Analysts from investment bank Berenberg have said that they believe global claims for the insurance and reinsurance industry due to the Covid-19 pandemic will be manageable, estimating a range from $50 billion to $70 billion for the total bill.

The analysts don’t specify whether this includes both life and non-life insurance claims from the pandemic, but they do point to the estimate from Lloyd’s of London as being too high.

“We estimate $50-70bn for global COVID-19 claims,” Berenberg’s analysts state.

Further explaining that the total bill from the pandemic is expected to be, “Significantly less than the $107bn estimate reported by the Lloyd’s of London market estimate on 14 May.”

A range of analyst reports had previously been looked at which came up with a broad range consensus for a pandemic industry loss from $30 billion to as much as $100 billion.

Now, a month or so further down the line, it seems estimates may be falling for the ultimate claims burden the insurance and reinsurance market faces from the Covid-19 pandemic.

Structurally, the analysts from Berenberg do not believe the pandemic to be a significant issue for the insurance and reinsurance sector, with losses being manageable, while re/insurer have weathered the pandemic well in terms of their Solvency II and related requirements.

Solvency ratios may be down roughly 20 to 30 points, but they remain well within target ranges.

Overall, Berenberg’s analysts remain positive on the sector and initiated coverage on 18 insurers, four within the reinsurance sector, today.

Summing up on the impacts of the pandemic, the analysts said, “Fundamentally, insurers are doing well. This is because they have huge back books which are earning profits and delivering cash flows day by day.

“While COVID-19 claims will be large, we believe they are manageable, and there are some offsets, namely lower motor claims during the period of lockdown, rate rises in reinsurance and in commercial lines, and from reduced competition from digital start-ups, which are running out of cash.”

Lower interest rates and exposure to corporate bonds spreads do both remain concerns for the sector, with the lower for longer interest rate environment posing the greatest threat to life insurers.

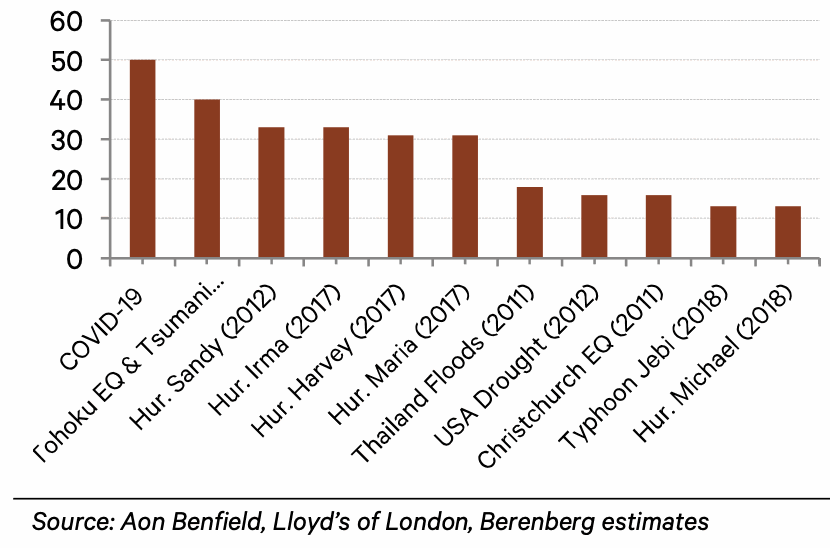

Overall, the analysts said that industry losses from Covid-19 are, “similar to those of a medium to large natural catastrophe and appear to be affordable.”

Berenberg’s estimate will make Covid-19 the largest single insured catastrophe loss event of the last decade, but still within the bounds of manageability.

Of course, it remains very early to understand the true financial costs of the pandemic, as well as the full extent of claims.

So far, Berenberg notes that estimated and reported losses from the insurance and reinsurance industry only amount to around $15 billion, meaning there is some way to go for the total to even reach the $50 billion lower-end of its estimate.

Berenberg explains its estimate, “Our total estimate is derived from: a) compiling the reported incurred losses so far by the biggest (re)insurers across the globe, along with our estimates for the ones we cover, totalling $14bn, and; b) a total allowance for the combined losses of the remaining relatively small insurers globally of $1bn, which means our total estimate is $15bn.

“We have also allowed for a 3.3x margin of safety which is based on our conservative estimate of the total ultimate magnitude of the claims, which brings our total estimate to $50bn. Our conservative margin of safety was based on the very high uncertainty regarding the ultimate total loss which will be driven by various unquantifiable factors such as: a) the duration of the lockdowns in various countries; b) the potential impact of a second wave and hence an extension or re-introduction of lockdowns; and c) uncertainty regarding business interruption (BI) contracts.”

It seems likely that we won’t be able to understand the true impacts of Covid-19 on the industry for a number of years, as certain longer-tailed lines of insurance may only begin to see the effect of claims in 2021 and beyond.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.