Catastrophe risk modeller RMS has come out with a high estimate of insurance and potential reinsurance losses for recent hurricane Nicholas, pegging the range of industry loss as from $1.1 billion to as high as $2.2 billion.

It’s significantly higher than other estimates, such as Karen Clark & Company’s around $950 million, but RMS also includes losses to the National Flood Insurance Program in its figures.

It’s significantly higher than other estimates, such as Karen Clark & Company’s around $950 million, but RMS also includes losses to the National Flood Insurance Program in its figures.

RMS’ estimate includes insured losses from wind, storm surge, and precipitation-induced flooding, including losses to the National Flood Insurance Program (NFIP).

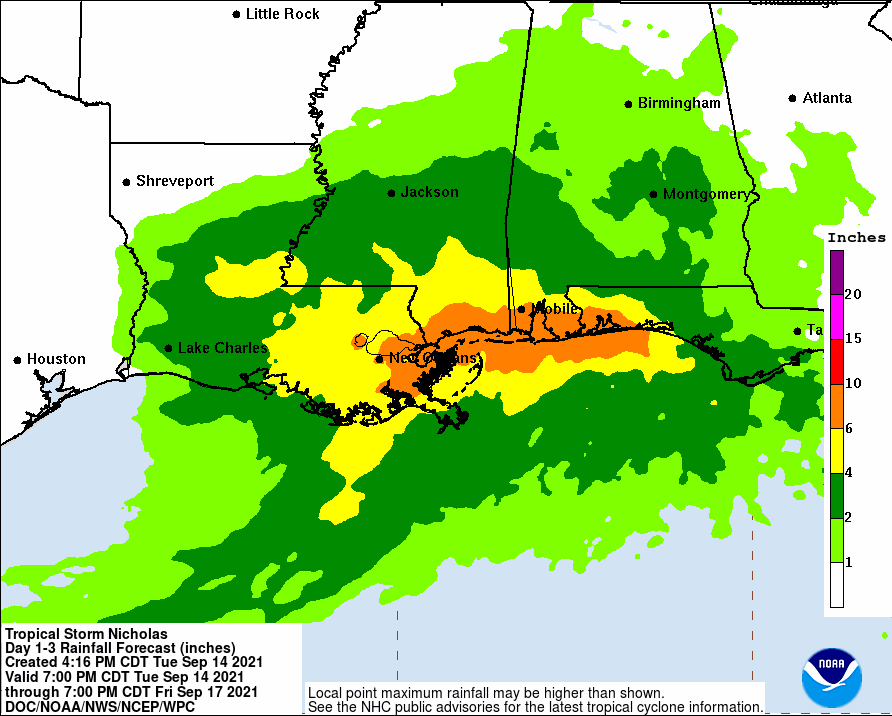

Hurricane Nicholas made landfall near Matagorda, Texas on September 14th as a minimal Category 1 hurricane but soaked the region and into Louisiana as well.

It affected areas still recovering from recent major hurricane Ida, as well as from 2020’s Laura and Delta.

RMS pegs the wind and storm surge related insured loss at between $700 million and $1.4 billion, which is the most comparable component to KCC’s estimate, so giving a mid-point of $1.05 billion.

To that, RMS adds between $200 million and $300 million of privately insured inland flood losses and from $200 million to $500 million of NFIP losses, to get its total range of $1.1 billion to as high as $2.2 billion.

“A notable impact from this event is the rainfalls, especially in Louisiana, where many towns and cities are still in the early stages of recovery after Hurricane Ida. RMS event response teams estimate roughly 40 percent of postal codes in Louisiana that were impacted by flooding in Nicholas were also impacted by flooding from Ida a few weeks earlier. We expect the overlapping nature of these two storms to further amplify losses, including the risk of rainfall infiltration, and to prolong the claims settlement process,” explained Jeff Waters, Senior Product Manager, RMS North Atlantic Hurricane Models.

RMS said that its losses reflect property damage and business interruption to residential, commercial, industrial, and automobile lines of business, and considers sources of post-event loss amplification (PLA).

The majority of wind and storm surge losses are expected in Texas, while the majority of the NFIP and insured flood losses are likely to come from Louisiana.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.