Hurricane Irma related insurance claims in Florida have increased further in the last week, rising around 8.5% to almost $5 billion, with almost 32% of claims now closed, according to the latest data from the Florida Office of Insurance Regulation.

Hurricane Irma approached Florida as an extremely powerful storm and the insurance and reinsurance industry had been expecting a major hit to property insurers. Claims totals have been rising steadily, but with 68% of claims still to settle the bill is set to keep rising.

Hurricane Irma approached Florida as an extremely powerful storm and the insurance and reinsurance industry had been expecting a major hit to property insurers. Claims totals have been rising steadily, but with 68% of claims still to settle the bill is set to keep rising.

The volume of claims being filed has risen again, with the Florida Office of Insurance Regulation reporting over 747,500 claims filed by 4.00pm local time on October 13th, with the total loss now estimated at just below $5 billion ($4.94 billion to be more precise).

At 4pm local time on the 18th September the reported insurance claims figure stood at 335,000 claims filed, with 4.5% of claims closed and a total estimated cost of $1.955 billion.

Then, as at 11.25am local time on the 21st September, the number of claims filed rose to almost 500,000, with 9.3% closed and an estimated insured cost of $3.076 billion.

By the 26th September the numbers had risen again to 605,500 claims filed, with 24.6% closed and a total loss estimated at just under $3.9 billion.

Then by the 6th October the loss total rose to almost $4.6 billion, with 704,000 claims filed, around 25% of claims closed and 14% having been paid out by insurers.

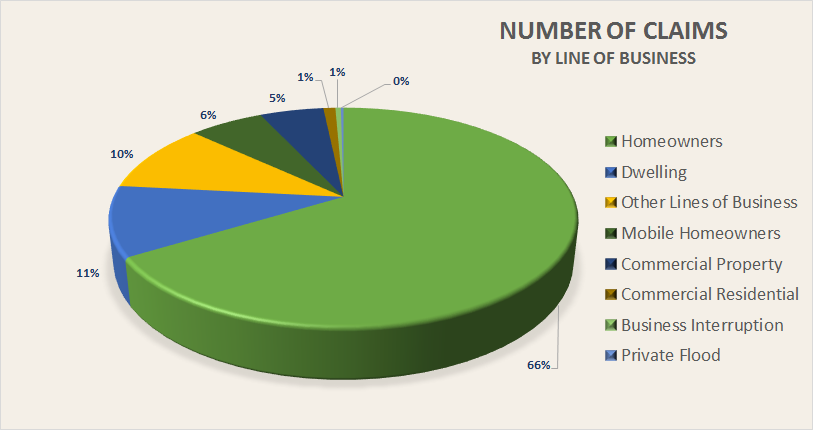

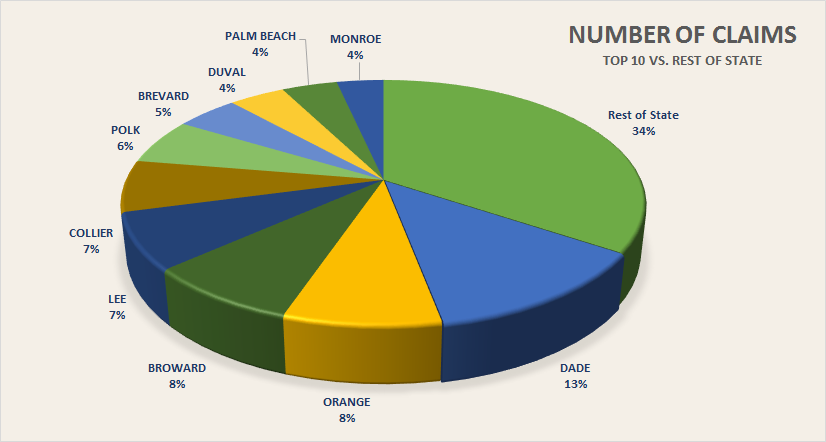

The Florida Office of Insurance Regulation has provided a breakdown of the claims tallied so far.

Almost 140,000 insurance claims have now been paid and closed, insurers responsible for these claims will in many cases have already received reinsurance monies to finance their clients recovery from hurricane Irma’s impact.

Residential property claims continue to make up the majority, at over 626,000 claims filed and are being closed at the fastest rate, with nearly 30% closed, compared to just 18% of commercial property claims.

Commercial residential claims are the slowest category to be closed down still, with just 8.5% closed to-date.

The number of claims remaining open has now fallen, as new claims are now coming in slower than insurers are closing them. There are still over 500,000 claims remaining open though, so there is likely to be a steady increase in the insurance and ultimately reinsurance total property loss as hurricane Irma claims continue to be dealt with.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.