Insurance-linked securities (ILS) and catastrophe bond returns continue to deliver attractive results despite the lower rates in the reinsurance market, outperforming most benchmarks in the last year, according to the latest market report from Aon Securities.

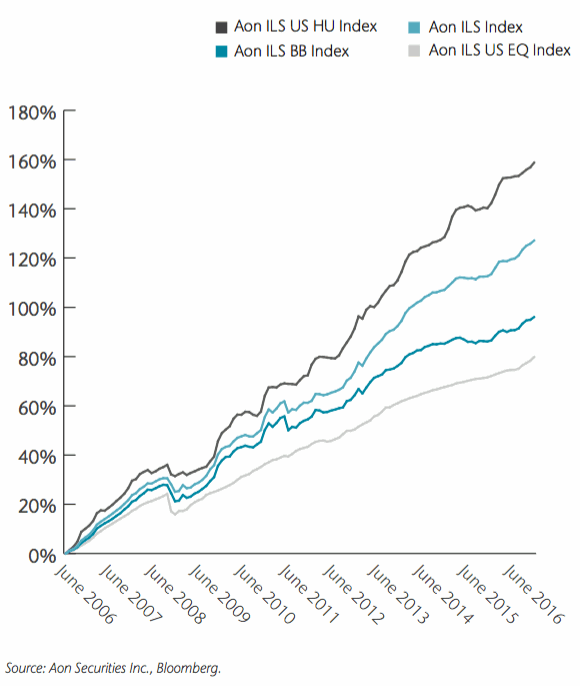

In the 12 months to the end of June 2016 the Aon ILS Indices delivered what can still be considered outperforming returns, Aon Securities said, with its All Bond index, covering the catastrophe bond universe, delivering a 6.84% return, while U.S. hurricane exposed cat bonds returned an impressive 7.73%.

Aon Securities, the investment banking division of global reinsurance broker and capital advisor Aon Benfield, released its latest report yesterday evening, covering developments in ILS and catastrophe bonds in the calendar year to 30th June 2016.

Performance is a focus of the report, as there has been so much discussion of the declining returns in the reinsurance market, as softening rates reduced ILS market and reinsurer equity returns. But Aon Securities clearly shows that the ILS and catastrophe bond asset class remains a very attractive alternative investment opportunity.

All of the Aon ILS Indices posted positive returns for the year to 30th June 2016. The Aon All Bond index which tracks the universe of cat bond perils and issues returned an impressive 6.84%, which shows the returns possible from a market-tracking basket of cat bonds.

Meanwhile the Aon ILS BB-rated Bond Indices posted a gain of 5.34%, while the U.S. Hurricane cat bond index showed that perils contribution to the cat bond markets return by gaining 7.73%, while the U.S. Earthquake Bond Index returned 4.85%.

Historical performance of Aon ILS Indices

“As equity market volatility and negative interest rates in certain regions persist, the ILS market represents an attractive investment opportunity for many investors,” the report explains.

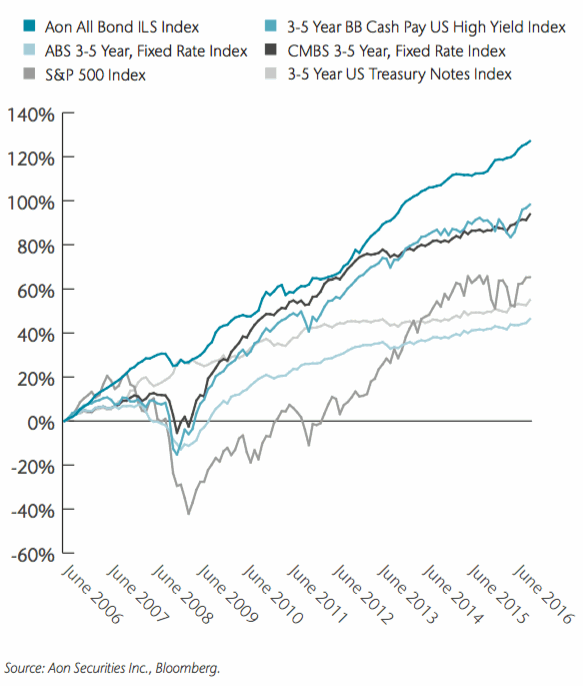

This is evidenced by the manner in which catastrophe bonds continue to outperform many benchmarks, without even taking into account any of the portfolio benefits that large investors can gain by investing in insurance risk and ILS instruments.

The Aon All Bond Index outperformed relative to the S&P 500 Index over the year under review, as well as the majority of comparable fixed income benchmarks, according to Aon Securities. One exception was the 3-5 year BB U.S. High Yield Index, which returned 6.93%, so slightly higher than the All Bond Index’s 6.84%.

Five-year average returns for The Aon All Bond Index hit 7.26%, while 10-year average returns reached 8.56%, which again beat benchmarks.

Aon All Bond index versus financial benchmarks

This “Continued the trend of outperforming comparable benchmarks, and in doing so reinforced the value of a diversified book of pure insurance risks for investors’ portfolios over the long term,” Aon Securities said.

Interestingly, the calendar year under review outperformed the prior year, which Aon Securities explains is down to secondary market price rises. We’ve been documenting this each month, as supply-demand factors have helped to raise values, sometimes unseasonably, in the secondary catastrophe bond market.

The report states; “The annual returns for all Aon ILS Indices outperformed the prior year’s annual returns. This was driven by tightening spreads in the secondary market, particularly for low coupon bonds, and the absence of a major catastrophe.”

Returns in ILS and catastrophe bonds will benefit from the continued growth and expansion of the market, as demand from investors and the increasing sophistication of the ILS product enables new risks, perils and geographies to be included in the market.

“Demand for bonds that diversify investors’ ILS portfolios by providing exposure to alternative perils, such as casualty and non-US perils, will continue to grow,” Aon Securities explained.

This expansion and growth will also benefit investors seeking diversity, and those seeking higher risk/reward, as a larger ILS universe of risk assets will enable more investors to enter the sector and more readily develop portfolios that suit their return requirements.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.