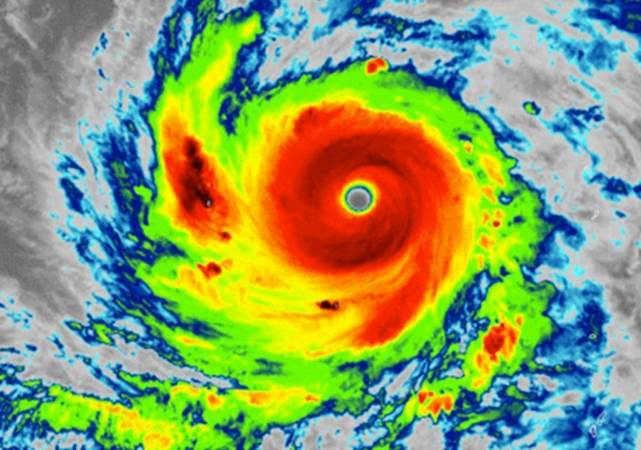

If the loss creep linked to Japanese typhoon Jebi continues it has the potential to impact RenaissanceRe’s retrocessional reinsurance underwriting book, according to the firms CEO.

Kevin O’Donnell, the CEO of Bermuda headquartered reinsurance firm RenaissanceRe (RenRe), explained during his firms recent quarterly earnings call that the potential for further development of the industry loss from typhoon Jebi concerns him.

Kevin O’Donnell, the CEO of Bermuda headquartered reinsurance firm RenaissanceRe (RenRe), explained during his firms recent quarterly earnings call that the potential for further development of the industry loss from typhoon Jebi concerns him.

Earlier during the call, O’Donnell highlighted that loss creep from 2018’s typhoon Jebi was actually the largest single catastrophe event that struck the reinsurance market in 2019.

It’s interesting that loss creep from a prior year has now been right up there with the largest loss events of the current accident period for two consecutive years now, as 2017’s hurricane Irma’s loss creep was one of the biggest impacts to the reinsurance market through 2018 and then Jebi in 2019.

O’Donnell explained how the loss creep from typhoon Jebi has impacted RenRe, saying, “The industry estimate for typhoon Jebi have increased materially since the third quarter of 2018 and now we’re above the high end of our estimates, which were more conservative initially than the market.

“Our gross loss has increased as well, although Jebi’s net negative impact to our property books is essentially unchanged from the third quarter of 2018 when we first reported it.

“We have successfully managed the volatility from this event, due to our superior underwriting tools, integrated system and robust gross to net strategy.”

He explained that RenRe has experienced some adverse development from 2018 loss events across aggregate and some retrocession contracts during Q2.

But looking forwards, O’Donnell said that it is Jebi that concerns him, saying, “We’re paying particular attention to typhoon Jebi and its growing impact on the retro market and we’ll continue to monitor it closely.”

RenRe at first reserved for typhoon Jebi significantly above where the market loss had been pegged by the main catastrophe risk models, a move that saved the firm from significant loss creep in the first instance.

Having booked a typhoon Jebi loss at around $8 billion to $10 billion originally though, this too proved too low in the end.

O’Donnell said that his view is the at the typhoon Jebi industry loss is now in the range of $15 billion, a figure analysts pointed to back in May.

However, it’s still important to watch for further loss creep, as the complexity with the typhoon Jebi loss has led to significant surprises, even for the largest and most sophisticated of reinsurers.

“It’s something that we continue to monitor,” O’Donnell said, warning, “We have more protections for our reinsurance portfolio than we do for our retro portfolio, which is one of the reasons we are so closely attuned to how this is flowing into the retro portfolios.”

O’Donnell continued to explain that RenaissanceRe hasn’t experienced any further net loss from typhoon Jebi since it originally booked the impacts in the third-quarter of 2018. The gross loss has risen, but the company’s retrocessional protections have taken its loss creep and protected its shareholders against impact.

But should the typhoon Jebi loss creep further and hit RenRe’s retro underwriting portfolio there is less protection available and that’s what concerns O’Donnell now.

“When I look at our reserves, I feel good about where we are,” O’Donnell said.

“But I do have a concern that if this loss continues to develop, that it can adversely affect us. Particularly through retro and in retro we purchase fewer protections than we do on our reinsurance book.”

The experience with the typhoon Jebi loss also leads O’Donnell to be hopeful about the catastrophe reinsurance renewals in Japan in 2020, as he said, “As the loss has grown substantially, even after the 4/1 renewal, I would hope that we go in with an expectation of rate increases in 2020.”

The comments on potential retro market exposure to further loss creep from typhoon Jebi are particularly interesting given RenRe has been underwriting more retrocession within its Upsilon vehicle of late.

If RenRe experienced an increase in its net loss, after Jebi loss creep hit its retro book, it’s possible that investors in Upsilon could find some impacts hit them as well.

The typhoon Jebi loss does continue to creep a little, but how much further it has to go is hard to guess at this stage.

Impacts continue to be revealed though, as we learned and wrote about yesterday related to French reinsurer SCOR having gone into its retrocession for typhoon Jebi.

As other companies also call on retrocession to help them with the loss, the chances of some of that negatively impacting RenRe will rise.

Something to watch for the quarter ahead.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.