Hannover Re faced more challenging market conditions when placing the renewal of its retrocession program at 1/1, resulting in a shrinking of protection, with its capital markets backed K-Cessions quota share sidecar facility declining 26% to around $450 million.

Almost all of Hannover Re’s core retrocession protections are smaller for 2022, the reinsurer revealed this morning, with the exception of a very slight increase in the catastrophe swaps that are a regular feature in the retro program.

It’s the second year in a row that Hannover Re has shrunk its capital markets-backed K-Cessions quota share retro reinsurance sidecar facility.

Two years ago, Hannover Re renewed its K-Cessions quota share sidecar at $680 million for 2020, which was the largest K-Cessions placement ever seen from the company.

But at the January 2021 renewals, Hannover Re shrank the K-Cessions sidecar by roughly 10%, to $610 million for 2021.

Alongside the shrinking of the retro sidecar for 2021, Hannover Re had slightly expanded its aggregate and whole account excess of loss retrocession protections.

But this year, for its protection across the 2022 underwriting year, the three core components of Hannover Re’s retrocession have all shrunk, with K-Cessions declining 26% year-on-year at $450 million, while some of its other retro covers shrank even more.

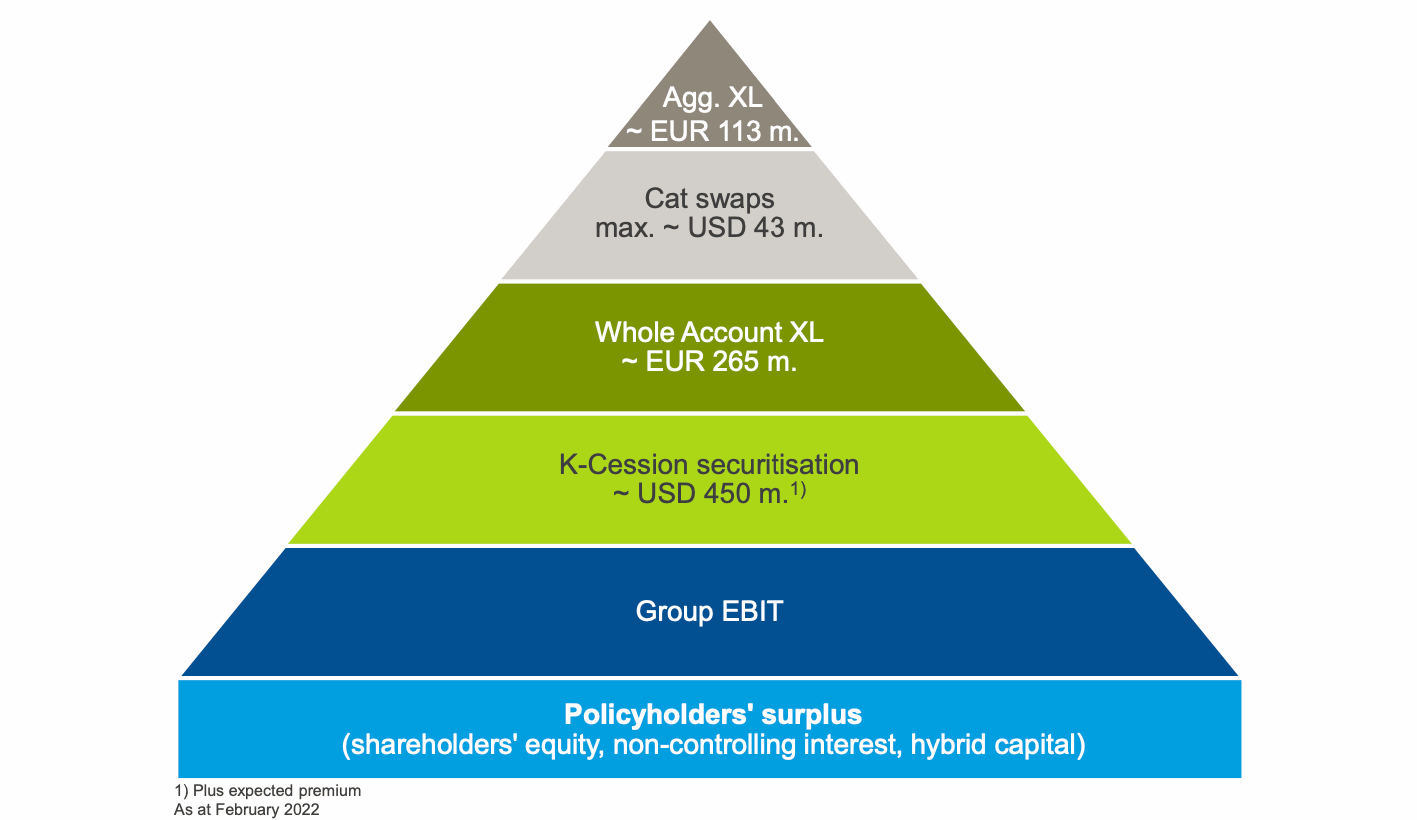

Hannover Re’s retrocessional reinsurance arrangements for 2022 can be seen in the diagram below:

K-Cessions is an important retro structure for Hannover Re, allowing it to partner with institutional and insurance-linked securities (ILS) capital investors within its retrocession program, sharing its underwriting profits and losses, leading the company to call the sidecar structure the backbone of its retro arrangements.

Appetite for quota share sidecars has reduced over the last few years, after consecutive years of heavy catastrophe losses.

In particular, ILS fund manager support for these structures has waned somewhat, especially as for many ILS managers it is more attractive to source the original business, than to be on another reinsurers’ retro program.

Alongside K-Cessions, Hannover Re’s core retro protections include its large loss aggregate excess-of-loss worldwide retro reinsurance arrangement, a number of catastrophe swaps and a whole account excess of loss retrocession cover.

For 2022, the large loss aggregate excess-of-loss worldwide retro reinsurance cover has shrunk to EUR 113 million, which is roughly half the EUR 225 million this layer had been renewed at for 2021.

A year ago, Hannover Re’s whole account excess of loss retrocession cover had been renewed at EUR 337 million for 2021, but for this calendar year, 2022, the whole account XoL retro layer has been renewed at EUR 265 million, so down 21% year-on-year.

The only piece of the retro tower that has grown for 2022 is the catastrophe swaps, which are sized at $43 million for 2022, up from $41 million for 2021.

It’s not surprising that the aggregate retro layer shrank so significantly, given the shortage of collateralised capacity for aggregate retro covers, as well as the reduced appetite for frequency exposure.

