catastrophe market environment.

It can help them manage volatility, maintain footholds in markets where there own balance-sheet capital is less appropriate, and expand into new catastrophe zones.

While, as we explained recently, analysts of and equity investors in reinsurance companies are not convinced, feeling that few reinsurers have actually demonstrated the cost-of-capital benefits of managing third-party capital in sidecar structures so far.

Some reinsurers will need to demonstrate that this fee income earned is at least a replacement for the earnings they could have made by writing the business on their own paper.

That won’t be the case for those with sizeable and diverse ILS management operations, as these are much more specialist. But those reinsurers with a sidecar, or smaller fund, that cannot clearly demonstrate to their shareholders how this is additive and delivers benefits beyond fee income alone, may find themselves coming in for questioning at a later stage.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.