Analysts tracking the property casualty insurance and reinsurance industry believe that hurricane Harvey could cause as much as $20 billion (at the top end of estimates) of industry losses, but with flood expected to be the major driver over the wind and surge exposure.

As we wrote earlier today, risk modelling firm AIR Worldwide has pegged the wind and storm surge industry loss from hurricane Harvey at up to $2.3 billion, relatively low for a Category 4 storm landfall reflecting the less populous areas that bore the brunt of the winds impacts.

As we wrote earlier today, risk modelling firm AIR Worldwide has pegged the wind and storm surge industry loss from hurricane Harvey at up to $2.3 billion, relatively low for a Category 4 storm landfall reflecting the less populous areas that bore the brunt of the winds impacts.

But equity research analysts are expecting the overall hit to insurance and reinsurance interests to be significant, with hurricane Harvey expected to be at least a top-ten hurricane loss and perhaps even a top-five.

Analysts at J.P. Morgan Cazenove suggest that hurricane Harvey could be a $10 billion to $20 billion loss for the insurance and reinsurance industry.

“At this stage, it remains early to provide reliable loss estimates, but something in the $10bn-20bn range appears likely, and could easily be exceeded given the extent of flood damage,” the analysts explained.

Part of this $20 billion (or greater) estimate may include some NFIP related exposures and this does seem a little on the high-side. However, taking into account all commercial property exposures at risk of flooding and private market covered, as well as the wind and surge damage, plus Gulf of Mexico energy asset business interruption and other related lines, the $10 billion lower end estimate of the private re/insurance market loss seems easily achievable.

J.P. Morgan Cazenove’s analysts see “a potential net of loss of ~27% of net income at the upper end or around 2% of Solvency II own funds” for the major European reinsurance firms, before allowing for the remaining catastrophe budgets.

Once again, the relatively benign catastrophe loss activity of recent years could help reinsurers to pay for this event, given they have not fully utilised their first-half 2017 allowances. Of course this could diminish their ability to provide capital returns to shareholders though.

The analysts from J.P. Morgan believe that commercial property could be the major driver of private market losses.

“Wind damage is expected to be in the low-single-digit billions, however it appears likely that the majority of economic and insurance losses will stem from flooding. While homeowners’ insurance is not generally covered for flooding (it is separately covered by the US government), it is covered under commercial policies and we believe could result in significant losses for insurers and reinsurers,” they wrote.

Continuing; “In our view, should Harvey develop into an industry loss of $20bn-30bn+ then questions could start to be raised about capital return plans for the European Reinsurers for 2017. We see no risk to ordinary dividends given the extremely strong capital positions in the sector, however a large industry loss, where it could potentially take time to establish the full extent of the exposure, could result in additional capital return plans being placed on hold.”

But the analysts say that no matter the loss size, hurricane Harvey is not expected to be big enough to significantly move reinsurance pricing.

“While we do not believe that Harvey is a significant enough event to meaningfully change the supply/demand imbalance in the reinsurance industry, in our view it may add further credibility to the argument that pricing is nearing a bottom,” they explain. “We believe that one reason that pricing has continued falling is that reinsurers have been persistently over-earning due to below average losses – if this dynamic changes for a year, we believe it will prove helpful to the reinsurers for pricing negotiations.”

Meanwhile, Deutsche Bank analysts are also erring towards a larger industry loss, with hurricane Harvey at least a top-ten hurricane of all time, once all lines and commercial flood exposures are taken into account.

“Taken into account that the flood cost are insured via the NFIP, Hurricane Harvey should make it into the top10 list (Irene, 2011, total losses of USD15bn, of which USD7bn insured), if not even into the top 5 (Wilma, 2005, total losses of USD22bn, of which insured USD12.5bn),” the DB analysts explained.

They expect the big four reinsurers to take the largest share of losses, “Based on a 200year event, we see Munich Re (EUR4.6bn) and Swiss Re (USD5.0bn) having the highest exposures toward US hurricane risk, followed by Hannover (EUR1.2bn) and Scor (EUR0.8bn). Historically for all events since 2008, Munich Re saw the highest market share (based on insured losses) in US hurricane losses and unsurprisingly Scor the lowest.”

Deutsche Bank’s analysts expect Harvey to be an earnings event rather than a capital hit, as all reinsurers have left over catastrophe budgets to use up which should minimise the hit to their capital bases.

