Hurricane Ian remains a strong and dangerous Category 3 major hurricane with 120 mph sustained winds as it approaches Florida and already its effects are being felt, with storm surge flooding reported across the Lower Florida Keys and tropical storm force winds now hitting the state.

Update: Hurricane Ian intensified to 155 mph winds, at Category 4 status, this morning. Our thoughts below on industry loss potential remain valid.

The forecast path for major hurricane Ian has slipped south somewhat, with the latest data showing a landfall somewhere between Fort Myers and Sarasota, with Port Charlotte currently around the centre of NOAA’s forecast cone.

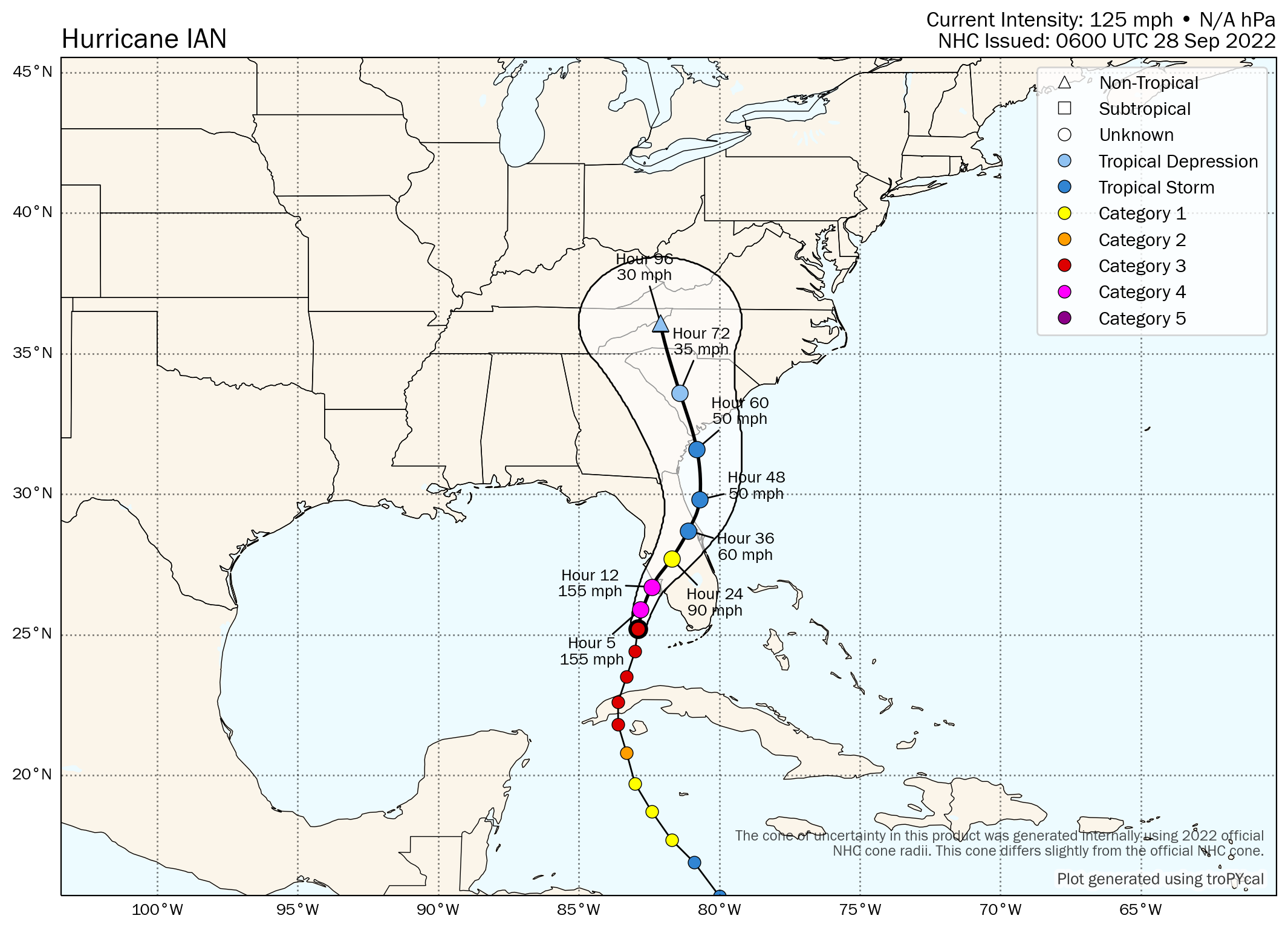

Here’s the latest forecast cone from the NHC:

Having undergone an eyewall replacement cycle since moving clear of Cuba, hurricane Ian is now growing in size, with hurricane force winds set to extend further out as the eye widens and the swathe of strongest winds also expands.

Cuba took a devastating hit from hurricane Ian, powerful enough to knock out the entire power grid on the island and with significant damages reported.

As ever though, all eyes for the insurance, reinsurance and insurance-linked securities (ILS) industry are on the United States and Florida, as reports come in from sources of industry loss estimates ranging up to $40 billion.

Tomer Burg’s latest forecast map for hurricane Ian, now shows a sustained wind speed of 155 mph up to landfall just to the north of Fort Myers area:

Here is the latest modelled intensity guidance from TropicalTidbits:

For reference, here also is the latest peak storm surge graphic from the NHC, which now shows a surge of up to 12 foot as possible and widely above 5 foot on the central west coast of Florida’s Peninsula.

Storm surge forecast values are still up to 12 feet, with the middle of Longboat Key to Bonita Beach set for the highest inundation of water as hurricane Ian approaches.

