Specialist catastrophe bond, insurance-linked securities (ILS) and reinsurance investment manager Twelve Capital has said that hurricane Henri, which is heading for the US northeast states, is not expected to cause a significant impact to its ILS funds.

It’s important to note that Twelve Capital’s update comes from earlier today (Saturday), prior to Henri strengthening into a hurricane.

It’s important to note that Twelve Capital’s update comes from earlier today (Saturday), prior to Henri strengthening into a hurricane.

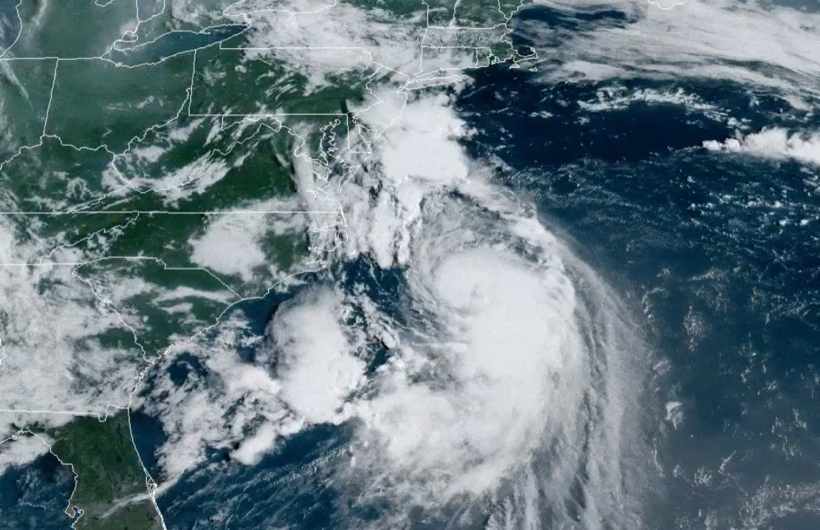

Hurricane Henri is heading north and expected to make landfall on Sunday in New York or New England.

In its update, earlier today (Saturday), ILS fund manager Twelve Capital said that Henri remained a bit of an unknown, but that it was expected to reach hurricane strength today, according to the models.

That has now happened and Henri could intensify further while it moves north over the warm Gulf Stream waters, which are plenty warm enough for strengthening to occur.

However, the models still suggest Henri isn’t going to intensify too much further, Category 1 seems about the most severe landfall scenario right now.

While many models suggest Henri will encounter cooler waters as it nears the coast and could weaken back to a tropical storm before it makes landfall.

However, Twelve Capital wisely cautions that the region hurricane Henri is heading for is highly populated and has significant insured values at risk.

“Given that this area is in parts densely populated, this storm has the potential to cause several billions of insured losses,” Twelve Capital said in its update from earlier today.

But also stated that, “At the same time, unless there is an unfortunate turn of events with this system strengthening more than expected, Twelve Capital does not expect any significant impact on its ILS funds other than attachment erosion for some indemnity transactions.”

We suspect that refers to aggregate indemnity collateralized reinsurance or ILS deals, some of which in the market have already seen deductible erosion this year.

If the insurance industry loss is in the billions, as does seem possible is Henri can intensify and maintain strength (albeit certainly not guaranteed), then reinsurance capital losses are to be expected.

How large the overall loss from Henri is will define how much of it could fall to reinsurance capital though. So Henri’s landfall strength in terms of wind speeds, storm surge heights, rainfall totals and ultimately the locations worst affected by all of these factors, will drive the eventual loss quantum.

So, there is still a lot of uncertainty and as a result the potential for insurance, reinsurance and insurance-linked securities (ILS) fund impacts to rise. Or for them to be relatively minor overall.

It does seem at this time that Henri will not strengthen considerably or become a major hurricane, while water (rain/surge) could be the biggest drivers of loss costs. Which may moderate how much of hurricane Henri’s eventual losses fall to insurance, reinsurance or ILS capital.

Insurance, reinsurance and ILS market interests can keep track of this activity over on our 2021 Atlantic hurricane season page and we’ll update you should a more significant threat develop.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.