Keefe, Bruyette & Woods (KBW) analysts see the industry impact as being greater than the initial estimates.

“We expect insured losses to exceed initial low-single-digit billion dollar estimates that emerged on Friday, with flooding likely driving significant Personal and Commercial Auto and Commercial Property losses,” KBW said in an update, adding that homeowners losses would be less severe as most exclude flooding.

On the reinsurance exposure KBW said; “Reinsurers and specialty carriers will also likely face some exposure, particularly from regional cedents with lower reinsurance attachment points, and energy (re)insurers, who should face significant business interruption and related losses following Houston’s flooding.

“We expect almost all of the hybrid specialty insurer/reinsurers under our coverage to have meaningful Harvey-related losses, reflecting both assumed quota share reinsurance and (re)insurance written on Houston-based energy businesses, including both actual property damage and business interruption losses.”

Peel Hunt, in a commentary on Lloyd’s of London market re/insurers, said that it expects up to $12 billion of private insurance and reinsurance market loss from hurricane Harvey.

“Based on precedent, we roughly estimate insured losses between $4bn and $12bn, excluding the personal homeowners flood claims to accrue to the NFIP,” the analysts wrote.

But added that this loss won’t be sufficient to move the market, saying; “This is unlikely to be a market turning event but enough to start to eat into the Cat budgets and expose the vulnerable underlying returns the Lloyd’s insurers are generating in the current soft market, with risk adjusted returns between 10%-11%.”

“The Lloyd’s Insurers will have loss exposure predominantly across Property D&F, Energy and Reinsurance classes weighted towards commercial risks rather than personal lines,” the analysts continued, breaking the potential loss down as follows, “We roughly estimate insured losses between $4.0bn and $12bn of which Wind up to $5bn, Energy up to $2.0bn, Commercial Property up to $3.5bn, $1bn personal property (NFIP reinsurance program) and Business Interruption a token $900m (this is impossible to estimate at this stage).”

However, the analysts from Peel Hunt note significant uncertainty, since “The main uncertainty is around commercial property & business interruption claims, particularly now the Houston metropolitan area is being affected by floods.”

Peel Hunt analysts also warned that Harvey could erode some of the reinsurers buffer against financial impact, explaining; “A further series of smaller to medium sized events (in what could prove to be an active hurricane season according to the NOAA) could force carriers with slim margins into a loss, triggering further cutbacks and perhaps a stabilisation of the cycle over time.”

Analysts at Morgan Stanley said that it expects global reinsurance firms will be affected by hurricane Harvey, with losses possible from both commercial and personal lines, although residential flood damage will be mostly uninsured or fall to the NFIP.

However they do not expect hurricane Harvey will turn property catastrophe reinsurance pricing, saying; “While it is too early to gauge ultimate losses, the industry’s balance sheet is strong, with plenty of excess capital and an influx of alternative capital.”

In fact the consensus seems to be that hurricane Harvey will provide more ammunition to help reinsurers stem the decline in pricing, but not be enough to help them increasing pricing significantly.

Morgan Stanley’s analysts said; “We think Harvey could help stabilize global reinsurance pricing, but do not expect a major turn in pricing to follow.”

Finally, for this piece on Harvey, Chuck Watson, a risk modelling expert with Enki Research, told Bloomberg on Monday that the total cost of Harvey could easily reach $30 billion, when taking into account the impact of flooding on the labor force, power grid, transportation and other elements that support the Texas region’s energy sector.

It remains very early to have an accurate handle on hurricane Harvey’s impact on insurance and reinsurance interests, but it is going to be significant, although not significant enough to turn the market it appears.

Also read:

– Cat bond funds don’t expect Harvey loss, private ILS more exposed.

– AIR puts Harvey wind & surge insured loss at up to $2.3bn

– Cat bond market drops on Harvey, close shave for Fonden 2017 deal?

– Live cat trades completed on hurricane Harvey threat.

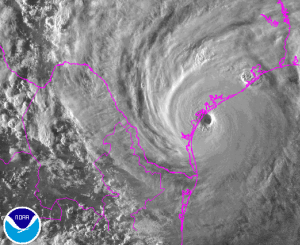

– Harvey makes landfall as Category 4 hurricane, 130mph winds.

– Half of hurricane Harvey loss could fall to reinsurance: J.P. Morgan.

– Hurricane Harvey – catastrophe bond exposure.

– As Harvey nears Texas, analysts highlight re/insurers risk of losses.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.