With storm surge flooding already underway in the Lower Florida Keys, it’s set to be a dangerous more than 24 hours for the Florida coastline across the western region, as storm surge will be pushed slowly higher as hurricane Ian nears.

Major hurricane Ian is forecast to slow down as it approaches the Florida Peninsula’s west central coastline, while the storm is also likely to continue to grow in size as well.

This sets the stage for a particularly impactful storm surge flooding event, with low lying property and marine exposures on the coast at particular risk.

Potentially concerning are forecasts for more strengthening too. Hurricane Ian’s minimum central pressure is now 953mb, according to NOAA’s NHC forecast, but some of the latest forecast model runs show the hurricane deepening further, to as low as 945mb before it makes landfall in Florida, potentially intensifying the winds and building an even higher than anticipated surge.

Meteorologists are suggesting that the recent eyewall replacement cycle could allow hurricane Ian to gain more strength, as it widens its wind field considerably as well, a potentially damaging combination and one that could exacerbate the eventual insurance and reinsurance market loss quantum.

On to that quantum, of which there is considerable discussion at this stage and it has to be said, still very high levels of uncertainty.

Given there remains a lot of uncertainty, the industry loss ranges we’ve seen remain relatively wide as well.

In general though, industry experts and sources are pointing to anything from a $10 billion to a $40 billion insurance industry loss from hurricane Ian. You can discount, for now, the unrealistic RDS Pinellas windstorm scenario from Lloyd’s that some have been sharing.

There are some estimates from modelled loss scenarios that are higher, of course, but we understand the range considered more realistic is sub-40, for now.

First, Broker BMS’s Senior Meteorologist Andrew Siffert said a $10 billion plus industry loss is almost assured.

There’s some scenario work that suggests an even higher figure. A number of sources point to the chance of Ian sustaining its wind speeds longer than anticipated and causing more damage in Orlando and surrounds, others to the chance Ian emerges into the Atlantic after crossing Florida and regains hurricane strength before making a second landfall on the southeast coast.

Some models show wind gusts of 120 mph plus widely around the landfall and coastal regions, but hurricane Ian could still have wind gusts to 90 mph around Orlando and through to an exit to the Atlantic near Daytona Beach, creating a much wider and more significant damage footprint.

Those scenarios are outliers though, it seems, with our most reliable sources pointing to an industry loss in a range from $15 billion to $30 billion, perhaps a bit higher.

Karen Clark & Company (KCC), the catastrophe risk modelling firm, sent its clients two modelled loss estimates yesterday.

One showed hurricane Ian making landfall near Longboat Key and causing $30 billion of insured loss from wind, with another $2.5 billion from flooding as it tracked inland towards the northeast.

Another KCC modelled industry loss scenario suggests that a landfall further south, around Venice, suggested a $17 billion insured loss from hurricane Ian’s wind damage and $2 billion from flooding.

The latest forecast path for hurricane Ian is now south of both of these points and we understand this could lead to higher estimates if Fort Myers area is thought likely to get a more direct hit from the strongest winds on the eastern side of the storm.

All of which is to say, that many in the insurance, reinsurance and insurance-linked securities (ILS) market are working off an assumption that the industry is facing a loss in the $10 billion to $40 billion range, while some are narrowing that to $15 billion to $32 billion, it seems at this time.

With hurricane Ian potentially set to strengthen further and also grow, potentially also wobbling its forecast path north or south a little, industry loss estimates could find themselves out of date quite quickly through today, so looking at a range is a much better solution with this storm it seems.

What impact for the ILS marketplace and catastrophe bonds though?

As ever, it’s very hard to say, but our sources and experience suggests that any industry loss event above $10 billion will cause some impact to certain ILS positions, largely private and collateralized reinsurance or retrocession, while quota shares will of course share some of the financial burden.

So it very much depends on the portfolio strategy and mix here, with those ILS funds writing largely higher layer excess-of-loss reinsurance perhaps the ones that will take the smallest level of losses from a storm like hurricane Ian.

Overall, hurricane Ian will cause a significant loss for the reinsurance market, as well as primary insurers it seems (more on the exposed primary insurers from our sister site Reinsurance News here).

Impacts to private ILS positions, collateralized reinsurance and some retrocession arrangements are highly likely, with the extent of losses commensurate with the overall industry-wide impact, as well as the portfolio mix of particular ILS strategies.

As we said, some more remote-risk ILS fund strategies may fare much better, especially those that have spent a considerable time re-underwriting and re-negotiating their terms over recent renewals. Hurricane Ian could be a good test of manger discipline and diligence in some quarters of the ILS fund market.

Quota shares and sidecars could be tapped in some cases too, so those managers investing in the proportional side of reinsurance could see positions negatively affected.

On catastrophe bonds it is far harder to say. There are some low-layer cat bonds at-risk and exposed, we’ve already heard of some price movements, in bidding that’s occurred. There are also the FloodSmart Re cat bonds to consider exposed, as well as numerous aggregate and nationwide multi-peril deals as well.

But whether any cat bonds will default is likely to depend on the magnitude or quantum of the industry loss, which as you get towards the higher-end of ranges being discussed, around $25 billion and more, you begin to see more chance of some principal losses, albeit very dependent on the actual landfall location and loss scenario that plays out.

It would be remiss not to mention inflation and also the challenges in Florida with litigation, both of which mean the industry loss from hurricane Ian may not be that comparable to the modelled events anyway. So there is room for a downside surprise with hurricane Ian, in terms of the loss being higher than anticipated, even though the scenario suggested something a little lower. This is an issue to watch out for over the coming weeks and months as more clarity of the damages and insured losses emerge.

Track the 2022 Atlantic tropical storm and hurricane season on our dedicated page and we’ll update you as new information emerges.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.