The Insurance Council of Australia has said that its estimate for the insurance and reinsurance market loss from the hailstorm event on October 31st 2020 that struck south-east Queensland is A$805 million.

That’s far lower than the A$1.3 billion estimate announced by PERILS AG, which is based on insured property and motor market loss data collected from insurers operating in Australia.

That’s far lower than the A$1.3 billion estimate announced by PERILS AG, which is based on insured property and motor market loss data collected from insurers operating in Australia.

The Insurance Council has said that the hail storm has driven some 33,500 claims to date according to insurers, driving losses estimated at $805 million.

Over 90 per cent of claims are from householders, the Insurance Council said. So it seems the difference in these estimates cannot be down to motor claims alone.

The hailstorm was originally designated as the first catastrophe to strike Australia of the 2020-21 season by the Insurance Council of Australia (ICA), with an expectation that it could drive a relatively significant loss to insurers and likely erode some reinsurance aggregates.

PERILS had first estimated the potential insurance and reinsurance market industry loss at A$1.231 billion, for the hailstorm event also known as the “South East Queensland Halloween Hailstorms” before then lifting that estimate by 6% to A$1.3 billion.

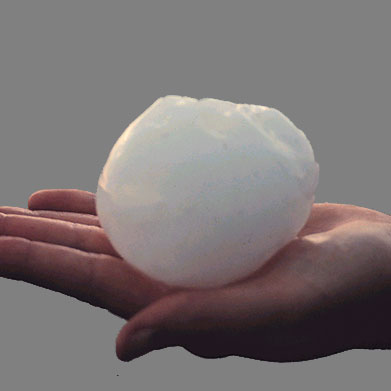

The hail event occurred after a string of severe thunderstorms developed over South East Queensland during the afternoon of October 31st. The result was large hail as big as 14 cm in diameter in some suburbs.

Severe thunderstorms struck much of South East Queensland that day, including the surrounding areas of Brisbane, the Gold Coast and the Sunshine Coast. But a narrow corridor of storms, from Amberley through to the northern suburbs of Logan near Brisbane, was the area hardest hit by the hail event.

Giant hail was also recorded in the Gympie area, with stones up to 7cm in diameter reported. In addition to hail, damaging winds were also experienced between Redcliffe through to Kingston near Brisbane, with gusts over 110 km/h recorded around Moreton Bay region.

It’s possible the Insurance Council’s definition of this loss is much narrower, perhaps only focusing on the hail, where as PERILS may include some of the related storm and severe weather losses in its estimate.

As we explained last December, a number of insurance-linked securities (ILS) funds invested into collateralised reinsurance positions that are exposed to catastrophe events in Australia, reported negative performance for November on the back of reserving for hail storms and severe weather events, which we believe included the impacts of this storm event.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.