The capital markets and ILS funds or investors have played a role across the retro program for Hannover Re historically, as we’ve detailed previously here.

For 2022, we suspect that reduced capital markets involvement was a big source of the reduction in available retro limit that Hannover Re has been able to secure.

The company said that there was “reduced but sufficient retro capacity” for its needs, explaining that after this renewal its net risk appetite is still “geared to the desired level with one of the largest retrocession programmes in the market.”

Commenting on the retrocession renewal this morning, Sven Althoff, Hannover Re’s Member of the Executive Board for Property & Casualty, explained, “”The renewal of our retrocessional program was a little more challenging compared to previous years.

“So in the end, we decided to buy a little less limit, when it comes to retrocession and therefore increasing our potential net loss position, on natural catastrophes in particular.”

Althoff said that the reduction in available retro limit and challenging retro market is one of the drivers of Hannover Re’s increase to its major loss budget for 2022, which we explained earlier here.

Given the challenging retro market conditions have affected a major global player like Hannover Re in this way, as evidenced by the reduction in limit secured, it’s almost certain others are going into 2022 with proportionally even less retrocession.

Hannover Re is large and diversified enough to reduce its retro when pricing is unattractive, while the company is also able to retain more risk net if it chooses.

There are other players in the market which do not have such a luxury, given their smaller footprints and less diverse portfolios, for who a reduction in retrocession can mean having to write less inwards business as a result.

Hannover Re, meanwhile, grew its natural catastrophe portfolio by some 25% at the renewals, even though its retro tower was smaller, showing that for a major global reinsurer retrocession is not as critical as it can be for smaller competitors.

That aside though, the importance of the retro program for Hannover Re should not be understated and analysts at investment bank Berenberg recently said that the comprehensive retrocession program has given investors confidence and helped to buoy Hannover Re’s share price through 2021.

Now, Hannover Re has written significantly more natural catastrophe risk, but is also likely to retain a lot more of any major losses, so it will be interesting to see whether that confidence persists, should we see another year of high catastrophe loss activity in 2022.

Finally, Hannover Re does also have a new worldwide aggregate catastrophe bond, the $100 million 3264 Re Ltd. (Series 2022-1) cat bond that it sponsored in December. We believe this could be additional to the retro tower detailed above, although it is also possible this cat bond cover cascades through to the benefit of one of its clients.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.