The Florida Office of Insurance Regulation has already reported almost $2 billion of insurance claims filed from hurricane Irma, with more than 335,000 claims filed and just 4.5% closed to date. The FLOIR data shows that claims have been quickest to come in from the eastern coast of the state.

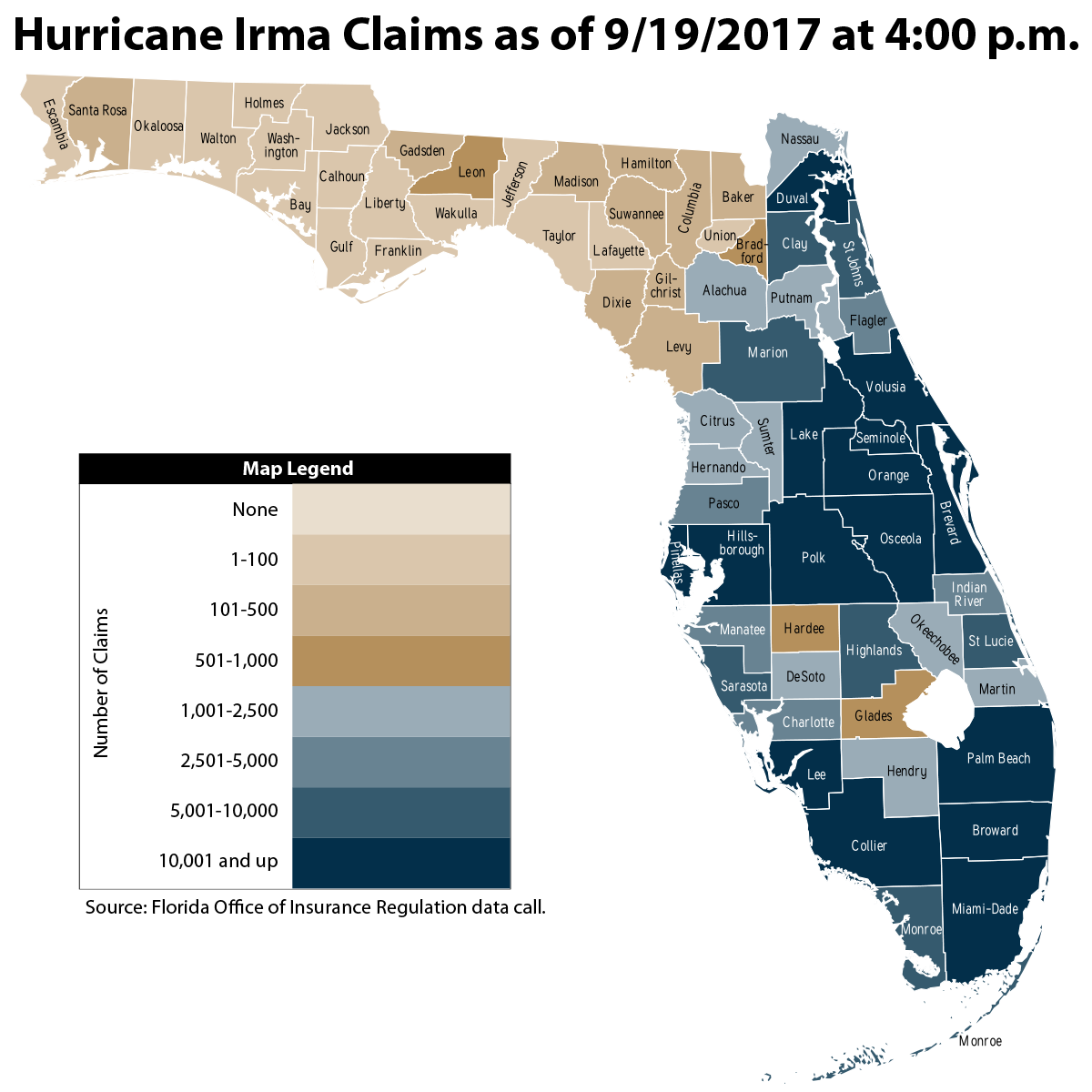

Hurricane Irma tracked up the western side of Florida so it’s perhaps a little surprising that so far the greatest proportion of claims filed are seen in counties on the east coast, such as Broward, Miami-Dade, Palm Beach, Volusia, Brevard Seminole, Orange and Osceola.

Another concentration of claims filed is seen around the area where hurricane Irma made landfall, in Collier and Lee county.

As insurance claims come in the numbers and distribution of the claims provide useful data for those expecting reinsurance claims to be required.

The map below, provided by the regulator, shows the distribution of insurance claims from hurricane Irma.

Hurricane Irma insurance claims filed by county

Residential property claims make up almost 295,000 of those filed, while commercial property accounts for almost 10,000 so far. Only 555 private flood claims had been filed as of late on the 17th September, along with 451 business interruption claims and almost 30,000 from other lines of business.

9,420 claims have been closed and paid out, with another 5,552 closed, which means a significant effort is required to accelerate claims payments to policyholders with over 320,000 claims still open.

The total paid out to date is $1.955 billion, a figure that will rise considerably over the coming weeks.

Hurricane Irma’s claims already far exceed those from hurricane Matthew last year, which only reached $1.2 billion from just under 120,000 claims filed.

Florida Citizens, which of course has a large reinsurance program including the use of catastrophe bonds, is said to be estimating that it will receive around 125,000 claims due to hurricane Irma.

Given Citizens market penetration these days, having depopulated its book significantly, that would suggest the overall claims filed number for hurricane Irma has some way to rise still.

The expectation remains that reinsurance capital will pay for the bulk of the claims from hurricane Irma, with the ILS and alternative capital market expected to take a reasonable share of both reinsurance and retrocession claims

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.