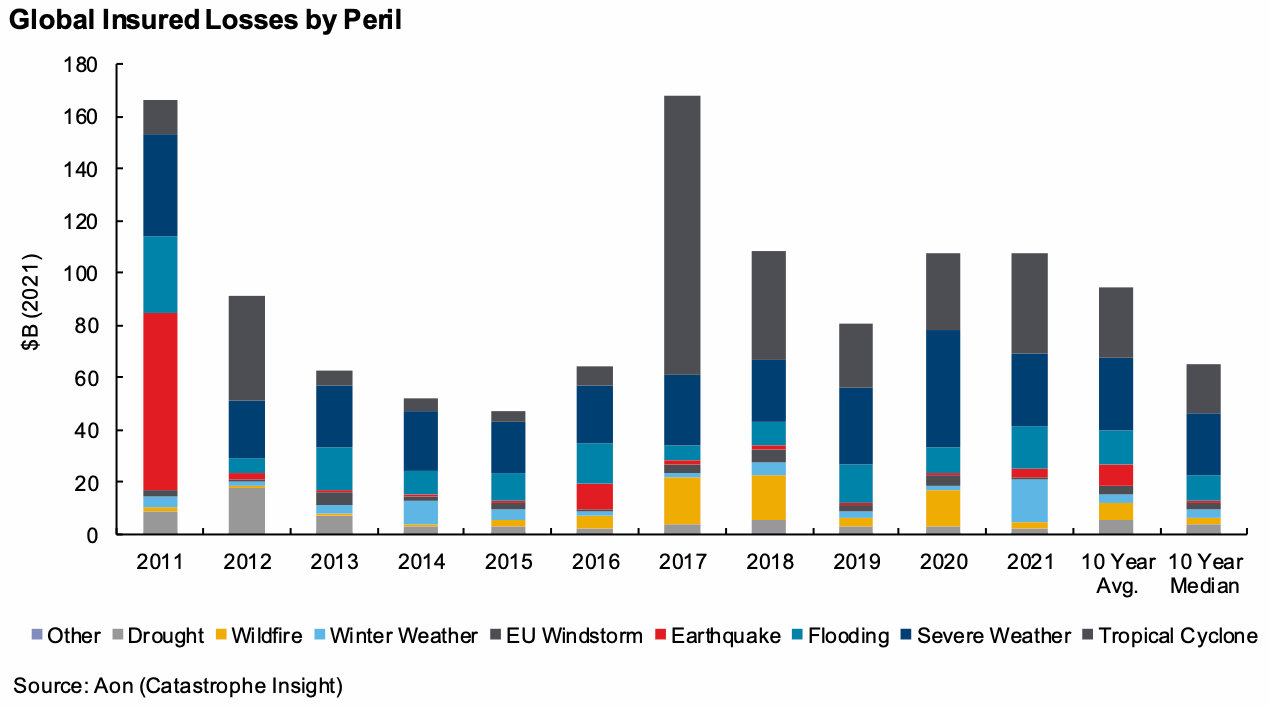

Insurance and reinsurance broker Aon estimates that as of early fourth-quarter 2021, global insured losses from natural disasters and severe weather are running around 13% above the annual decadal average, having reached roughly $107 billion.

Conversely, the number of events recorded remains below average for 2021 tear-to-date (YTD), but the financial loss from these natural catastrophes and severe weather outbreaks has been particularly costly, the broker explained.

The $107 billion global natural disaster insured loss figure includes impacts to both private insurance and reinsurance markets, as well as public insurance entities.

2021 is already running well-ahead of the annual average, with the The $107 billion figure already 13% higher than the recent decadal average ($95 billion) and 26% above the decadal median ($86 billion), by Aon’s reckoning.

Third-quarter events have lifted insured payouts dramatically, after the estimate for hurricane Ida is now seen as exceeding $30 billion by Aon, while the European flooding is estimated as a $12 billion industry loss.

This comes on top of the $15 billion estimate for the United States winter weather and storm Uri in February.

As of early Q4 2021, there have now been 15 individual billion-dollar insured natural disaster loss events this year.

Nine out of the 15 occurred in the United States, with the rest in Europe (3), APAC (2) and the Americas (1), Aon said.

