The alternative, or third-party reinsurance capital market, has permanently altered the structure of reinsurers and will continue to do so moving forward, according to Dr. Morton Lane, President, Lane Financial LLC, and Director, The University of Illinois in Urbana-Champaign.

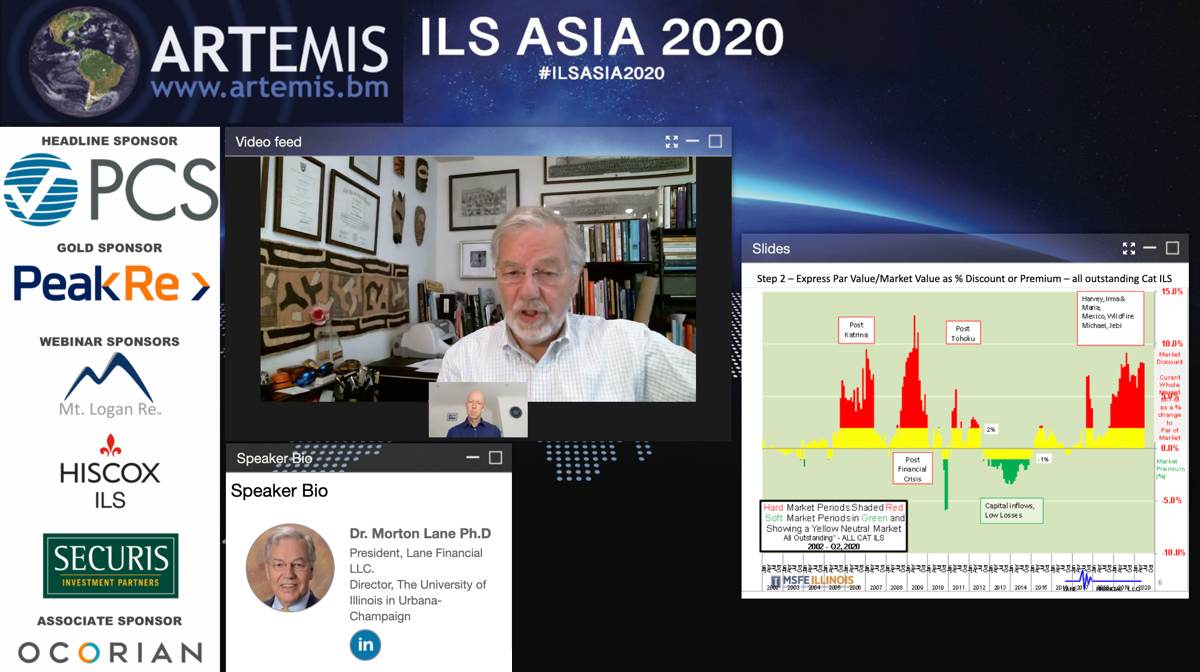

During the penultimate day of the virtual Artemis ILS Asia 2020 conference, Lane delivered an insightful keynote speech in which he explored numerous trends within the insurance-linked securities (ILS) and broader reinsurance space (available to watch on-demand now).

During the penultimate day of the virtual Artemis ILS Asia 2020 conference, Lane delivered an insightful keynote speech in which he explored numerous trends within the insurance-linked securities (ILS) and broader reinsurance space (available to watch on-demand now).

As part of Lane’s extensive market commentary, he offered some analysis on natural catastrophe yield risk premium and, against the backdrop of a firming reinsurance marketplace, discussed whether alternative capital has permanently affected reinsurance market dynamics.

“I think it has,” said Lane. “I think it has had an effect on the way reinsurers structure themselves and it will have an effect going forward. Maybe this is to facile an answer, but the answer is yes.

“There is definitely an underwriting discipline, which can get overwhelmed from time-to-time. In soft market conditions, traditional reinsurers are desperate for premium, if that’s their only source of premium, and ILS funds will equally under-price things but that’s just so that they can stay in the game.

“But, once the losses start to accumulate and the capital is trapped, I think everybody sharpens their pencils and does a better underwriting job.”

According to insurance and reinsurance broker Aon’s latest figures, alternative capital fell by 4% to $91 billion in Q1 2020, contributing to a 6% decline in the level of overall global reinsurance capital, from both traditional and alternative sources, to $590 billion.

But despite the Covid-19-induced dip in total dedicated reinsurance capital, in recent years, the ILS market has broadened its remit and cemented its position as an increasingly influential slice of the overall reinsurance market pie.

As the market has grown in both size and maturity, the investors and sponsors in the space have also matured and hold a sophisticated understanding of the asset class. Of course, the ILS market remains heavily focused on the nat cat space but as the ILS universe has developed there’s been a growing desire to participate in more exotic risks, including specialty type exposures.

“How are they (exotic risks) viewed by investors? Cautiously is the answer,” explained Lane. “I think the great thing that the ILS market did for itself in the early days was to have three modelling companies who allowed their analysis to be put into a prospectus. Different ones at different times, but, that I think is a keystone of the building of the ILS market.”

Ultimately, this enabled investors to have confidence in the models being leveraged to assess the risks in the ILS space. However, when it comes to more exotic exposures, including things like cyber and terrorism, Lane advised that market capabilities and investor comfort likely isn’t where it needs to be.

“I think investors will want to have confidence in the models that people are using to assess that risk. I don’t know that we’ve reached that point. I think we will and I think that the existing companies and other companies are beginning to tackle those things, and coming up with quite interesting results.

“I have to say it is in my peripheral vision rather that my direct vision, so I’m not on top of what’s been done but I expect those things will happen. In the meantime, they will be using parametric surrogates.

“The difficulty with something like cyber risk and terrorism and the exotic end, is that you really don’t have a great history to go on. And, when it comes to cyber, we are all afraid of the way that can accumulate.

“So, what we are going to end up with, I’m sure, is bits and pieces of that risk having been identified, parcelled and sent out, and we will have models to do that and we will build up our confidence like that. That’s the history of the cat and ILS market, we built up our confidence.

“It took a decade or more to get to that point and I think that’s what we will see in those other markets. For terrorism or cyber risk, maybe we are halfway through that decade of building up confidence.”

Watch this full keynote from our virtual ILS conference on-demand here.

As well as the on-demand playback, we will be archiving every session from our online and virtual ILS Asia 2020 conference over on our YouTube Channel in the coming weeks.

Our Headline Sponsor:

|

Our Gold Sponsor:

|

Our Webinar Sponsors:

|

|

|

Our Associate Sponsor:

|

For all enquiries regarding sponsorship opportunities for future Artemis conferences please contact [email protected].

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.