The results of our latest global reinsurance market survey, in collaboration with Reinsurance News, suggest that the use of insurance-linked securities (ILS) capacity is likely to rise again at the January 1st, 2022 renewals.

We reached out to our readership community again in the last few weeks to get a sense for how the sector is feeling ahead of the upcoming reinsurance renewals.

We reached out to our readership community again in the last few weeks to get a sense for how the sector is feeling ahead of the upcoming reinsurance renewals.

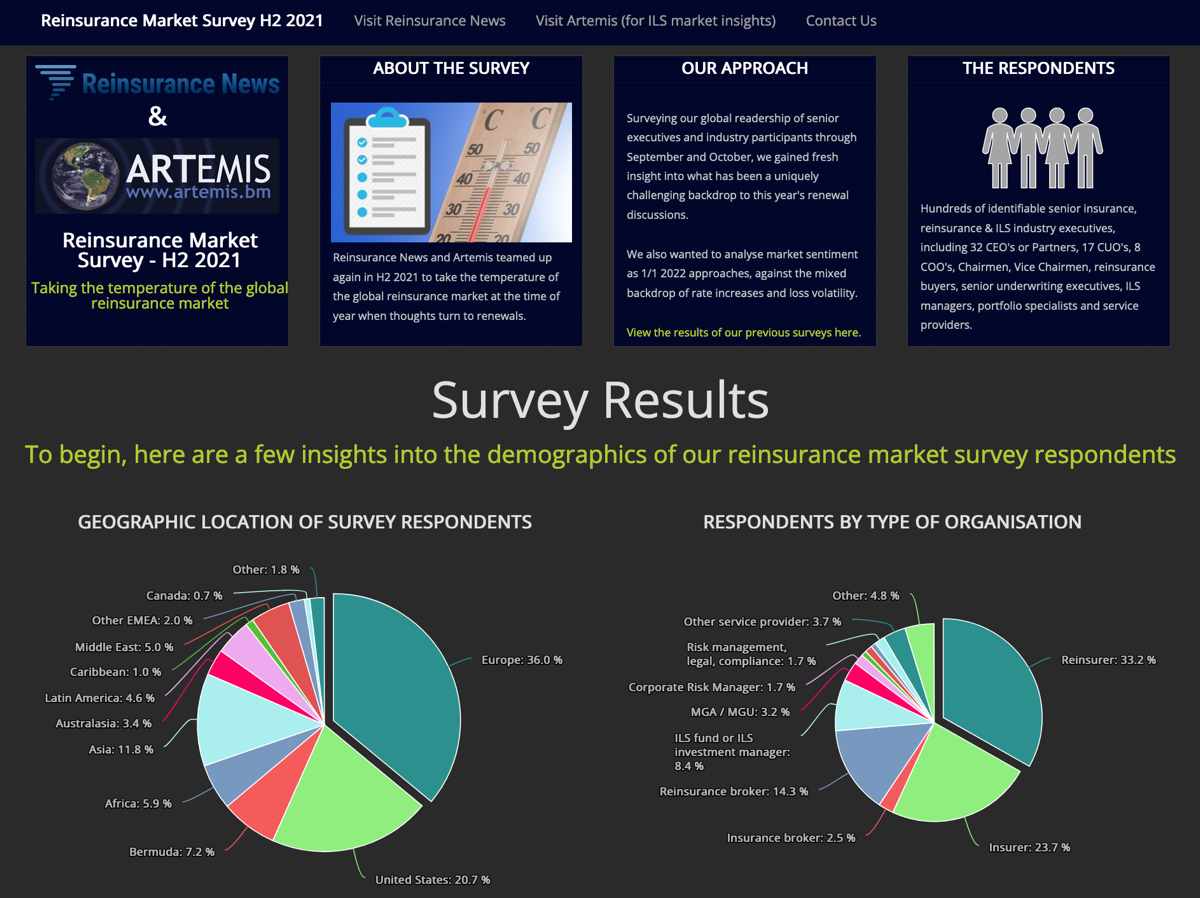

Our H2 2021 reinsurance market survey is based on responses from hundreds of identifiable market participants, of which over 70% make or provide input into reinsurance buying decisions.

The full results are available online for free and you can analyse the data from responses here.

Elevated natural catastrophe losses from both primary and secondary perils, coupled with the impacts of the COVID-19 pandemic, have seen reinsurers experience greater demand for their services throughout 2021. And according to the survey, this trend is expected to continue.

Almost 84% of respondents expect to purchase about the same or a little more traditional reinsurance protection at Jan 1st, while roughly 9% expect to procure significantly more.

