A newly launched equity index of Lloyd’s specialty insurance and reinsurance players provides a proxy for their performance and offers a glimpse of something that perhaps in future could become tradable to help investors track market returns.

Insurance Capital Markets Research (ICMR), a specialist analytics and consulting firm focused on insurance and reinsurance, has announced the launch of its equity index named the ICMR (Re)Insurance Specialty Equity Index, which can be found under the ticker symbols ‘RISX’ and ‘RISXNTR’ for a total return version.

The RISX Index is being calculated and administered by Moorgate Benchmarks, a company focused on provision of financial metrics and indices.

The RISX is focused exclusively on publicly listed global insurance and reinsurance companies that control syndicates at Lloyd’s and targets provision of an equity benchmark better suited to specialty insurance and reinsurance underwriting than other, more generalist insurance equity indices.

Ultimately, with the RISX Index, ICMR hopes that investment products targeting the specialty insurance and reinsurance market can be created, which could present an interesting opportunity for allocators looking to track global re/insurance returns.

Quentin Moore, co-founder of ICMR, commented, “We are extremely excited to launch the RISX Index, given the difficulty investors have traditionally encountered in benchmarking specialty insurance risk investment. We are delighted to be working with Moorgate Benchmarks as our regulated benchmark administrator and index partner. Their experience and regulated status allow all stakeholders to have full confidence in both the calculation quality and the governance of the index, as well as to develop investment products.”

Markus Gesmann, co-founder of ICMR, added, “This index is a first in our industry, opening up the potential for new research in relation to more liquid Lloyd’s-related investments, as well as providing alternative metrics to measure and benchmark performance. I would like to thank the team at Moorgate Benchmarks, who have been instrumental in bringing our idea to market.”

Gareth Parker, chairman and chief indexing officer of Moorgate Benchmarks, also said, “We are delighted to be the administrator of ICMR’s innovative index. ICMR’s insurance markets expertise and our index design input has resulted in a hugely interesting, important and tradable proxy for returns made from specialty (re)insurance business.”

The RISX Index could get particularly interesting were an exchange traded fund (ETF) to be launched to track the Index performance, so providing investors with a very simple way to proxy the performance of the Lloyd’s specialty insurance and reinsurance market’s returns.

While this wouldn’t be akin to an insurance-linked securities (ILS) investment, in that you’re also tracking correlated performance factors, ICMR is weighting the RISX Index using a transparent algorithm based on reported premiums written.

The company explained that, “It measures these companies’ aggregate equity performance, weighted by their premiums written both at Lloyd’s and globally, not their market capitalisation.”

That helps to give the Index a more appropriate mix of underlying risk than a traditional market capitalisation weighting, ICMR believes, while ensuring sufficient liquidity in the underlying index components.

Because of this, ICMR believes the aggregated weighted underwriting return profile of the index has mimicked that of Lloyd’s.

So it’s a closer proxy for underwriting performance than any other Index, making its potential use as the underlying for investment products in future a very interesting prospect for investors seeking access to returns from insurance and reinsurance market performance.

ICMT said that its RISX Index, “Opens up the potential for new research in relation to more liquid Lloyd’s-related investments, as well as providing alternative metrics to measure and benchmark performance.”

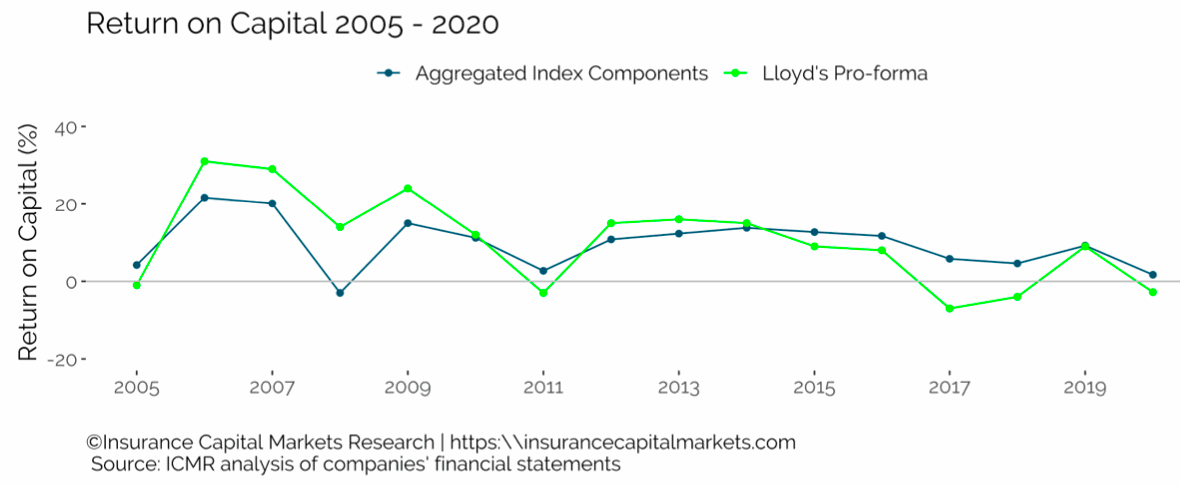

Of course, with this new Index offering a transparent view of Lloyd’s market performance and the broader specialty insurance and reinsurance space, it also shows that returns have been dwindling.

Looking at the return-on-capital of the aggregated ICMR RISX Index components, versus the Lloyd’s pro-forma return-on-capital, shows that returns are well-down over the last fifteen years, perhaps showing that underwriting returns are still in need of improvement.

.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.