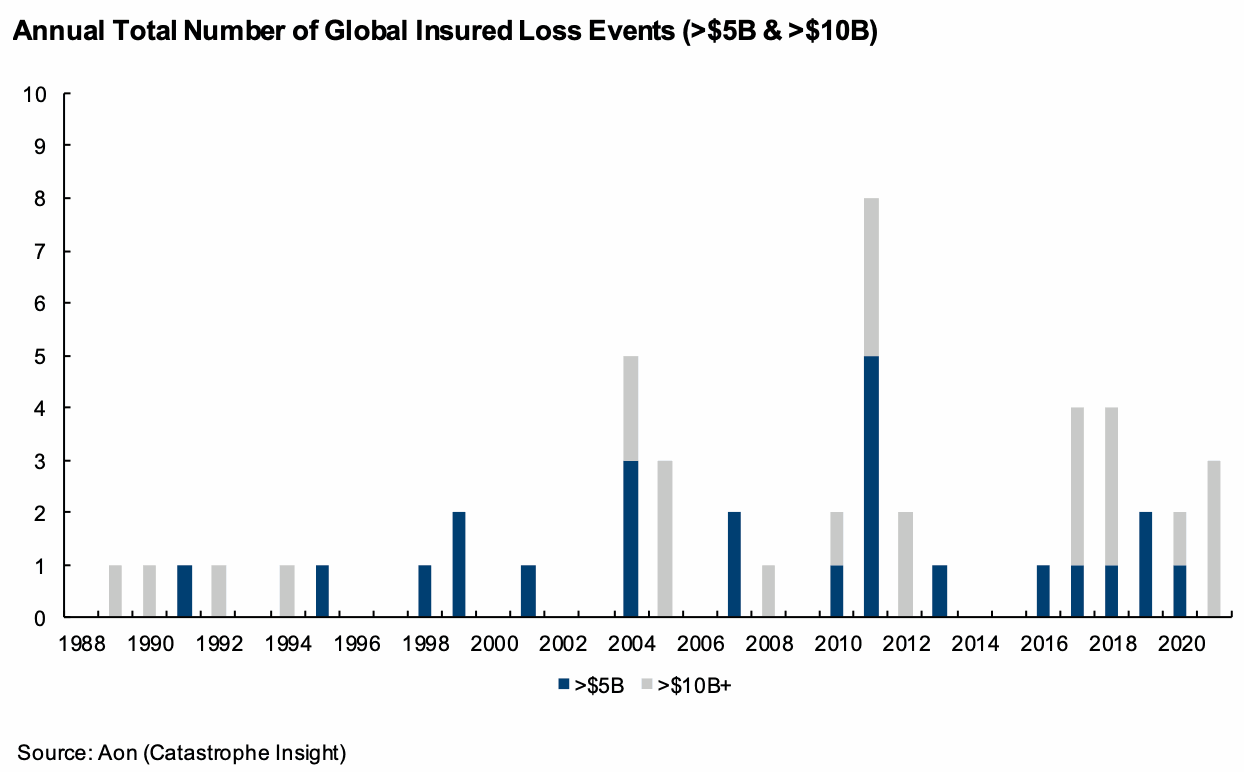

Aon focuses in on the previously mentioned three $10 billion plus disaster loss events in 2021 so far, asking whether “mega” catastrophes are on the increase?

Aon explains:

Many factors result in a high-cost natural catastrophe event: location, intensity, event length (time) and type of construction. All these factors – and more – are critical when analyzing why some disasters are more expensive than others. The continued influence of climate change on specific weather and climate- related events has only amplified the behavior and unusual nature that individual occurrences continue to exhibit. This means hurricanes are intensifying more rapidly; extreme rain events are dropping more precipitation; wildfires are burning hotter and faster; droughts are more pronounced and prolonged; and the Polar Vortex can affect latitudes not accustomed to any prolonged periods of cold.

What does this mean?

Natural peril risk grew with time due to the noted weather, climate and human factors (more people and stuf f moving into highly vulnerable locations). This directly corresponded with more expensive events on an aggregate and individual basis.

Leading the broker to explain that, it believes for the insurance industry the frequency of “mega” events, or industry loss events $10 billion on a nominal or inflation-adjusted basis, is increasing.

The chart above shows that the first $10 billion plus event occurred in 1989 (Hurricane Hugo), with this magnitude of event occurring every few years since.

But since 2017 there have been ten natural catastrophes that caused a $10 billion plus insurance industry loss, with three of these in 2021 and fifteen of the twenty-six events tracked having occurred since 2011, by Aon’s data.

In terms of smaller events, based on insured losses, there have been 24 that cost over $5 billion since 1989, but half of these occurred since 2011, Aon says.

Aon expects that we will now see “increased pressure by the re/insurance industry to handle the costlier trend” as risks related to natural perils grow more costly, for some of the reasons detailed in the quotes further up this piece.

“Whether this results in a more active movement into parametric-based insurance products, or more future looking investment strategies around a carbon tax or green bonds, the traditional way of viewing natural peril risks is quickly being forced to change,” the broker explains.

Adding that, “As concerns around litigation or liability risk grow as natural perils become more intense, this will only further advance the need to invest with a forward -thinking mindset as event behavior and resultant impact types seemingly evolve with each passing day.”

The data drives home the need for risk commensurate pricing in reinsurance and for the industry to look both at its recent history, as well as longer-term trends and to embrace forward-looking scientific views of climate and weather trends.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.