Less than 8% of respondents anticipate purchasing a little / significantly less reinsurance at the renewals.

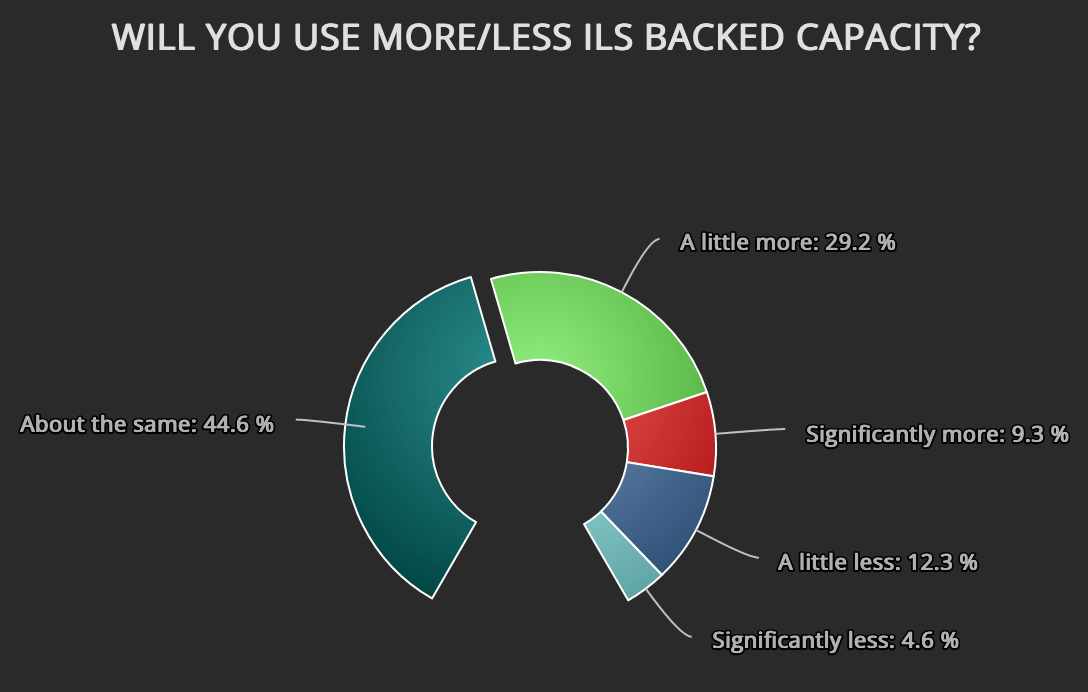

The results also show that the use of ILS, or alternative reinsurance capital is likely to rise as well, with approximately 74% of respondents expecting to use about the same or a little more ILS-backed capacity at 1/1.

More than 9% of respondents intend to use significantly more ILS, while 12% expect to use a little less, and just 5% expect to leverage significantly less third-party capital.

We also asked survey participants how they see ILS’ influence playing out over the coming years.

More than a third of respondents expect ILS to account for 20% of global reinsurance capital by 2025, while roughly a fifth envision ILS contributing 25% of dedicated reinsurance capital.

Just 3% of respondents expect ILS to account for more than 30% of reinsurance capital by 2025, while just shy of 44% expect ILS’ contribution to decline to 15% or less in the period.

The compounding effect of recent losses and the lower for longer interest rate environment has supported a continuation of underwriting discipline as reinsurers look to maintain and intensify market firming.

And as our survey shows, there’s an expectation of further rate momentum in loss-affected lines at 1/1, including in U.S., Europe, and retrocession property catastrophe business, as well as cyber, professional lines and political risks.

Looking forwards, respondents were split on how positive the outlook is for the sector with climate change, cyber risks, and rising losses from secondary perils seen as the greatest challenges to profitability over the next five years.

The data also reveals that market players are eager to prioritise technology, diversification, and the fostering of talent and acquiring expertise as we head into 2022.

The full results of our second global reinsurance market survey provide a useful test of the temperature of the industry, offering insight on market sentiment and expectations as we move towards the January 2022 reinsurance renewal season.

We hope our readers and other interested parties find the results enlightening and useful in making their strategic decisions for the renewal season ahead.

The full results of our latest survey are freely available from today and we’re happy to discuss them with any industry participants. We’re interested to hear your thoughts.

We’ll also be analysing the full reinsurance market survey results over the coming weeks on both Reinsurance News and Artemis.

Analyse the results of our global reinsurance market survey here.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.